Delivering Impactful AI Revolution

Transforming Customer Experience in Financial Services with Cutting-Edge Generative AI Solutions.

AI Solutions Suite that power Unprecedented Growth

Harness the power of AI-driven features for real-time insights, personalized responses, and proactive strategies across sales, service, and customer retention initiatives.

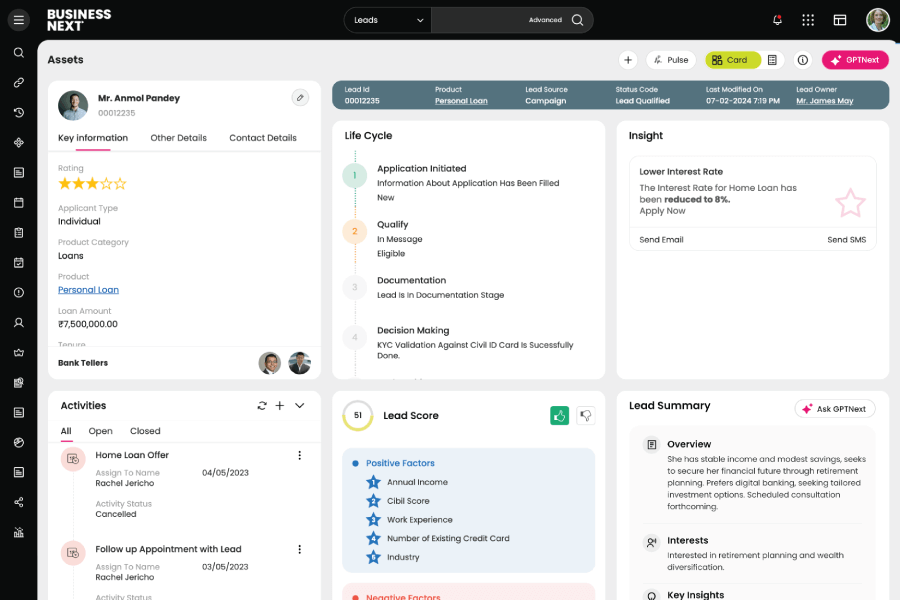

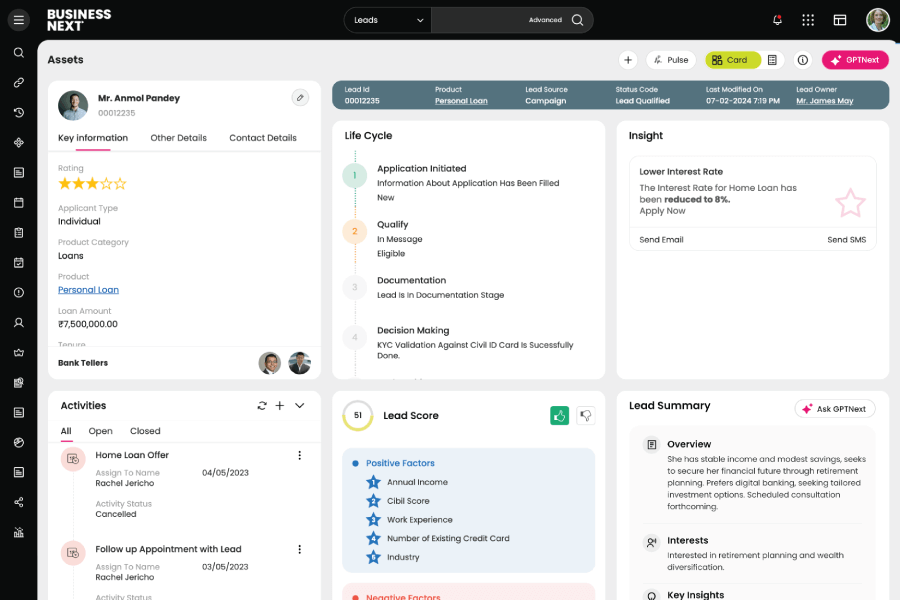

FRONTLINE SALES PILOT

Close deals faster with daily predictions like lead scoring, sales predictions, customer behaviour insights, competitive analysis, product recommendations, and more. Boost productivity with AI-powered day planner, follow up Email generator with customizable tone, discussion pointers/conversation strikers by analysing personal interests of prospects/customers.

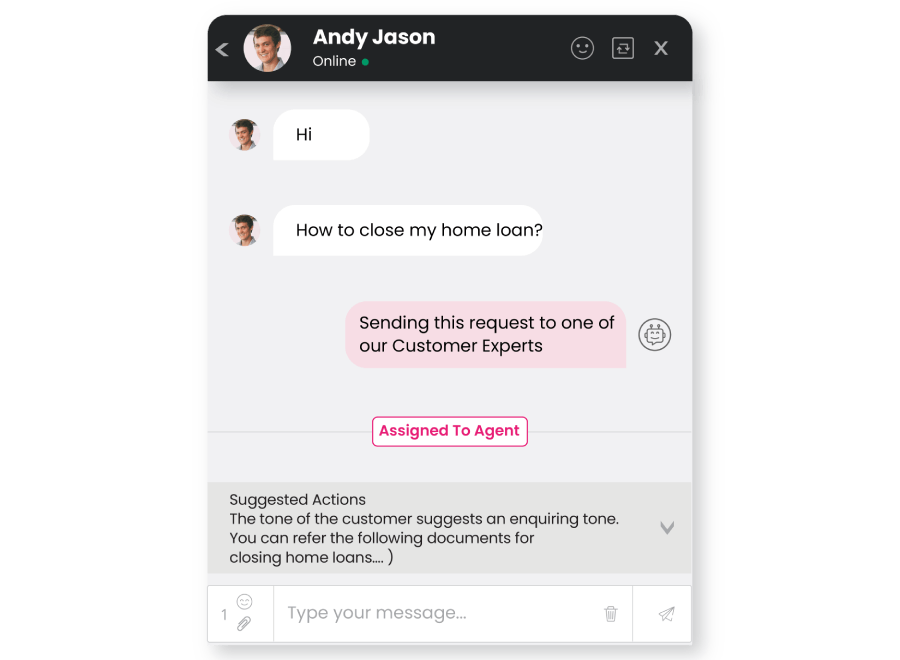

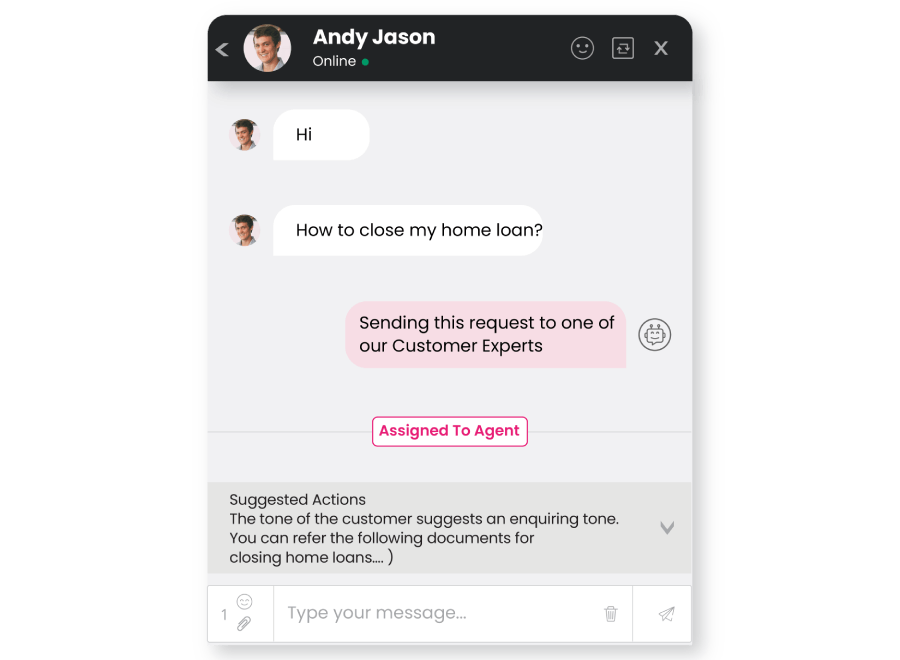

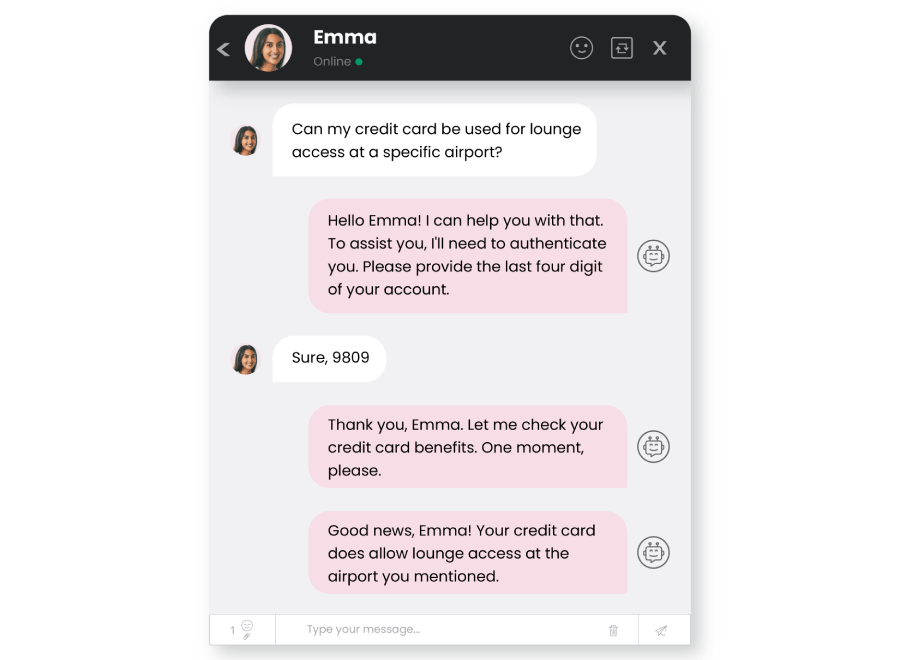

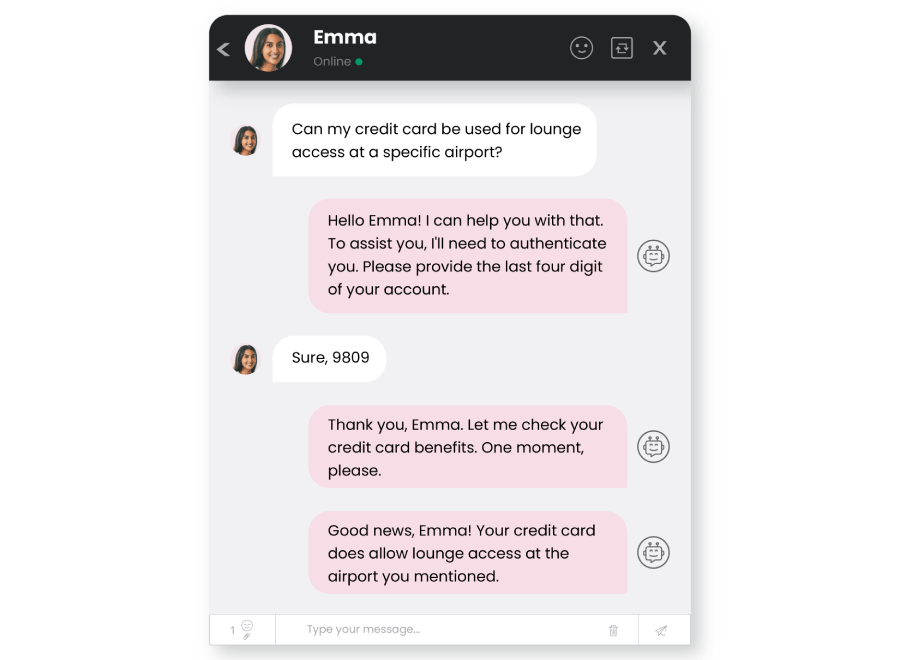

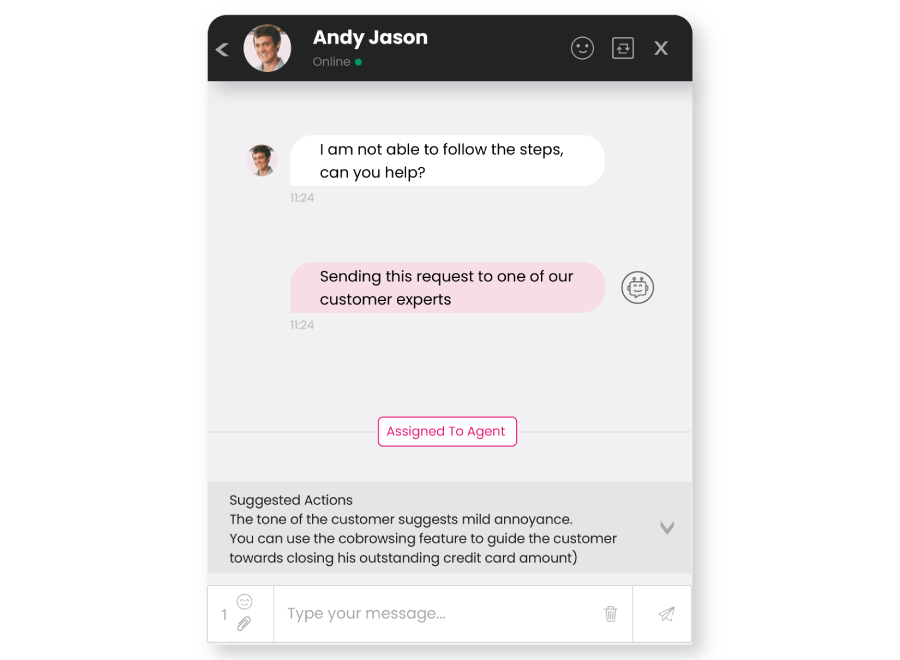

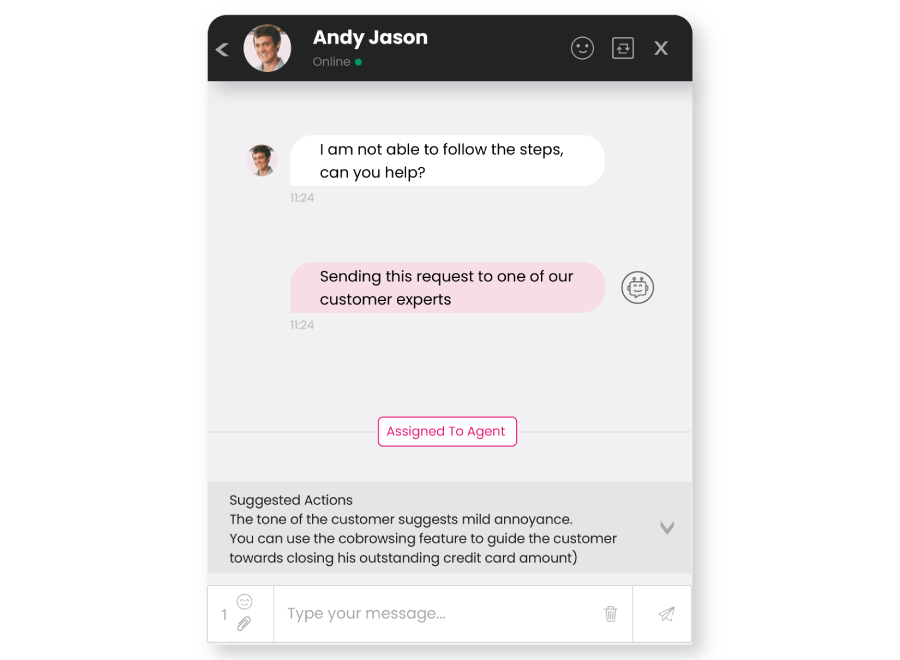

CONTACT CENTER ASSISTANT

Empower your service agents to automate customer interactions, automate service workflows like case creation and updates, and craft personalize email communication and message responses through targeted messaging, all designed to streamline customer interactions.

SEMANTIC KNOWLEDGE BASE SEARCH

Leverage the power of data with advance searches within vast information repositories and diverse datasets including documents, articles, and structured databases. Gain contextual understanding to interpret user input, discerning the underlying meaning and intent, allowing for highly accurate and contextually relevant search results.

CUSTOMER INTERACTION & SENTIMENT ANALYSIS

Streamline various tasks by automatically processing text data and categorizing into predefined or custom groups, like customer feedback sentiment and extract entities like names, products from customer interactions and even define priority of the message.

Resulting in targeted marketing, timely issue resolution, and accurate data capture.

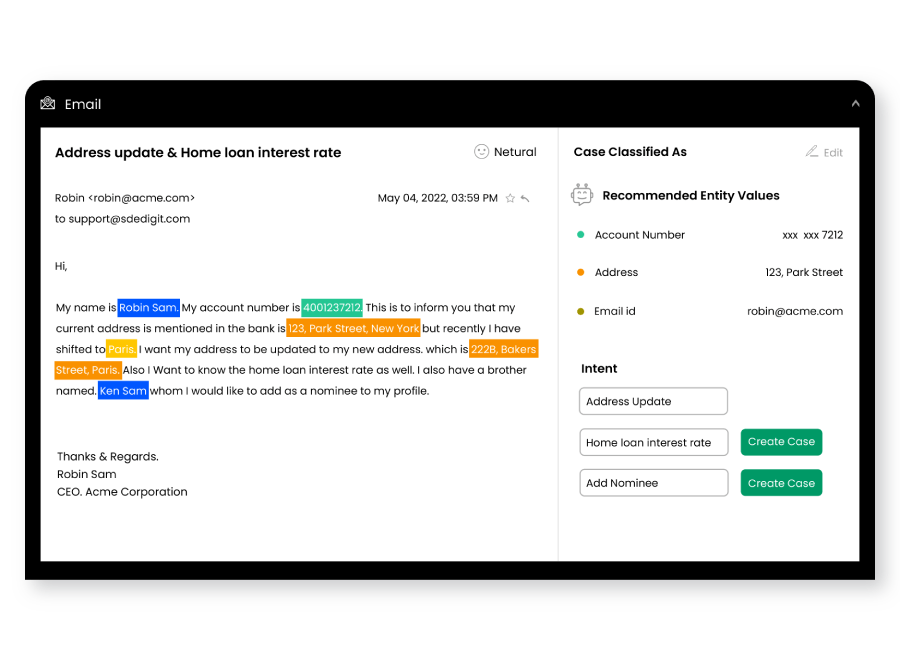

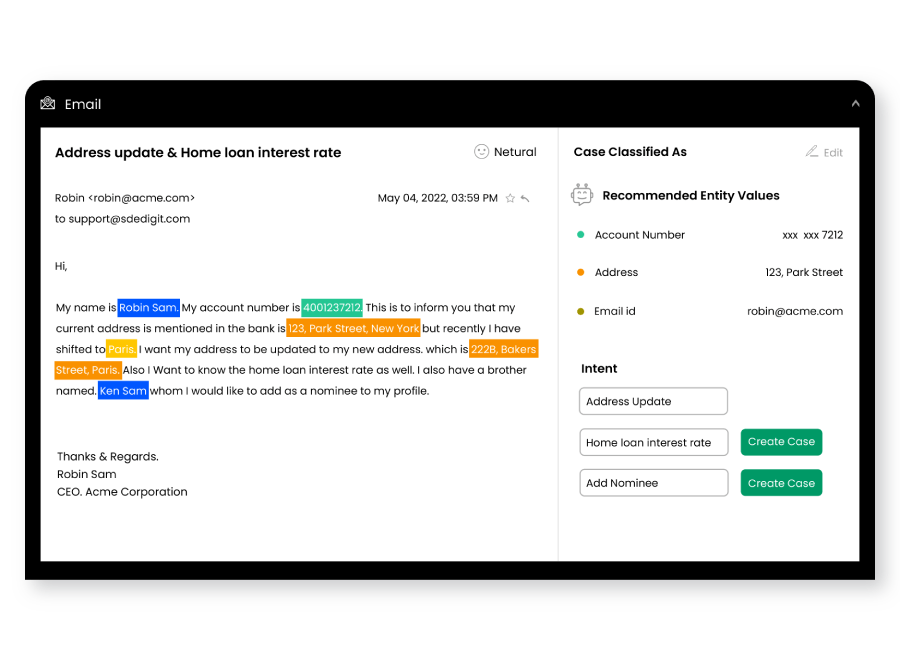

TEXT CLASSIFICATION & ENTITY EXTRACTION

Streamline various tasks by automatically processing text data and categorizing into predefined or custom groups, like customer feedback sentiment and extract entities like names, products from customer interactions and even define priority of the message.

Resulting in targeted marketing, timely issue resolution, and accurate data capture.

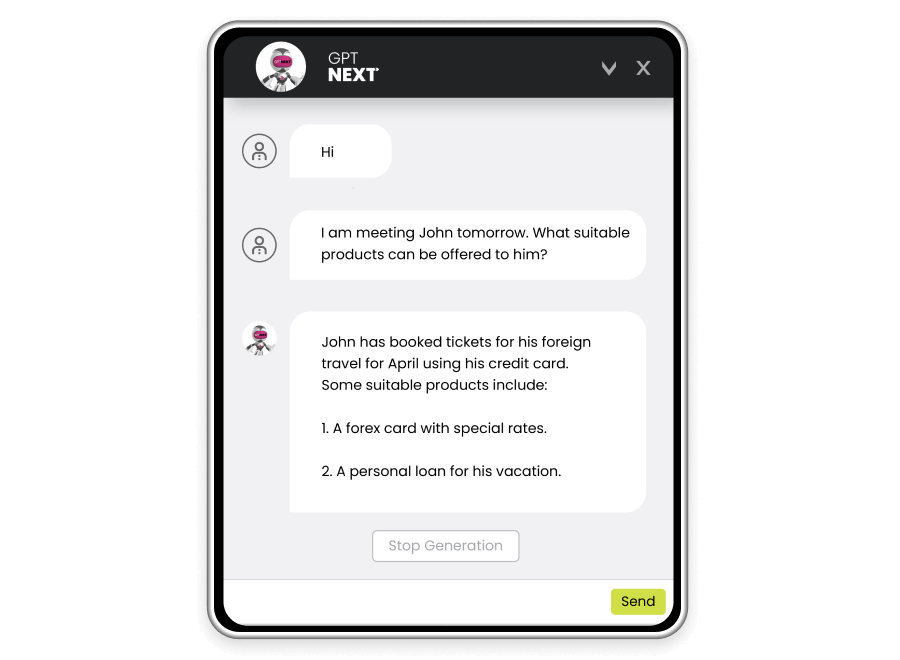

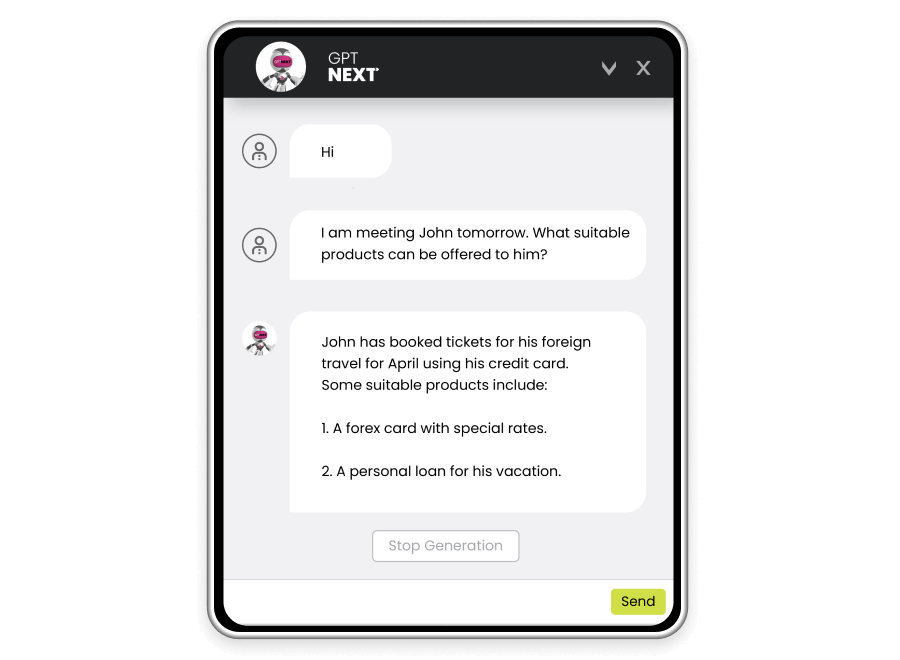

PRODUCT RECOMMENDATION ASSISTANT

Deliver personalized experience to the customers with tailored product recommendations, based on customer’s financial history, transaction patterns, and individual preferences.

Help customer improve their financial health with the financial behaviour analyses and insights.

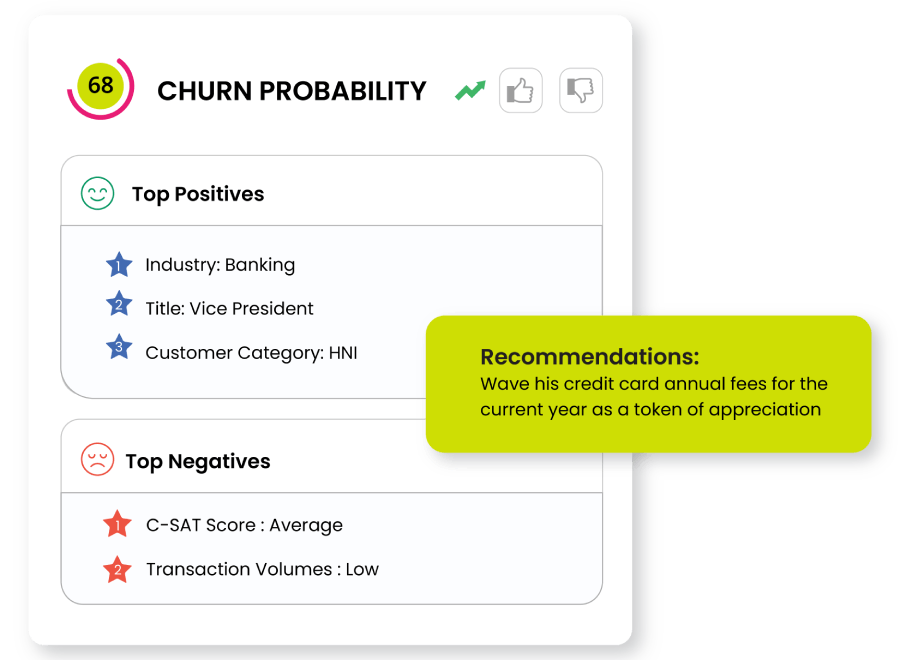

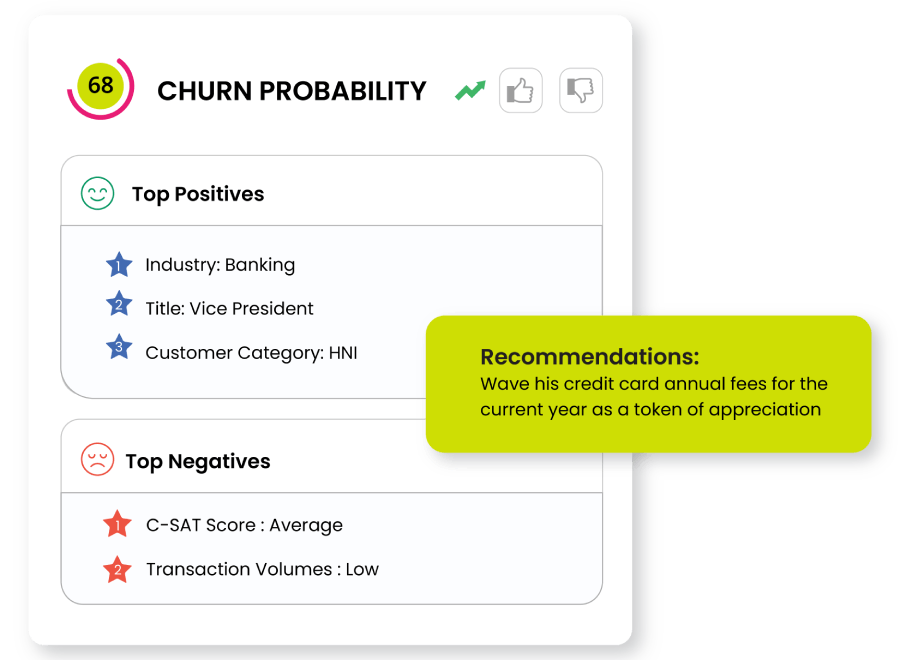

CUSTOMER CHURN PREVENTION

Reduce the churn rate by identifying at-risk customers with advanced predictive analytics by assessing various indicators and personalized retention strategies and, triggering real-time alerts and automated campaigns to re-engage and retain at-risk customers through tailored offers and communication channels.

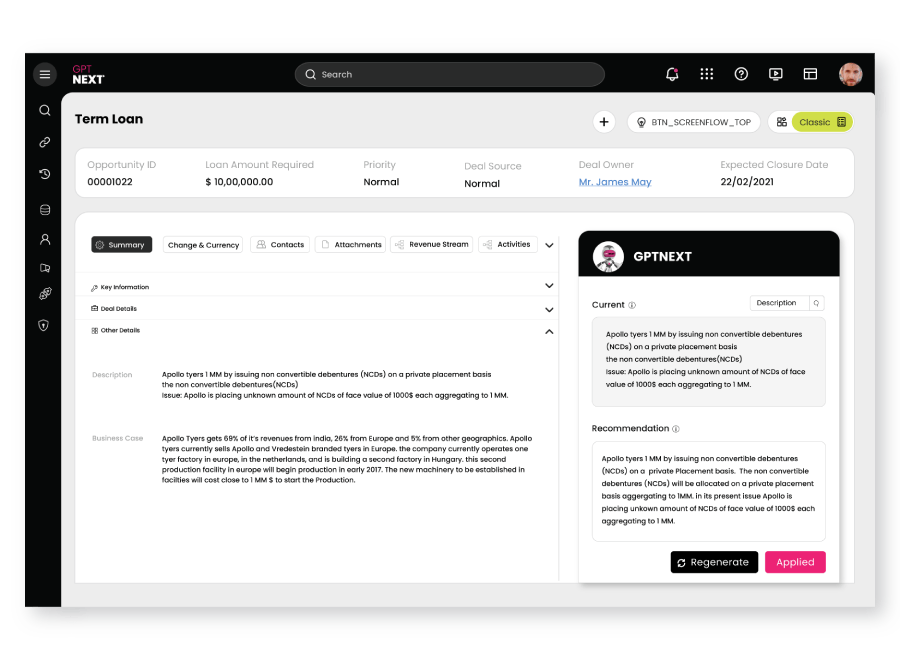

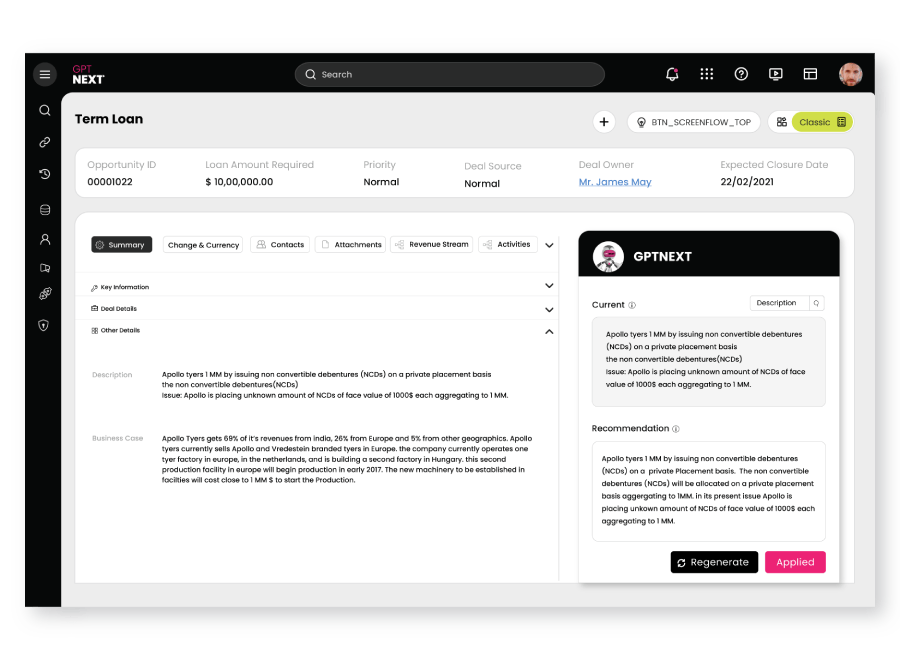

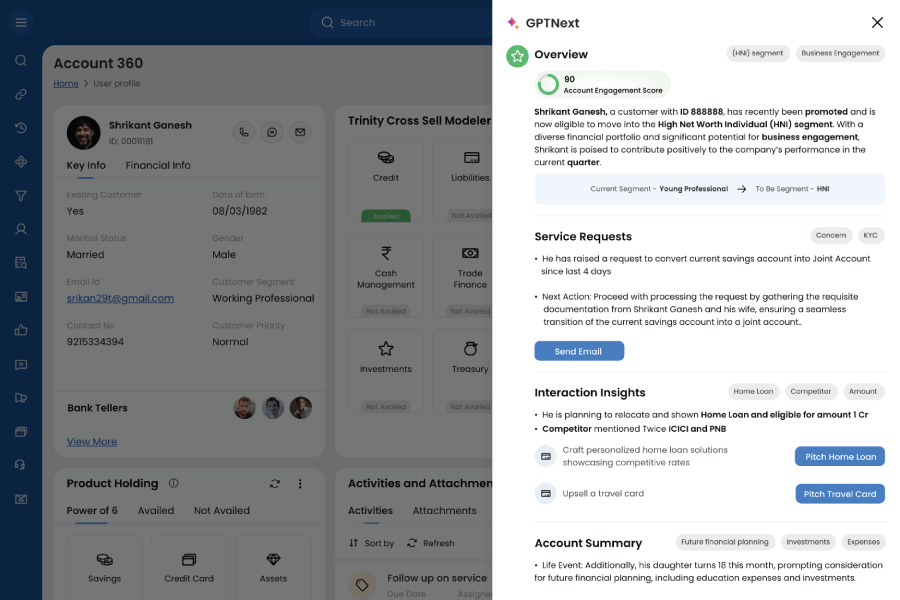

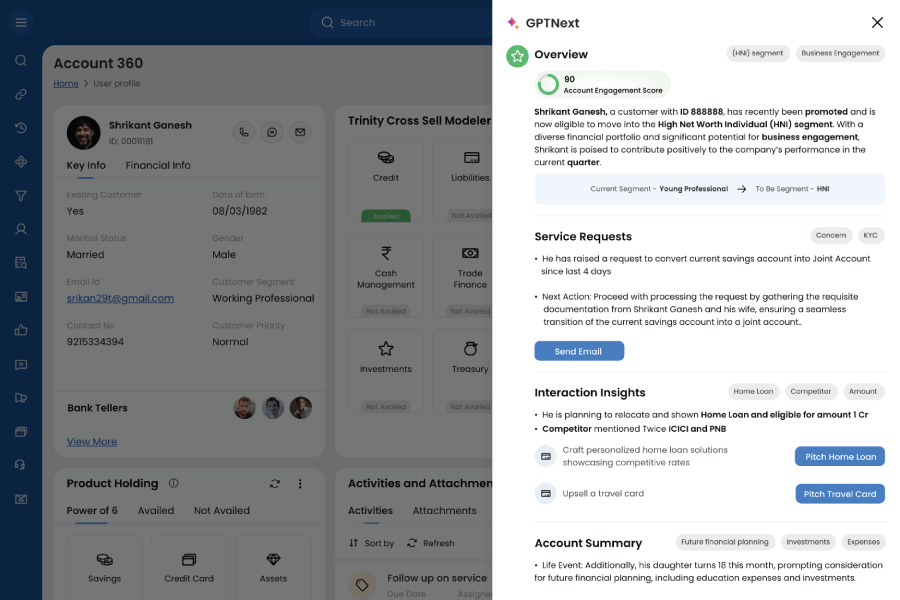

Account Summary

GPTNEXT aggregates and analyses vast amounts of data from various sources to generate comprehensive account summaries, that provide a cumulative understanding of customer interactions, purchase history, communication patterns, and also lists down potential upsell opportunities, personalized engagement strategies, or predictive insights into customer behaviour.

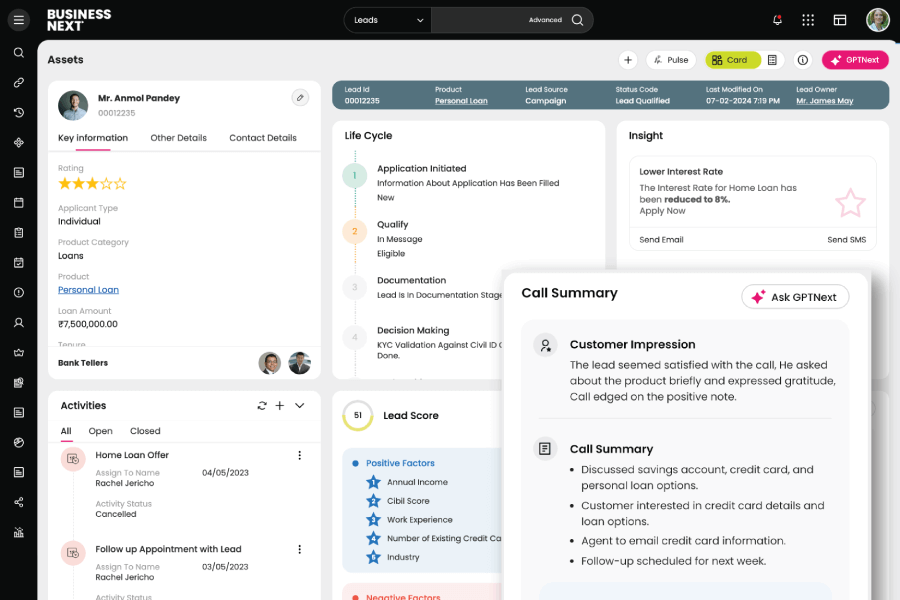

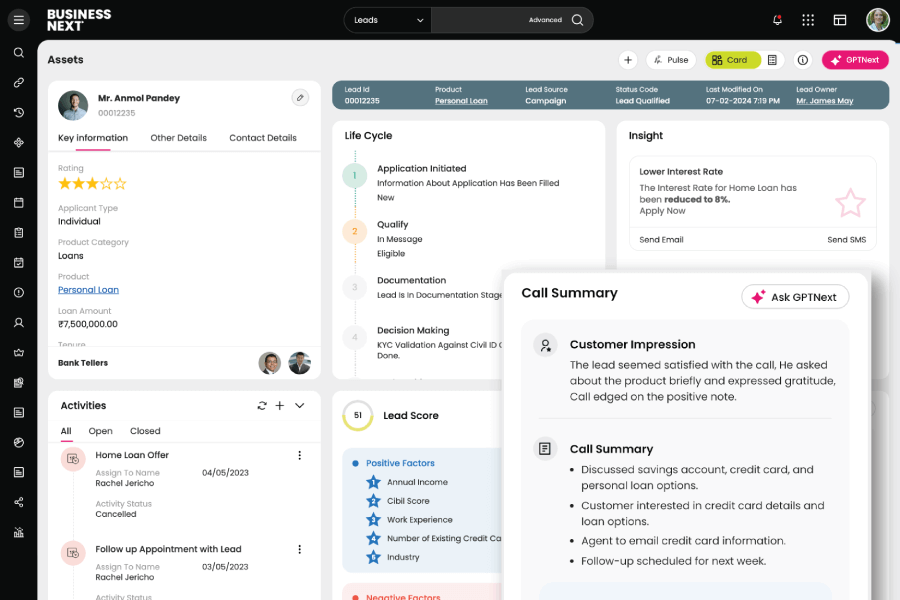

Activity Call Summary

GPTNEXT employs natural language processing (NLP) and sentiment analysis to provide real-time insights during sales calls and can detect key phrases, emotions, and conversational cues, generating a summary of the call’s content, tone, metrics such as call duration, frequency, successful outcomes, and areas for improvement.

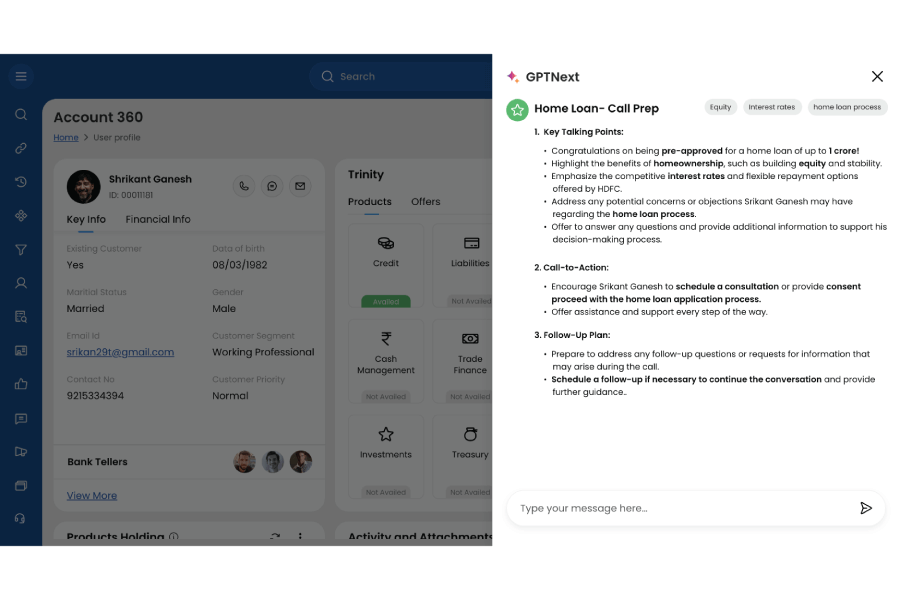

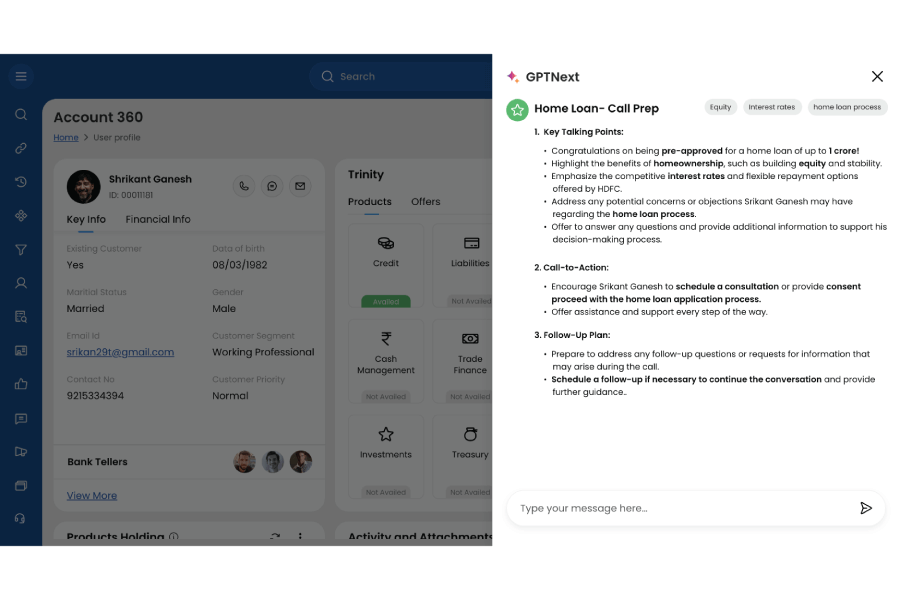

Call Preps

GPTNEXT dynamically generates call talking points tailored to individual customer profiles and sales scenarios by analyzing historical data, customer preferences, and buying behaviour, the user can craft personalized scripts that resonate with each prospect, increasing the likelihood of successful engagements.

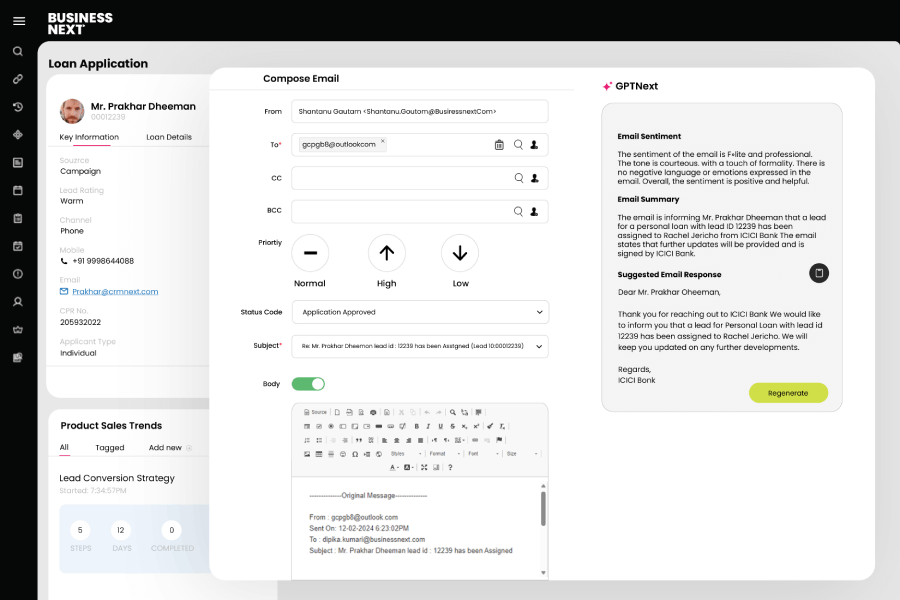

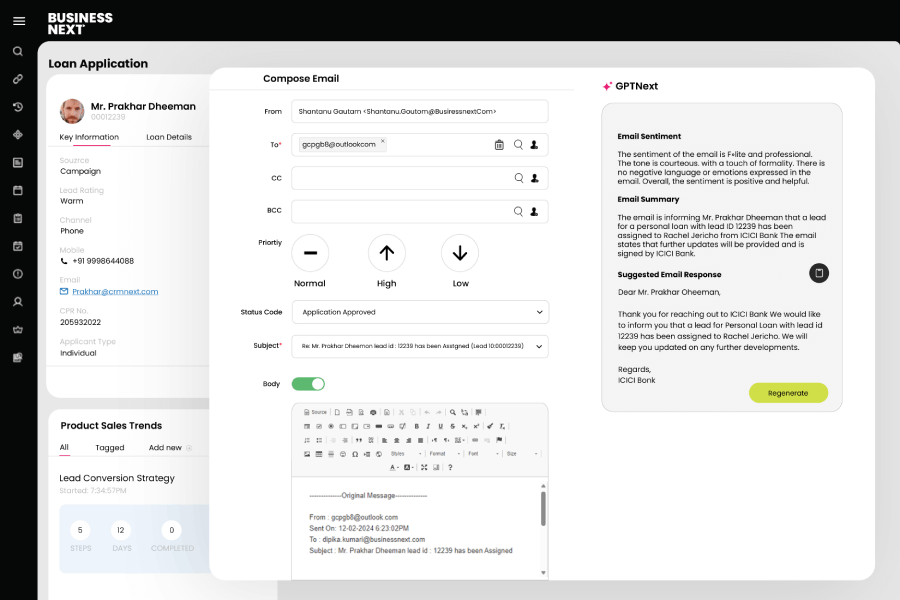

Email Auto Responses

Users can generate personalized email auto-responses by analysing historical communication data, lead/prospect preferences, and behavioural patterns, tailored to each recipient’s queries.

Lead Summarization

Employing machine learning algorithms like lead scoring, GPTNEXT gives lead summaries that prioritizes leads based on conversion likelihood and condenses complex lead data into actionable insights, delivering personalized recommendations for follow-up actions, engagement strategies, and targeted messaging, empowering sales teams to efficiently nurture leads through the sales funnel and boost revenue growth.

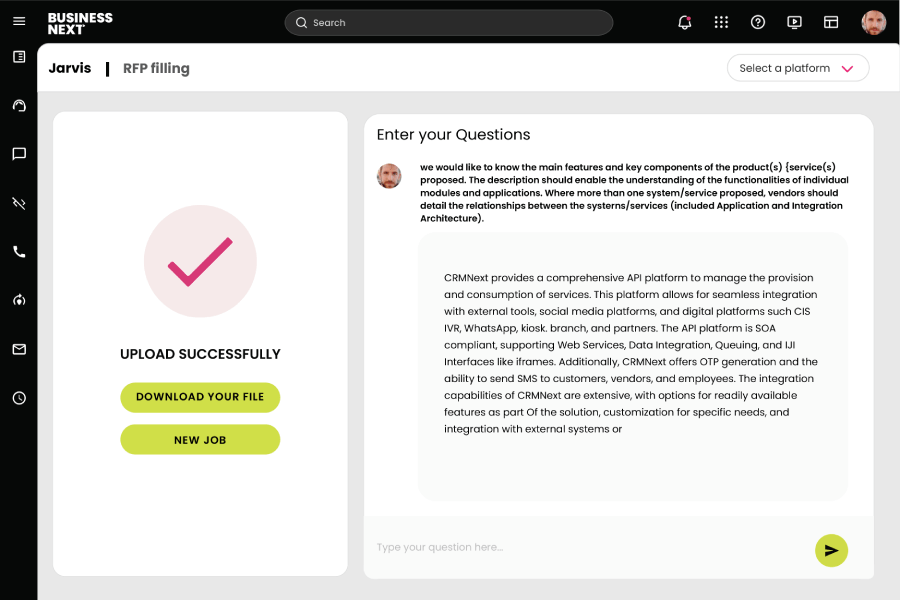

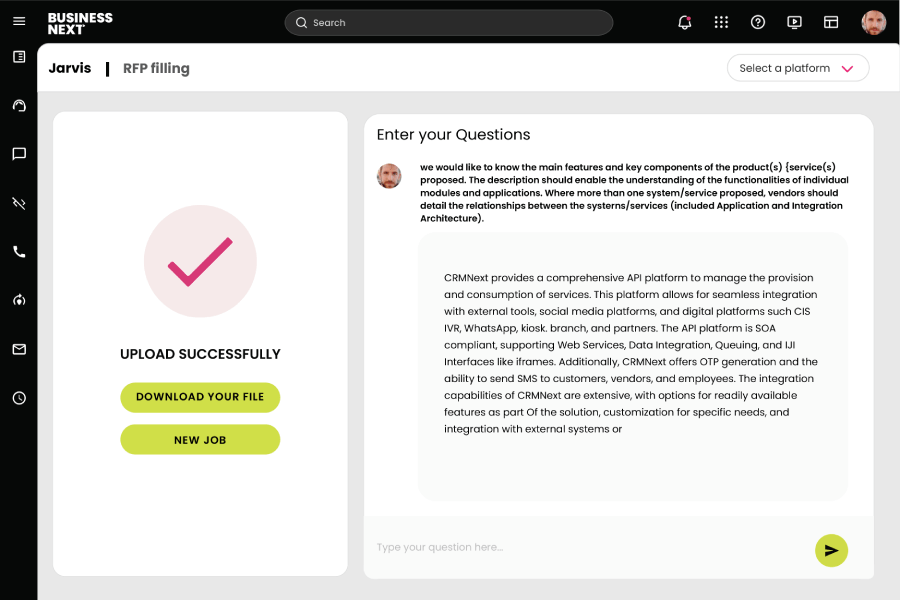

RFP Bot

RFP Bot automates initial draft creation, saving time and resources by generating comprehensive proposals tailored to client needs and key features that include automated draft creation, customization options, Excel file upload for RFP details, interactive chat interface, multiple RFP submission processing and much more.

CRMNEXT Recognized as a leader

what our cutomers say

Insights & Trail Of Success

Boosting loans & deposits: The blueprint for credit unions to maximize CRM data strategy

Data is the key to unlocking a robust member experience. That’s because it enables CUs to learn deeply about members and predict and identify their next best needs. Doing this allows the credit union to demonstrate itself as a partner in their financial journey and conveniently position its products at just the right time. To succeed with data, credit unions need a strategy to bring data together and use it to drive actionable insights. A well-designed data strategy with a CRM can help credit unions unlock significant value.

learn More

Demystifying banking CRMs: 4 critical reasons credit unions need CRM in 2023 and beyond

Today, CRMs are everywhere. They might not stave off an end-of-the-world catastrophe, but they can be used to help your credit union grow and avoid being merged in the process. Just be warned. There’s a big difference between a CRM built for managing sales and marketing versus a true credit union CRM. You need a CRM that does more than store contact information as well as a member’s product and service mix. You need one that helps you avoid a business meltdown and sets you up for success in 2023 and beyond.

learn More

How to unlock the future: Predicting your members’ behaviors with CRM magic

For too long, credit unions have relied on the idea that knowledge + intuition would predict the future. But it doesn’t. All you get are vague assumptions, like some crystal-ball fortune-teller at a fly-by-night carnival. Sure, they’ll tell you what you want to hear. But you’ll lose money, time, and dignity in the process. To get real answers that retain (and attract) members, deepen relationships, and grow your credit union, you need to add data to the equation. Let’s take a look at these three magic words and how they, along with forward-thinking strategy and process, can make predictions possible for your credit union.

learn More