2 million+ instant

digital accounts

Significantly reduce journey abandon rates.

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

AI Driven

account opening & Onboarding

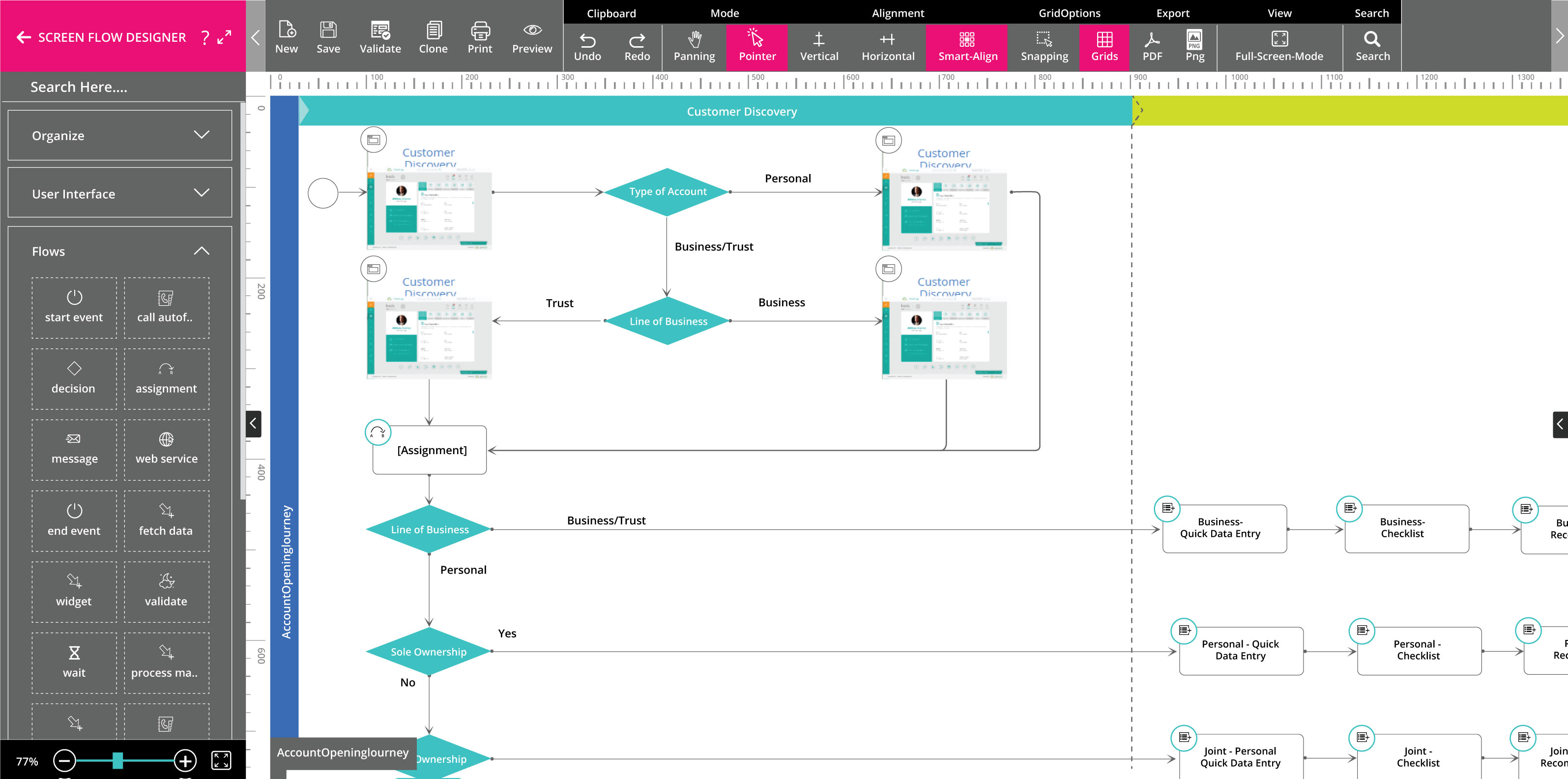

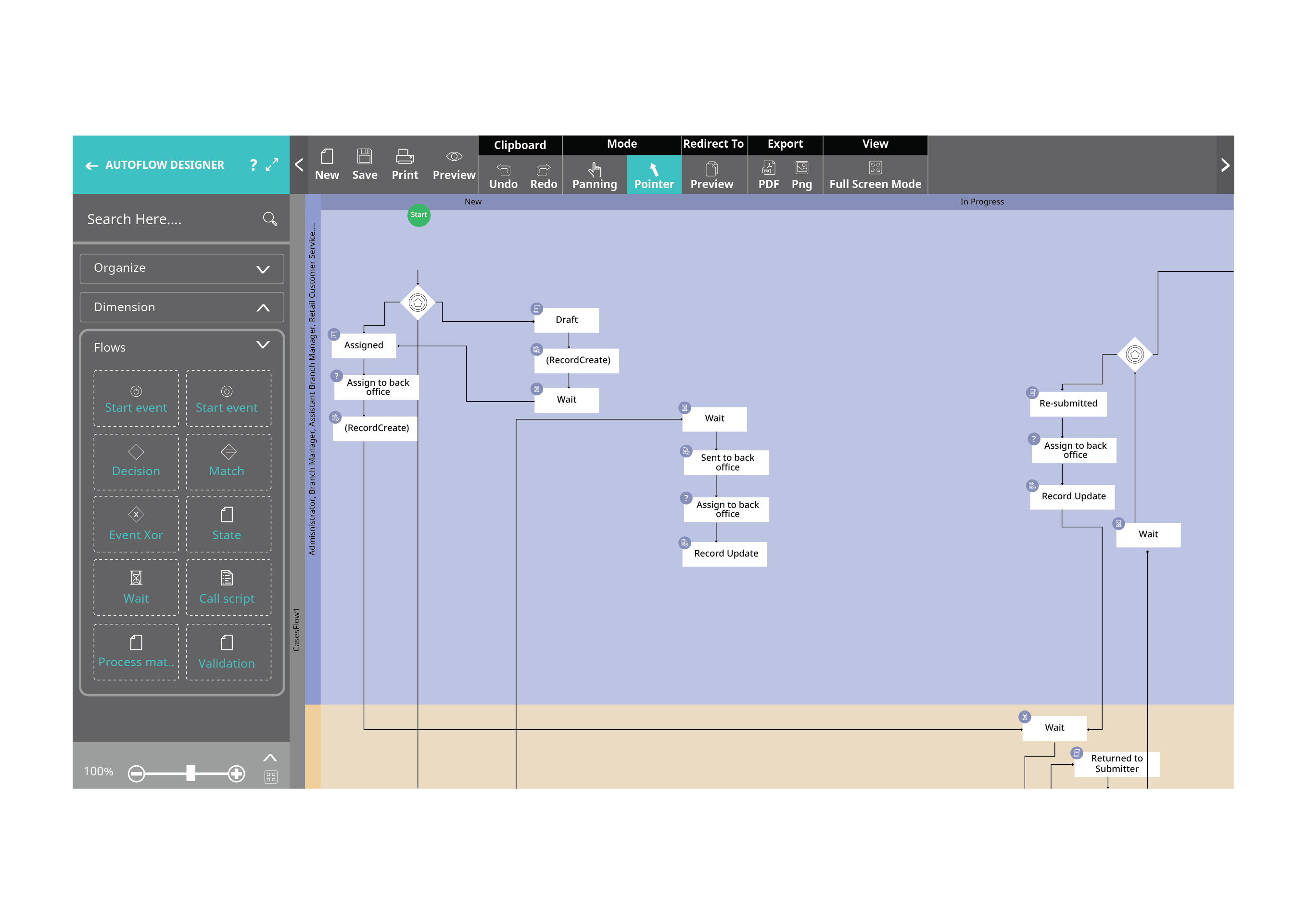

Create attractive, responsive screens

-

Modify backgrounds and add validations on fields with a drag and drop designer.

-

Design screens for change ready journeys on the fly.

-

Intuitively define data sources and custom actions.

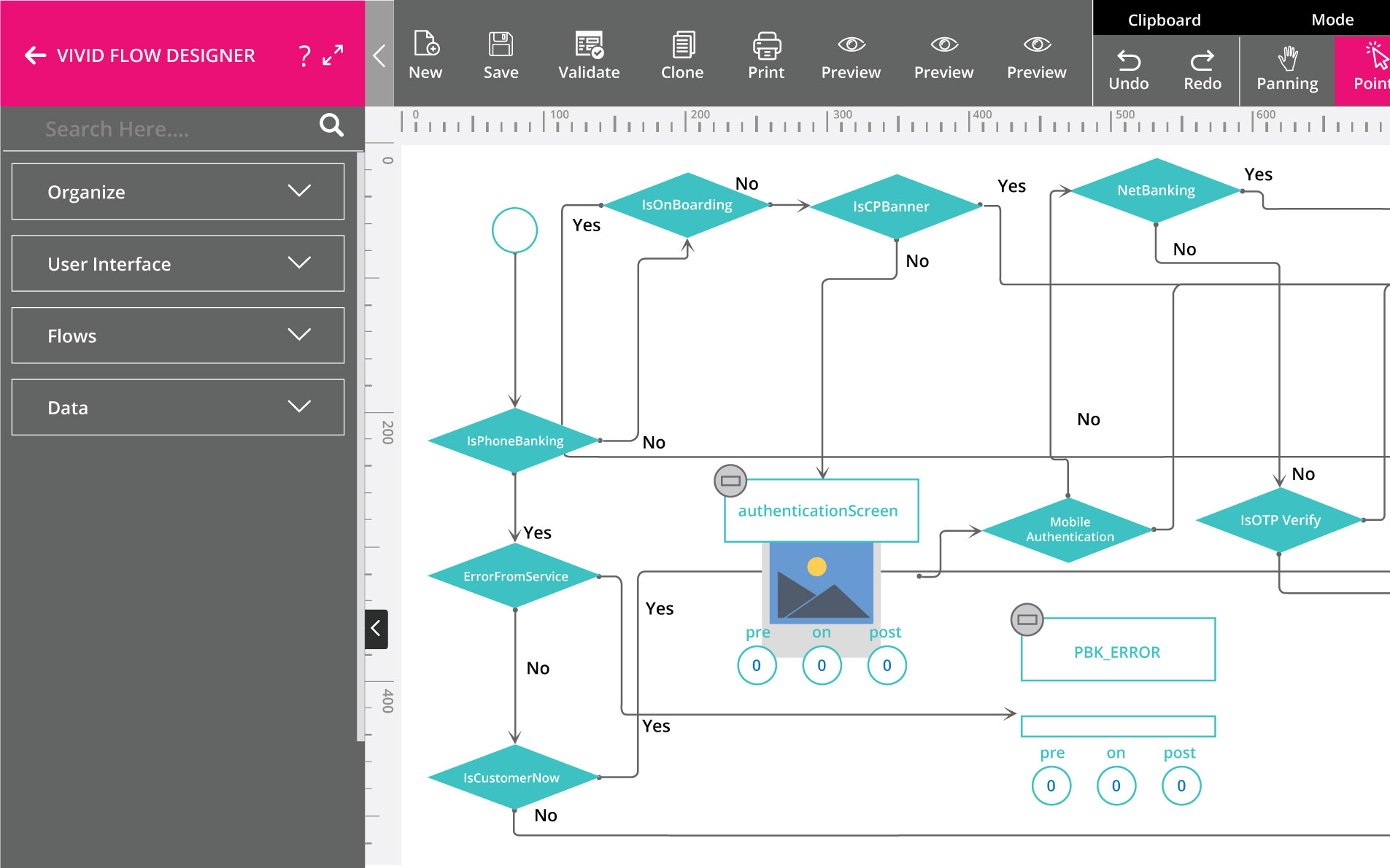

Create compelling experiences

-

Create personalized customer journeys and consume microservices with drag and drop screen navigation elements.

-

Stitch together multiple elements with real time redirection and API calls.

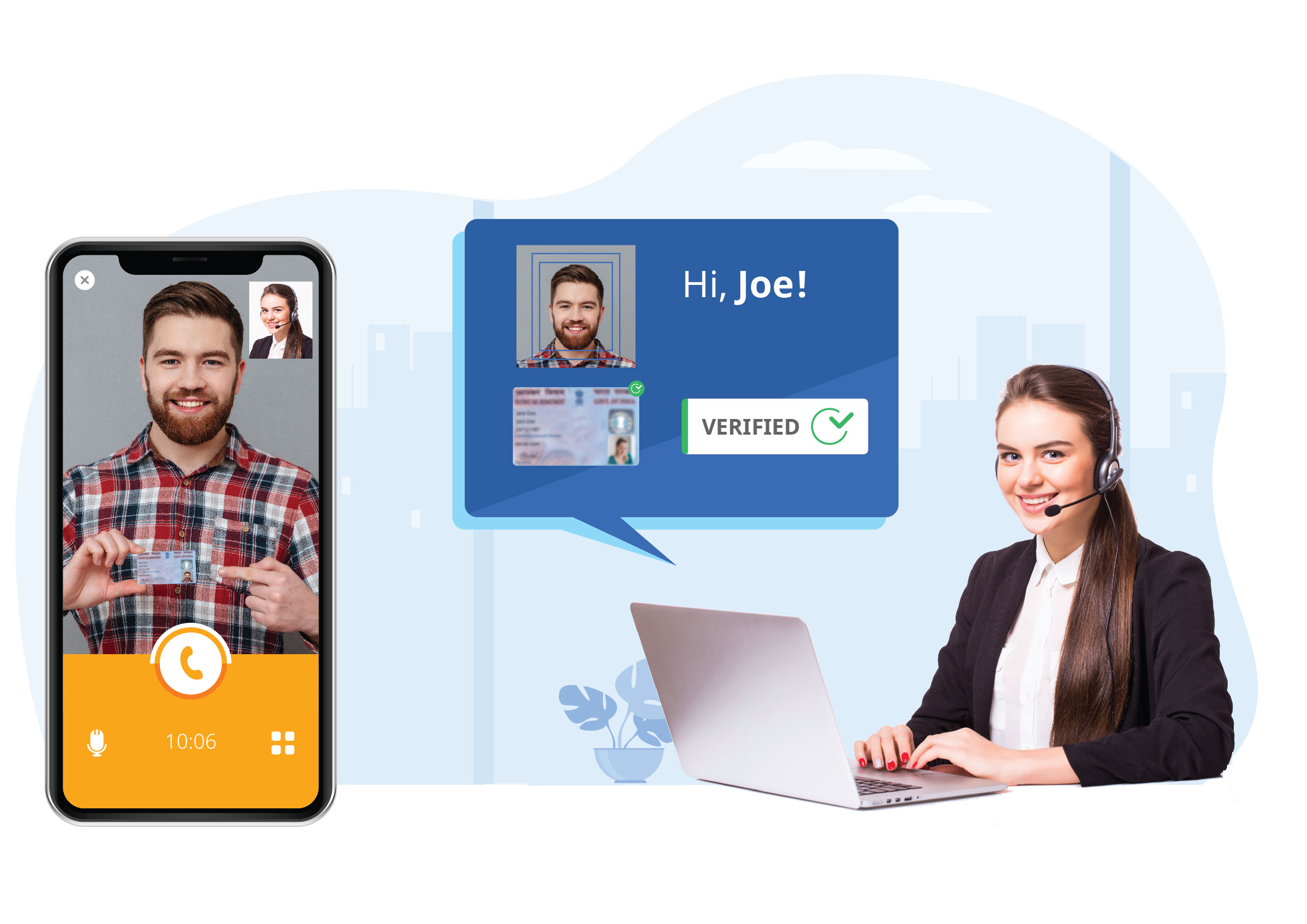

Verify customers and be regulatory complaint in real time

-

Eliminate bad actors by providing integration with regulatory agencies to deliver OTP based eKYC and Video KYC providers to prevent fraud.

-

Be enabled with features such video call recording for identity capture and verification, Geo tagging and concurrent audit.

-

Be compliance ready with GDPR, AML, KYC and other Government regulations.

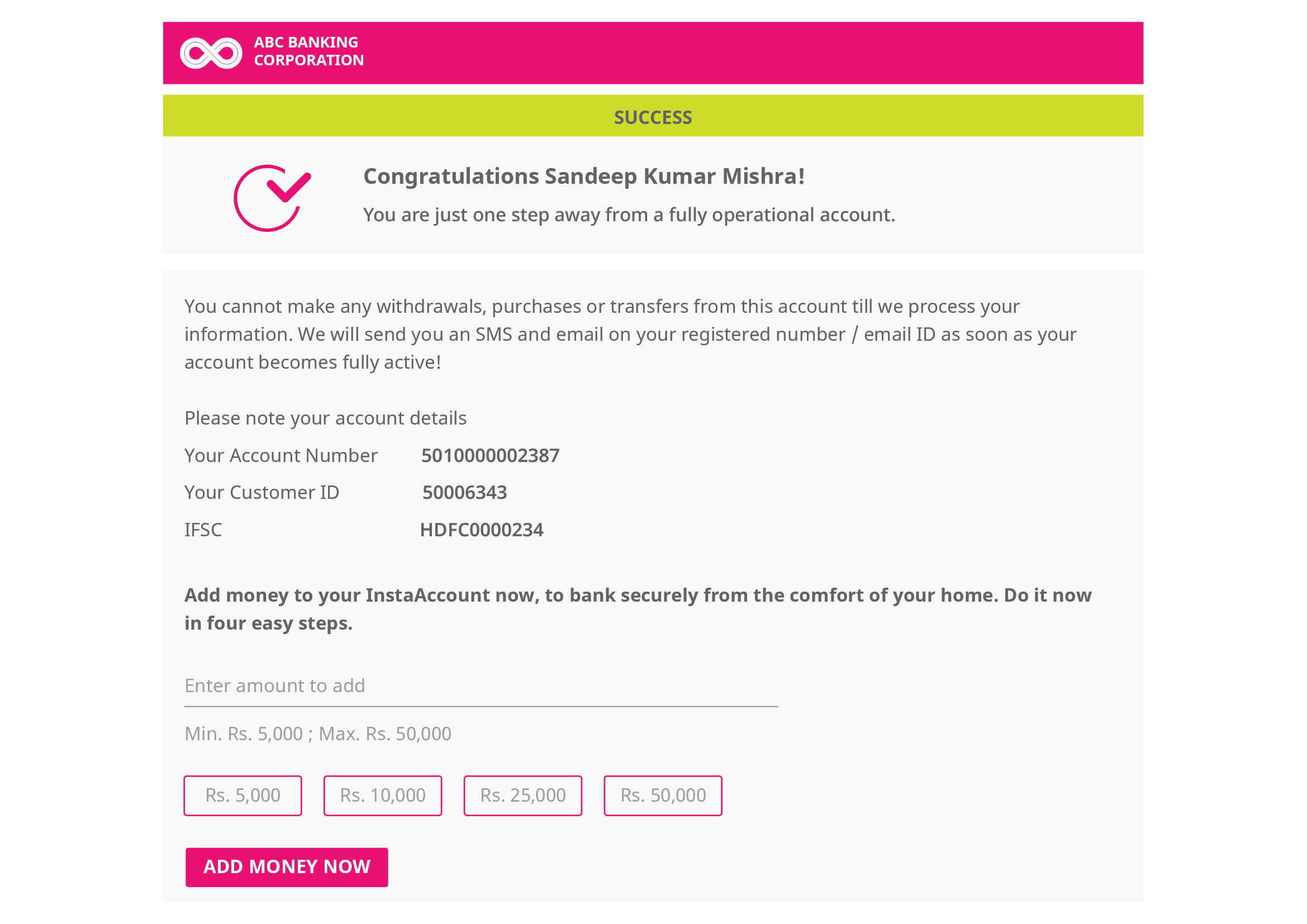

Grow deposits faster

-

Activate accounts instantly with a unique Customer Account Number and onboarding process.

-

Attract deposits instantly by enabling instant funding options

-

through integrations with multiple payment gateways and core systems.

Maximize conversions and reduce journey drop offs

-

Analyse customer behaviour with machine learning and whitespace analysis with algorithmic win back modeler.

-

Create dynamic personalized offers along the account opening journeys.

-

Leverage compelling journeys that magnify your unique value propositions.

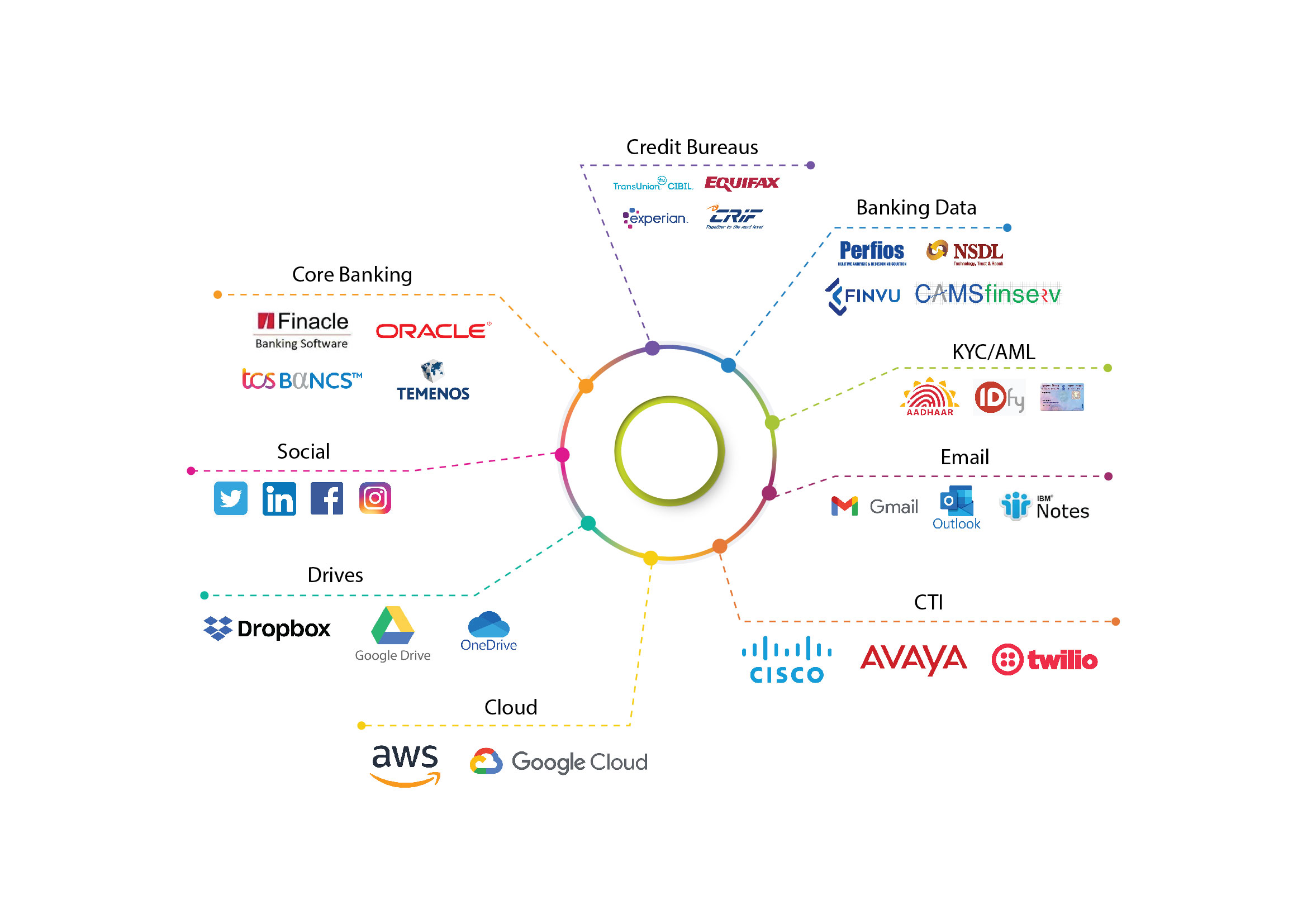

Create end to end account opening and onboarding experience

-

90+ Ready connectors to fetch, extract and utilize data from various systems including National ID system, Tax systems, credit card, core banking, credit rating bureaus, social and more.

-

Codeless configuration with more than 50 out-of-the-box patterns.

-

Make full use of multi-app capabilities with restful web services which can share data with any external application and support 2-way bidirectional integration.

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all