Solutions

MODERNIZE SALES

400% Increase in CASA leads and more transformations inside at Kotak Mahindra Bank

-

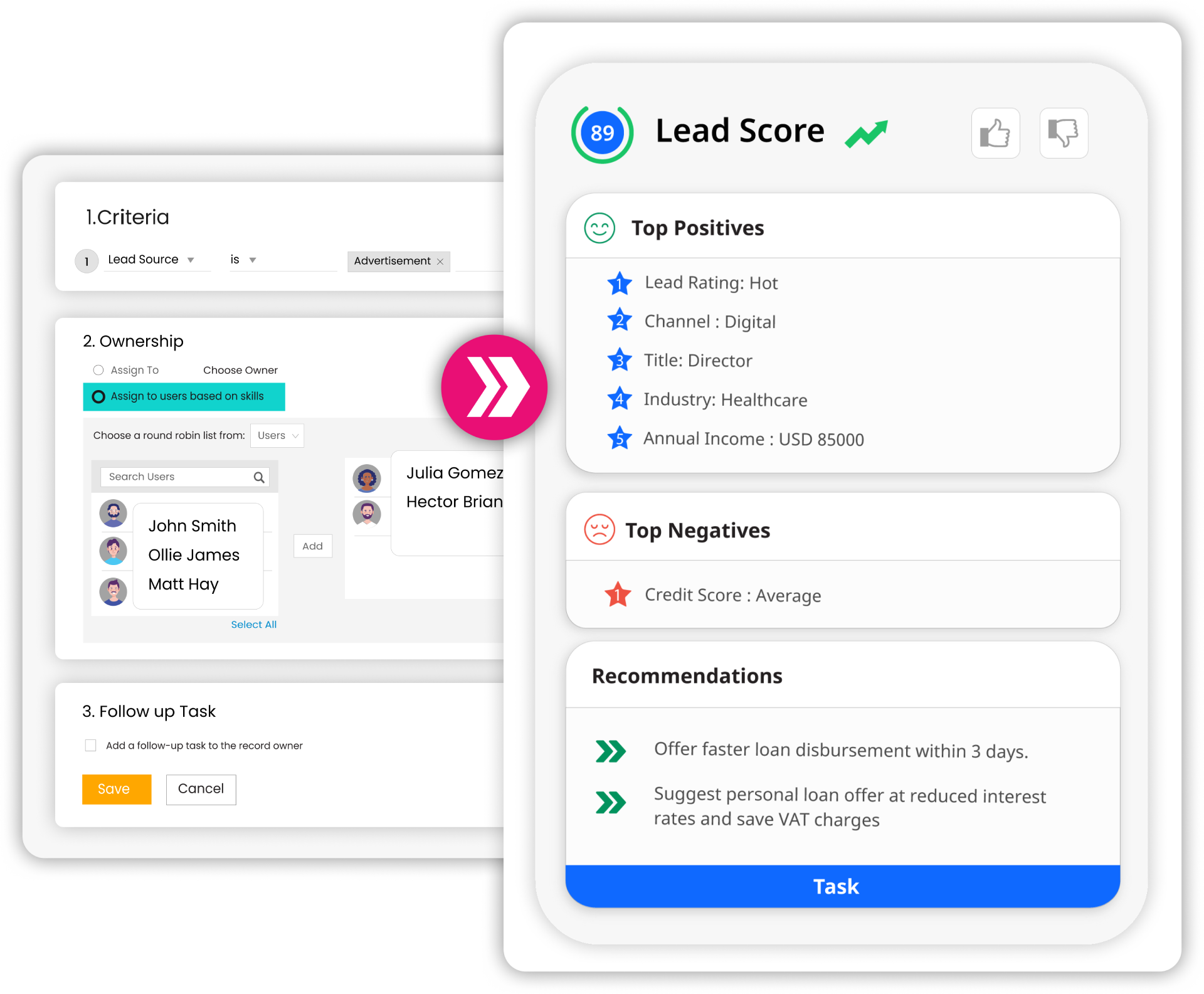

Convert leads faster

-

Quickly process leads, captured from multiple sources.

-

Auto score leads based on multiple predefined or customizable parameters, using AI/ML models.

-

Auto assign/rout leads with intelligent rules.

-

-

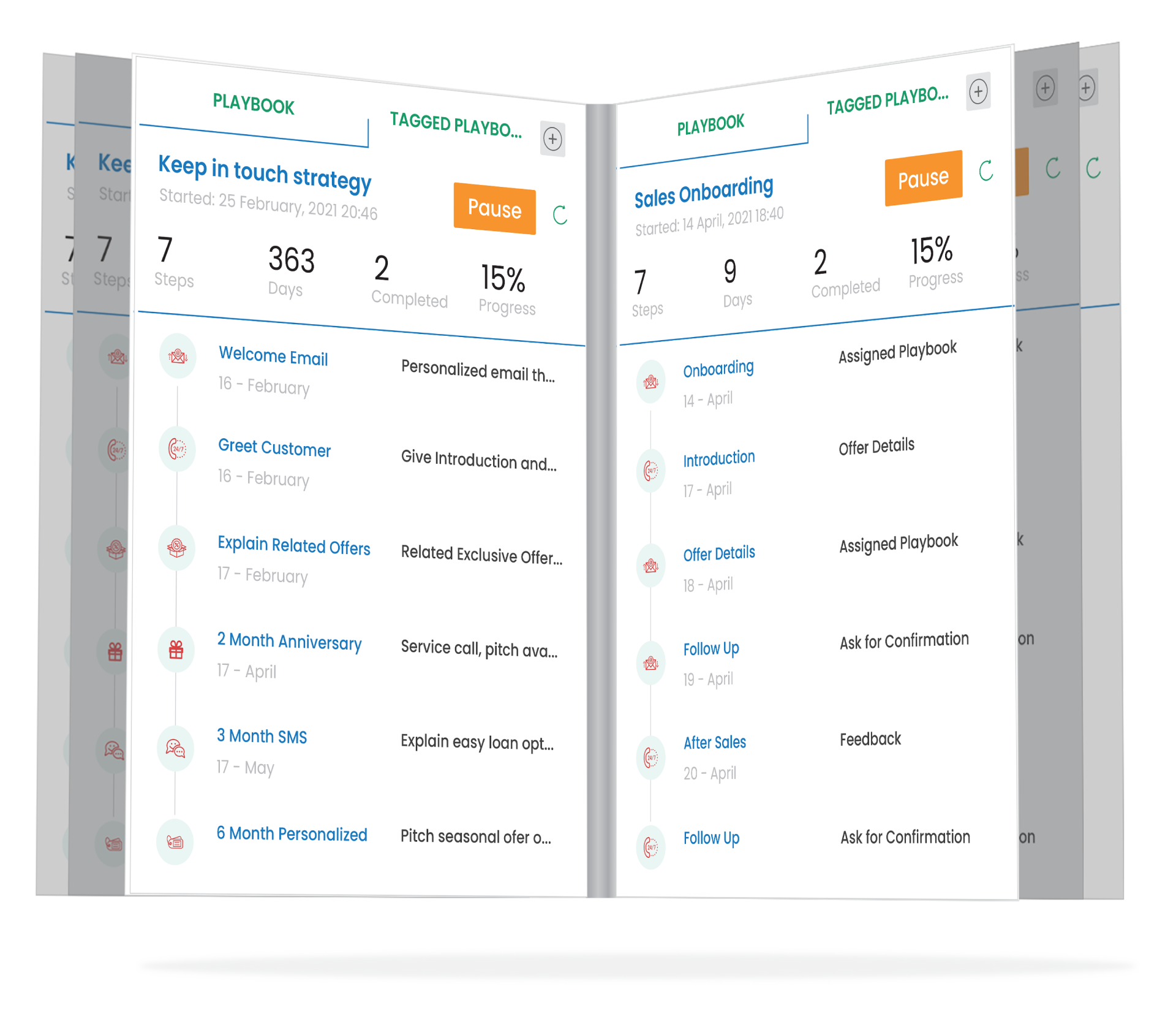

Personalize offers & playbooks

-

Algorithmically derived 1:1 offers with modern CRM for banks.

-

Utilize guided call scripts and playbooks to increase the probability of conversions.

-

Event-based, real-time alerts from integrated systems.

-

-

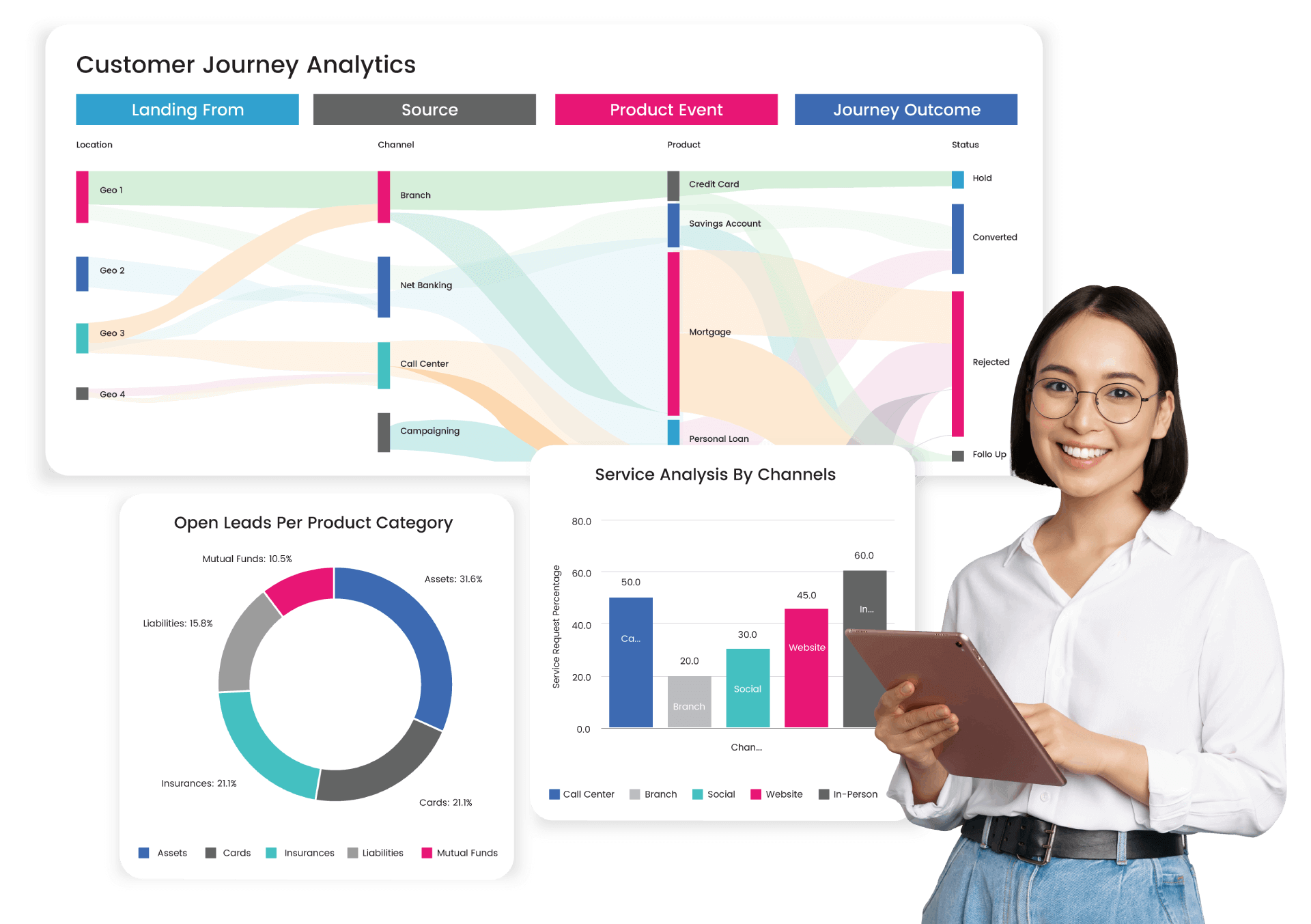

Keep track of activities with Reports and Dashboards

-

Design custom tabular and matrix reports through the UI Report designer in a few clicks.

-

Conduct advanced analysis with custom calculations, trend analysis for user-defined time periods with advanced data visualization options, such as heat maps, tree maps, bubble charts, or scatter plots.

-

Auto-generate, schedule and trigger personalized reports based on roles and permissions via emails from a single report.

-

-

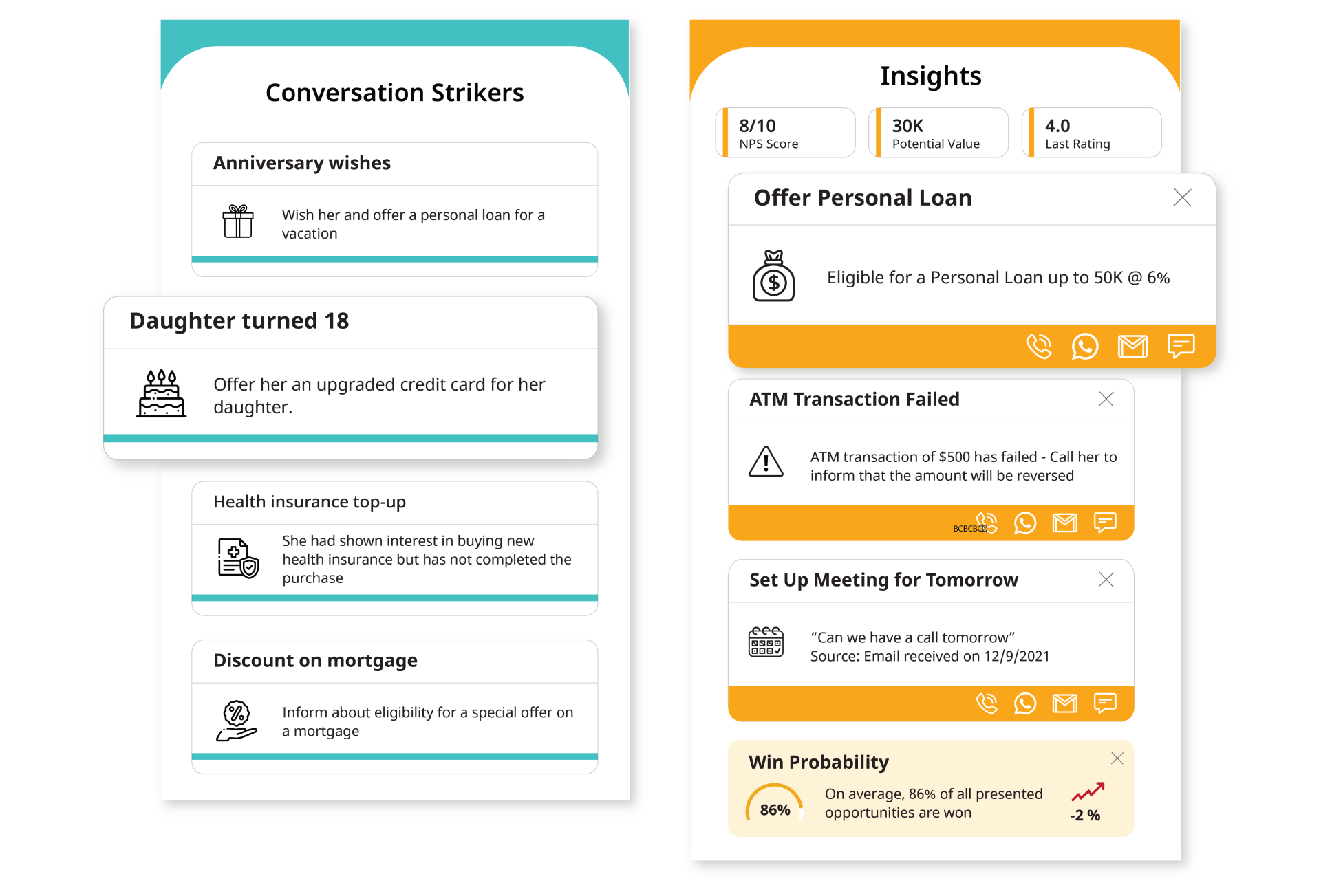

Grow CLV with Smart RM

-

AI-driven day planners to prioritize tasks.

-

Smart conversation strikers for relevant engagement.

-

Straight through processes for faster fulfilment.

-

Smart retail banking CRM empowering RMs to deliver a delightful customer experience.

-

-

Deliver results with Performance modelers

-

Retail Banking platform's Catalyst Performance Modeler assists your team in setting targets based on roles, products, time period, channels, revenue, quantity and conversion rates etc. for indepth planning and execution.

-

Assign targets at multiple hierarchies and rolled up depending on organizational policies and strategies.

-

Sales team can achieve targets by auto calculating and auto creating the required number of leads, campaigns, interactions and conversions on daily basis.

-

-

Uberize your sales team with Mobility

-

Prioritize daily activities and get the optimum sales route with geo routing functions.

-

Track leads in real time and manage follow up /engagement activities for nearby leads with GPS Navigation.

-

Get advanced mobile functionalities including voice functions for entering or updating sales data along with push alerts.

-

MODERNIZE SERVICE

90% Improvement in Average Service TAT and more transformation inside at Axis Bank

-

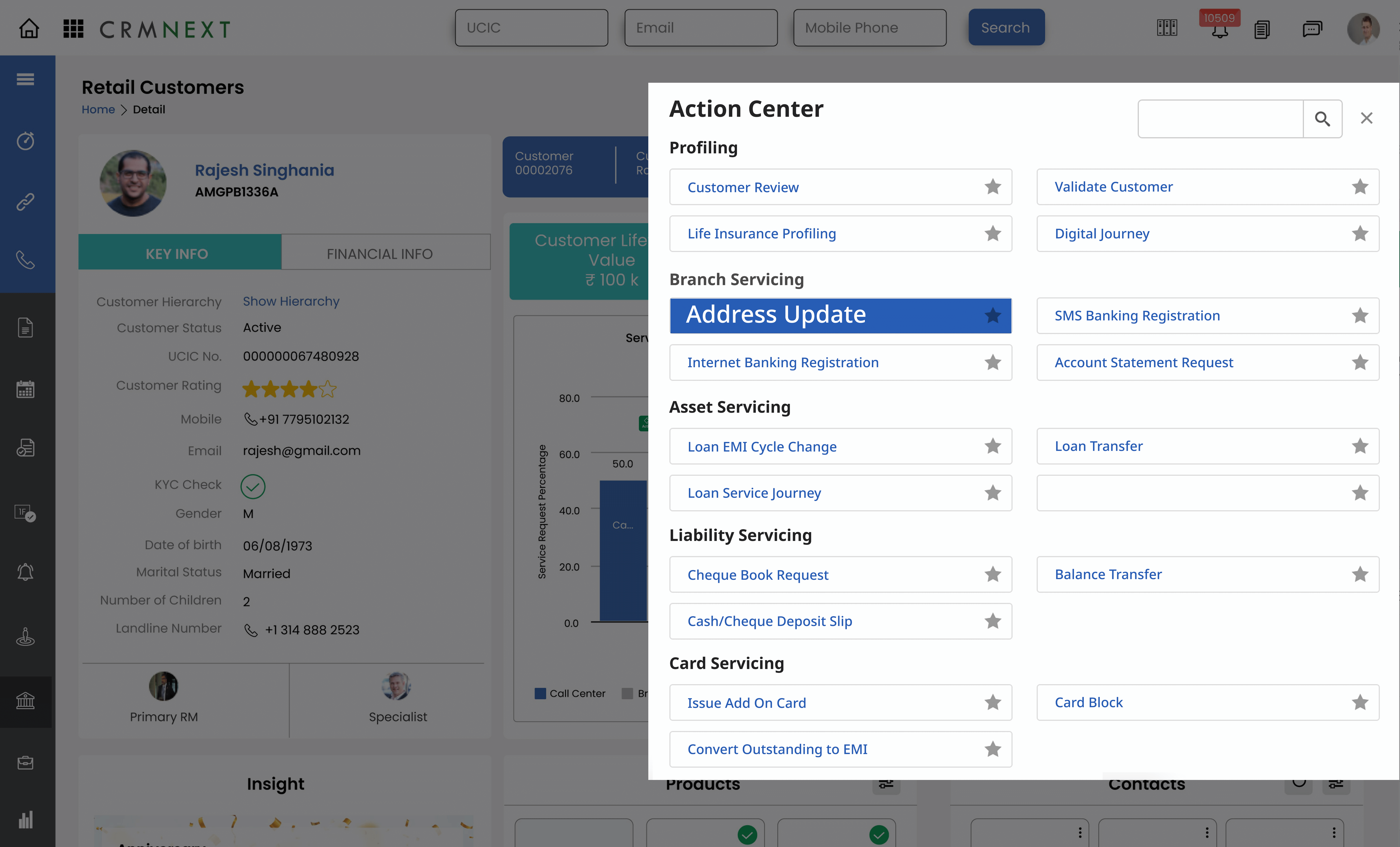

Ability to do, not just view with Customer 360

-

Real-time display of product holdings, transactions, interaction, engagement analysis and more on retail banking CRM.

-

AI models predictions, scoring, segmentation, insights & personalization.

-

Guided Action Center to fulfil any need with simple clicks.

-

-

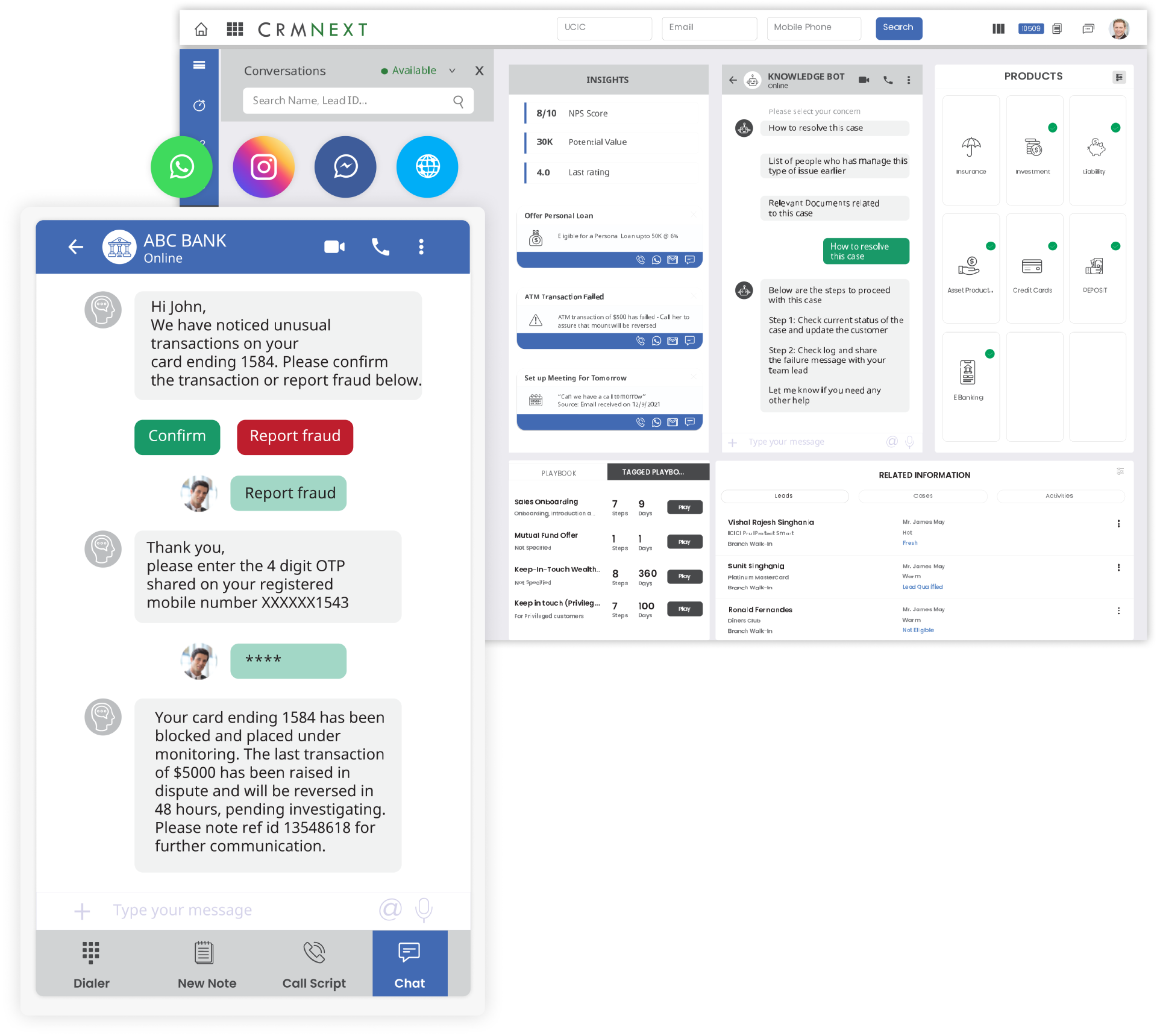

Close cases faster

-

Capture service requests including from any channel including email, SMS, web, social, WhatsApp, Facebook Messenger, Google Business Messenger, call centre, branches.

-

Enrich cases automatically with customer information, categories, sub-categories and sub-subcategories.

-

Capability to create parent and child cases on retail banking platform to simplify case logging for customers and provide faster turnaround times.

-

-

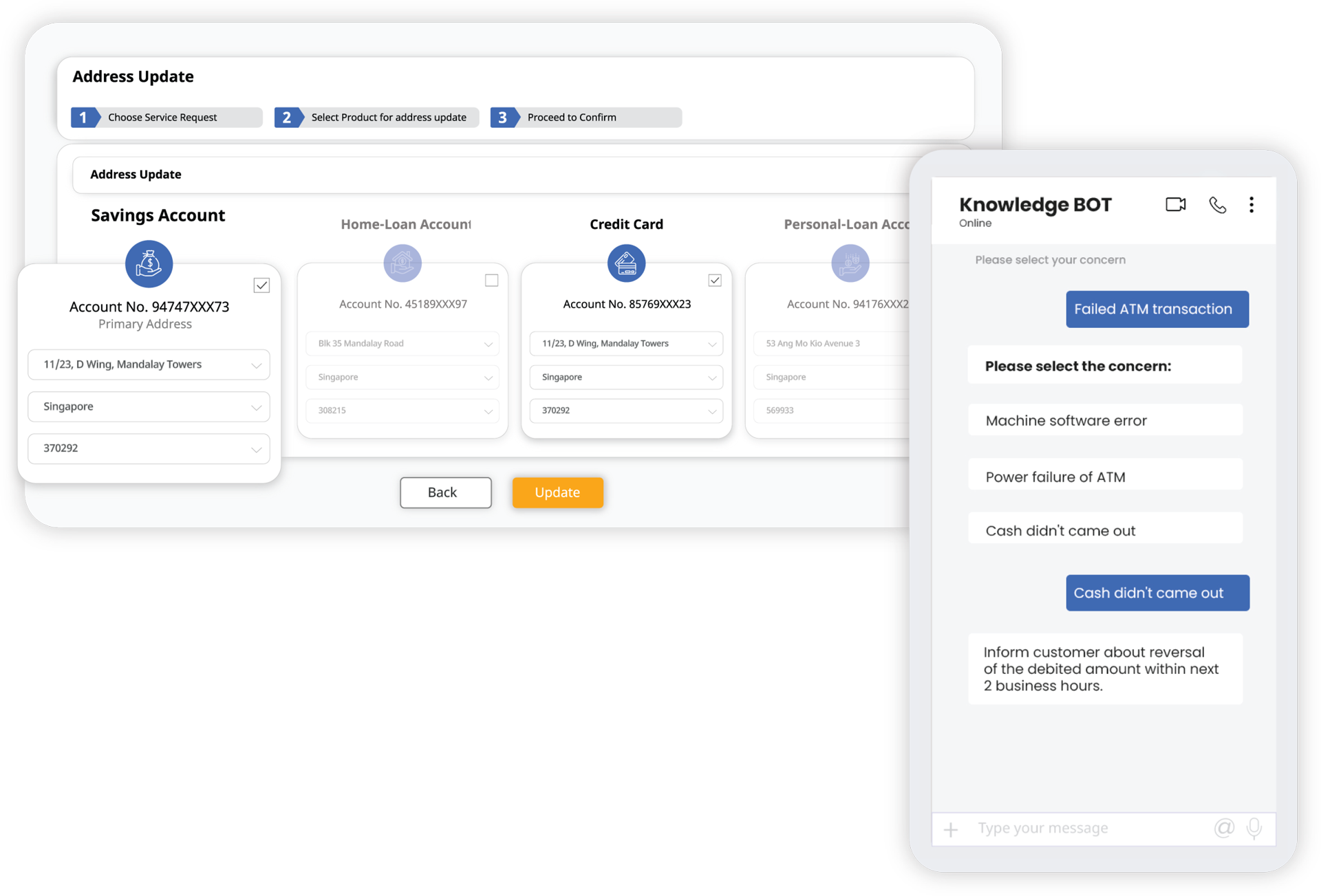

Increase First Touch Resolutions with STPs

-

Deliver accurate solutions at the first contact itself with AI/ML driven nudges.

-

Enable straight through processes to instantly fulfil service requests.

-

Manage End-to-end QRC cases on a single retail banking CRM platform.

-

-

Service instantly on OCP

-

Engage, serve & sell across modern, traditional channels.

-

Connect on customer's choice of channel easy integrations.

-

AI/ML driven STPs for automated service resolutions & real-time assistance.

-

-

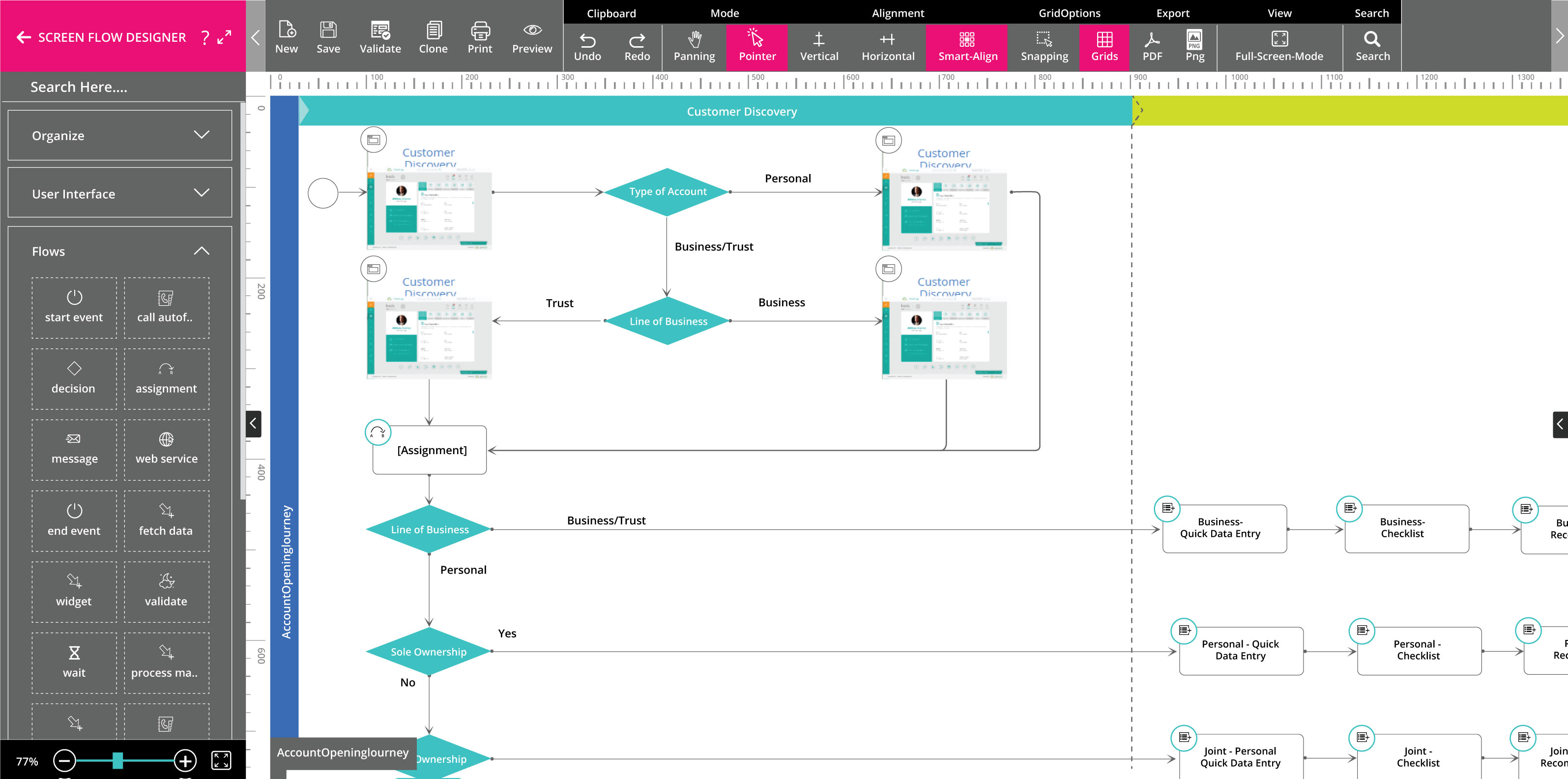

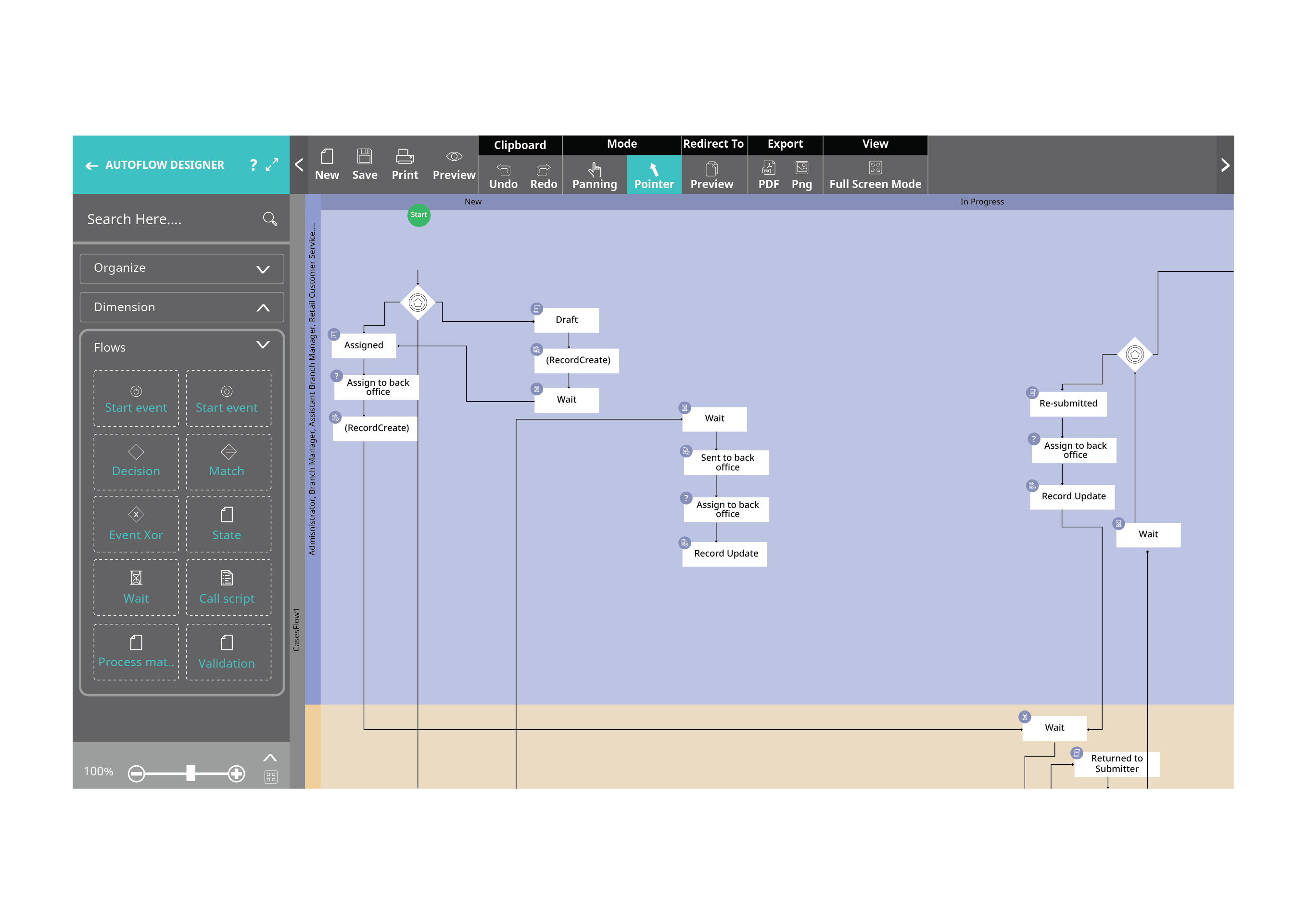

Service workflows are made simpler with AI

-

Create agile and adpative process with retail banking CRM's 7 layers of proprietary AI-driven journey and process designers.

-

Drag and drop driven, visual graphical tools to design intelligent and change ready processes and screens.

-

Handle complex parallel workflows, assignment rules and categories of queries, requests or complaints.

-

MARKETING AUTOMATION

370% Increase in leads generated and more transformation inside at HDFC Bank

-

ROI-Driven, Multichannel Campaigns

-

Create Multichannel, Multiwave, Multistep Campaigns.

-

Create event triggered campaigns.

-

Continuous channel strategy execution on single platform.

-

Advanced channel support with seamless integrations.

-

-

Lead Management

-

Capture leads across channels.

-

Get AI-based lead scoring.

-

Create complex lead workflows.

-

-

Intelligent Analytics and Reporting

-

Natively embedded A/B and multivariate testing.

-

Marketing Campaign Analytics.

-

Smart Reports and Dashboards.

-

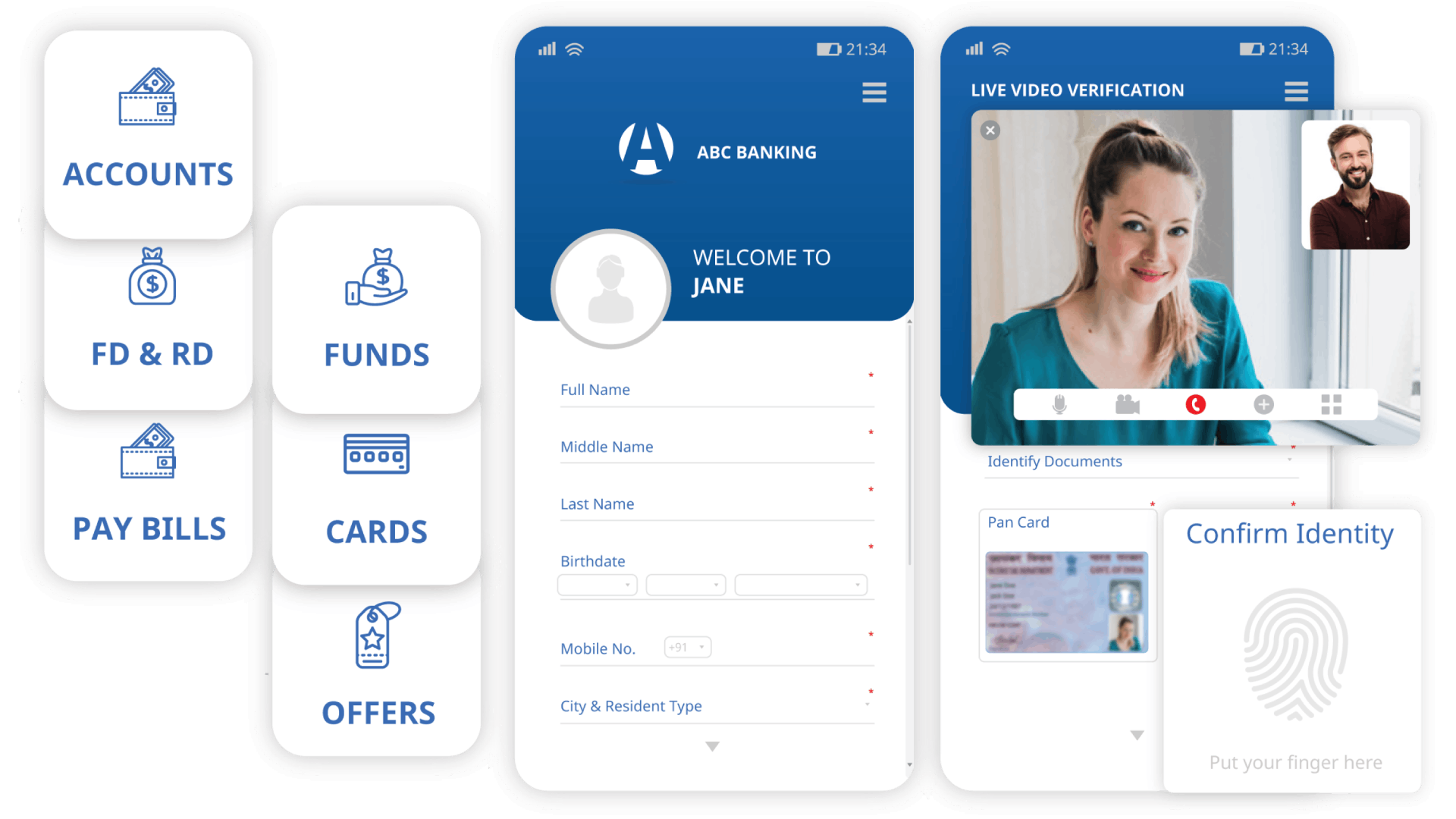

INSTANT DIGITAL ACCOUNTS

See how HDFC bank is leveraging smart digital journeys to reduce account opening time from days to minutes

-

Instant account opening with faster onboarding

-

Create responsive screens quickly, define data sources, add validations, real-time API calls, and more.

-

Eliminate bad actors with OTP-based eKYC.

-

Attract deposits with instant funding options through multiple payment gateways.

-

-

Create attractive, responsive screens with Vivid Screen DesignerTM

-

Modify backgrounds and add validations on fields with a drag-and-drop designer.

-

Design screens for change-ready journeys on the fly.

-

Intuitively define data sources and custom actions.

-

-

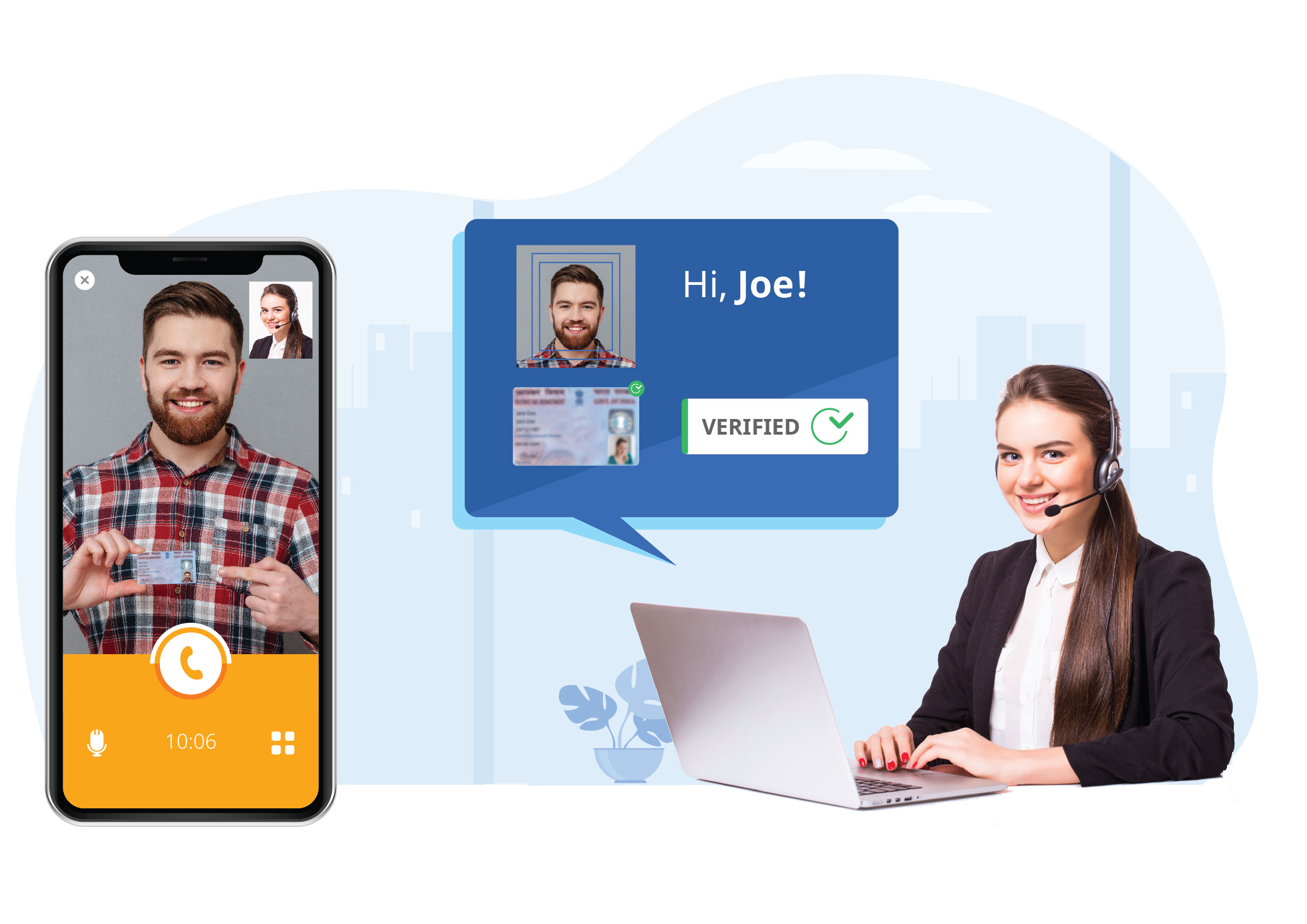

Verify customers and be regulatory compliant in real-time with eKYC and Video KYC

-

Eliminate bad actors by providing integration with regulatory agencies to deliver OTP-based eKYC and Video KYC providers to prevent fraud.

-

Be enabled with features such as video call recording for identity capture and verification, geo-tagging and concurrent audit.

-

Be compliance ready with GDPR, AML, KYC, and other Government regulations.

-

-

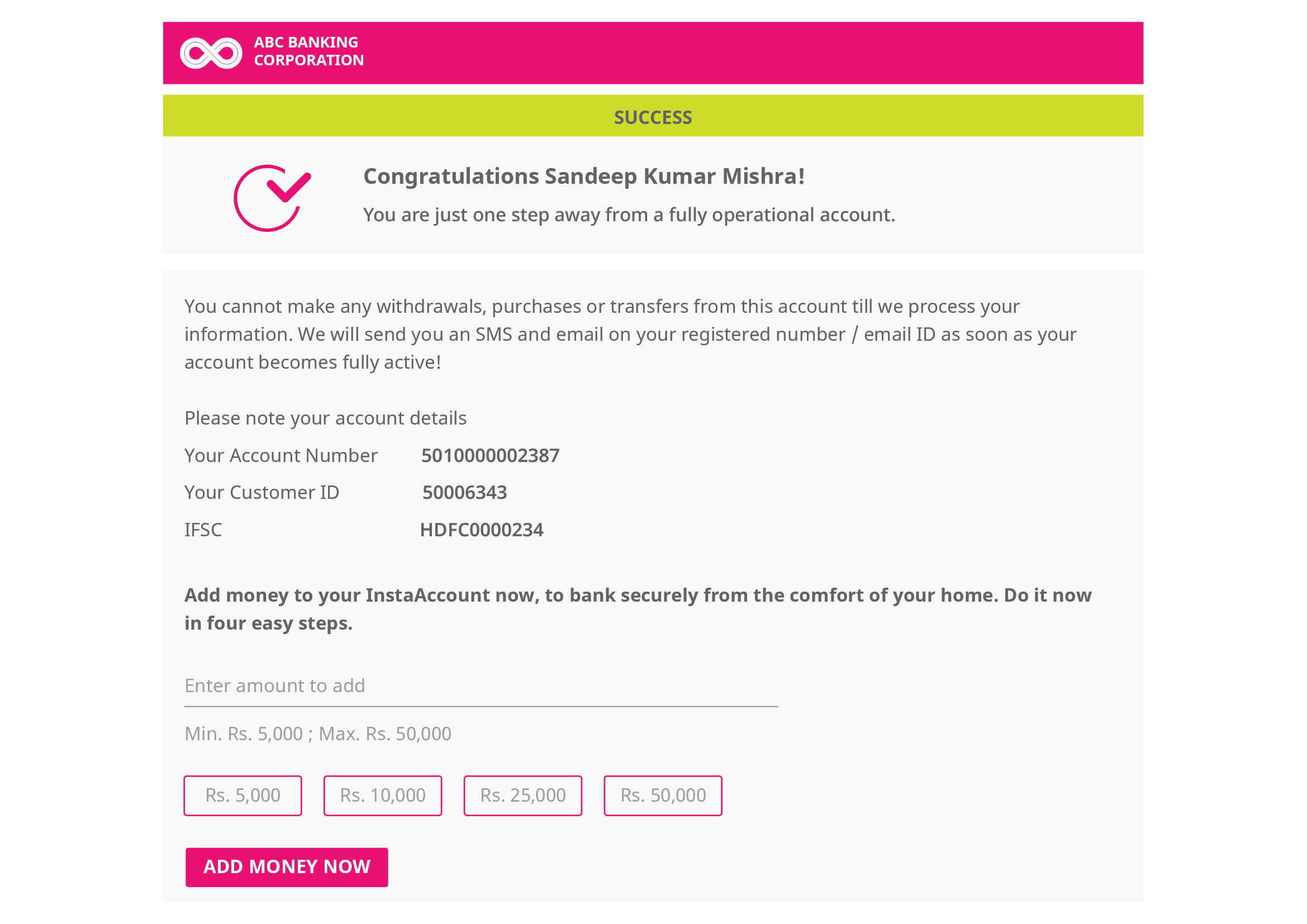

Grow deposits faster with instant activation and funding

-

Activate accounts instantly with a unique Customer Account Number and onboarding process.

-

Attract deposits instantly by enabling instant funding options through integrating retail banking CRM with multiple payment gateways and core systems.

-

-

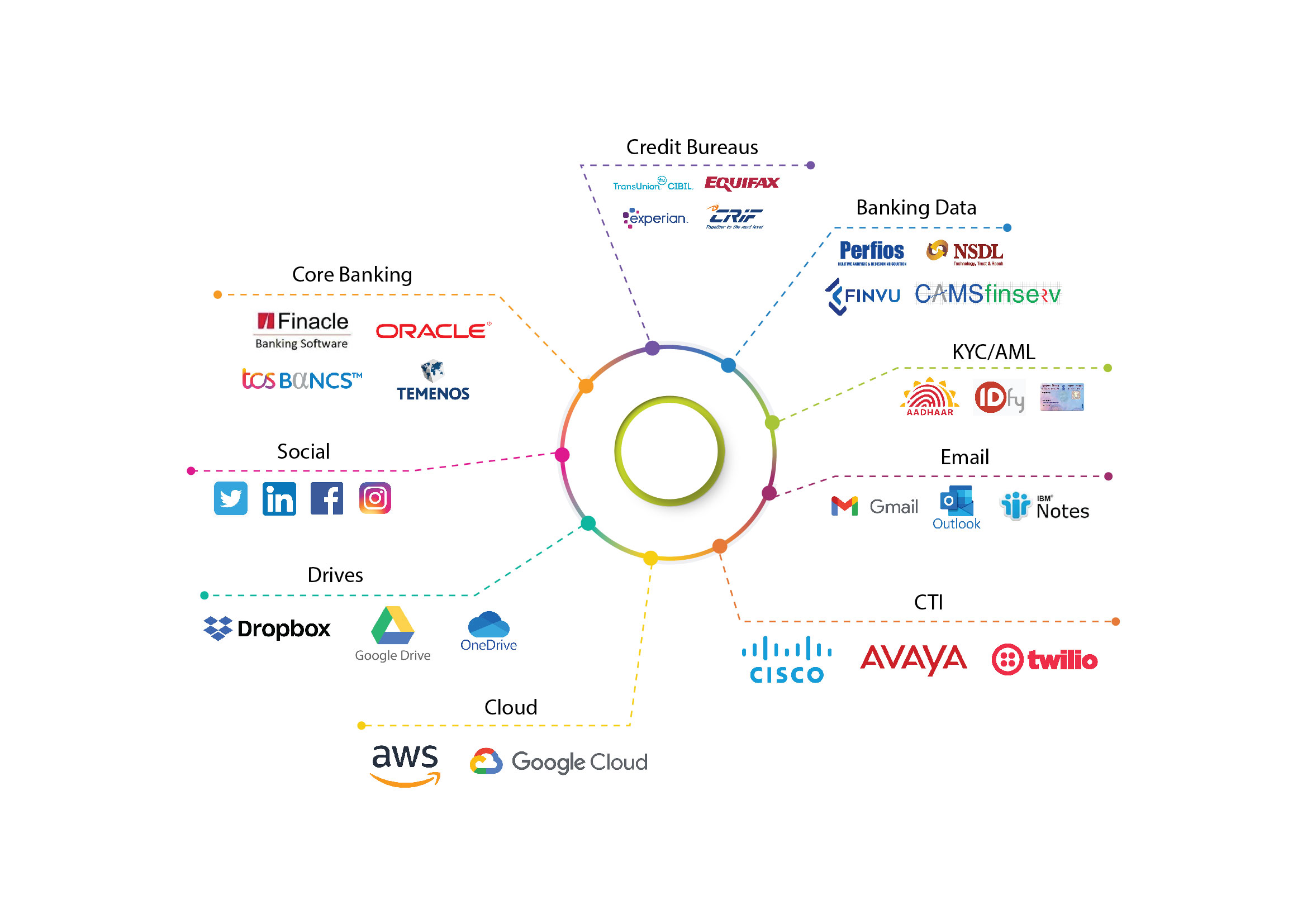

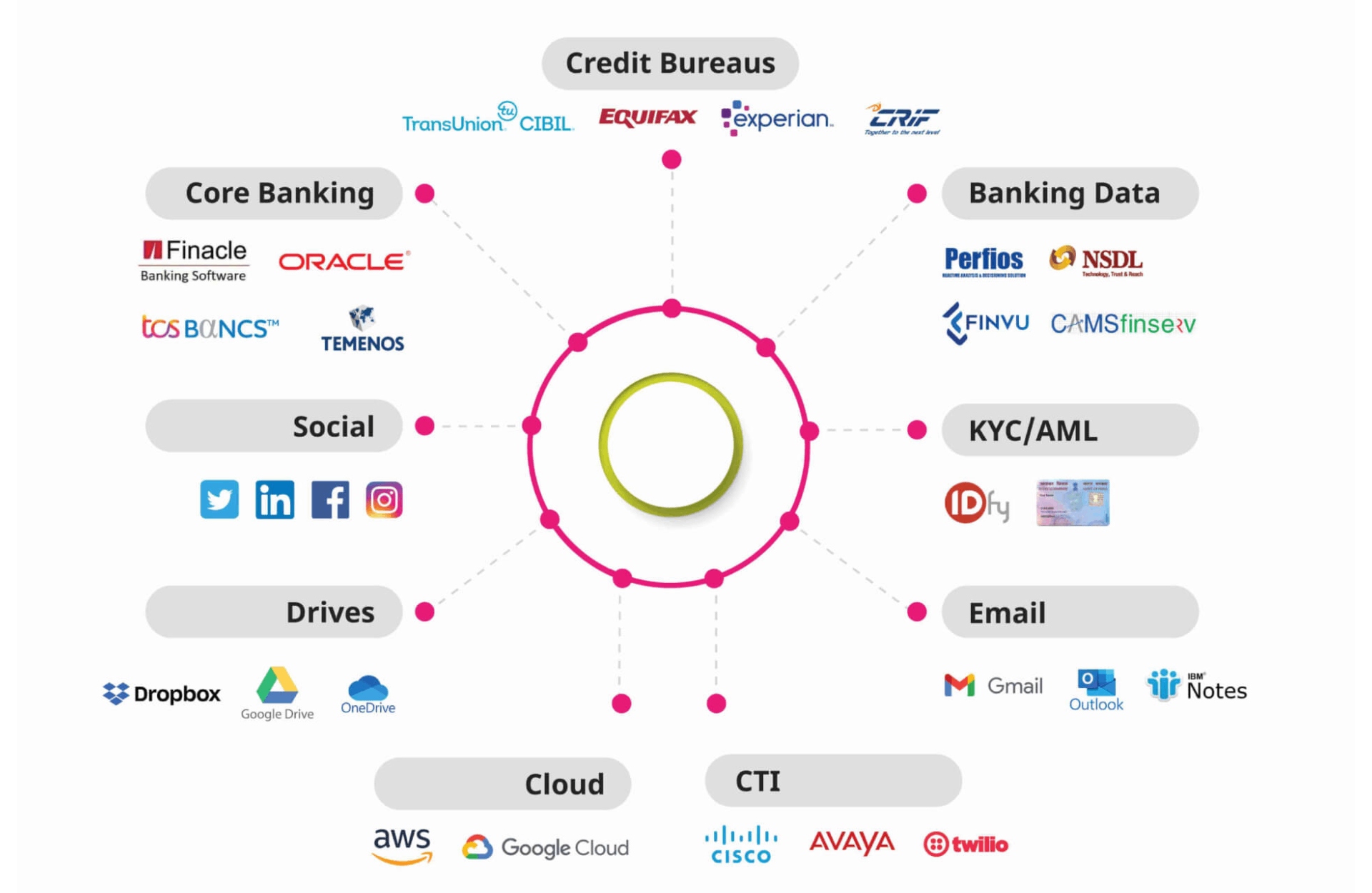

150+ ready ecosystem connectors

-

Fetch, extract and utilize data from various systems including the National ID system, Tax systems, credit cards, core banking, credit rating bureaus, social and more.

-

Codeless configuration with more than 50 out-of-the-box patterns.

-

Make full use of multi-app capabilities with restful web services which can share data with any external application and support 2-way bidirectional integration.

-

-

Maximize conversions and reduce journey drop-offs AI driven win back modeler

-

Analyze customer behavior with machine learning and whitespace analysis with an algorithmic winback modeler.

-

Create dynamic personalized offers along the account opening journeys for retail banking and financial services customers.

-

Leverage compelling journeys that magnify your unique value propositions.

-

DIGITAL LENDING PLATFORM

90% Reduction in avg. loan processing time inside Kotak Mahindra Bank

-

Upgrade lending experience with application capture

-

Capture applications from the website, mobile apps, SMS, phone calls, missed calls, TAB, Branch, ATMs, KIOSK, Business Correspondents (BC), Business Facilitator (BF), Direct Selling Agent (DSA), online lead aggregators and more.

-

24X7, Omnichannel accessibility with hyper-personalized offers and advanced targeting.

-

Effortlessly upload documents, check eligibility from automated predefined business rules and display pre-approved offers.

-

-

Get highly configurable, AI-driven lending workflows

-

Intelligent, customizable workflow journeys backed by AI/ML models.

-

Enable robotic process automation (RPA) to speed up operations, reduce operating risks and tightly control costs to serve.

-

Designer-driven workflow designers capable of creating, and deploying complex, parallel processes.

-

-

Create end to end lending experience with ecosystem connectors

-

100+ Ready connectors to fetch, extract and utilize data from various systems including the National ID system, Tax systems, LOS, credit card, core banking, credit rating bureaus, social and more.

-

Codeless configuration with more than 50 out-of-the-box patterns.

-

Make full use of multi-app capabilities with restful web services which can share data with any external application and support 2-way bidirectional integration.

-

-

Reduce NPAs with Automated Underwriting

-

Capture behavioural data and algorithmically analyse risk level with intelligent retail banking and financial services CRM.

-

Automatically approve conforming applications or prioritize deviations for final decisions.

-

Streamline and speed up processes for faster decisions and set customizable dynamic risk limits.

-

-

Lending domain native OCR enabled DMS

-

Integrate seamlessly with existing systems with best-in-class encryption and data privacy.

-

Enable easy document uploads, fetching, auto-filling and data extraction with OCR capabilities.

-

Enable extensive APIs for a smooth DMS experience.

-

-

Unlock more opportunities with partner enablement

-

Enable partners to orchestrate credit processes and offer personalized services.

-

Activate new revenue streams through partner ecosystem that magnify and extend credit value chains.

-

-

Lower credit delivering time by 90% with auto decisioning and faster disbursals

-

Enable end-to-end, instant decisions with AI/ML-powered retail banking and financial services CRM.

-

Automate identity verification and validation.

-

Configure smart business rule engines for lending in minutes.

-

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view allRelated searches

FAQ's

-

What is banking crm?

A banking CRM platform helps in managing interactions and relationships with the retail banking customers. Banking CRM provides complete 360-view of the customer including account details, transaction history, interactions, product usage and preferences, and many more. The platform helps in understanding the customers’ needs with real-time insights and provide the right solution at the right time throughout their financial life journey.

-

What are CRM best practices in retail banking industry?

Retail banking CRM provides personalized and omni-channel customer experiences, enhances the productivity of sales and service teams resulting in increase in digital sales. To make the most of the banking crm, harness the customer data for informed decisioning by leveraging the AI-powered customer insights and next-best action to deliver personalized experiences, Gen-AI recommendations for tailored communications and faster resolution, omni-channel engagement for seamless customer interaction and intelligent workflows & day planner for improving the efficiency of the sales & service teams.

-

How does AI in Banking CRM help in enhancing the customer experience?

AI in Banking CRM enables the banks to create personalized customer journey. Real-time AI-powered analytics helps in predicting the needs, provide next-best actions and offer personalized products to the retail banking customers. Chatbots powered by AI provide self-services and helps in navigating the customers to the right solution thus enhancing the customer experience.

-

How is Gen AI improving customer services for retail banking customers?

Generative AI acts as an additional hand for customer service agents as it categorizes cases based on text, identifies customer sentiments, provides case summarization and next actions to provide faster resolution to engage in more meaningful and relevant conversations with customers. Gen AI also provides email syndication to identify intent and generate quick responses in just a click. Service teams can automate service workflows like create new case or update existing ones.

-

What are the benefits of BUSINESSNEXT’s retail banking platform?

Deliver simplified retail banking experience with BUSINESSNEXT’s retail banking platform with the power of Digital Journeys + CRM + AI, supercharged with Gen AI and AI-ready models. The platform, purpose-built for banks, provides unified omni-channel journeys, Gen AI-powered sales teams and smart bots for faster fulfilment. Leverage AI-powered real-time insights, next best actions, and alerts to provide personalized customer experience. The platform empowers your teams with analysis of customer interactions, provide summary and sentiment analysis with next-best actions to deliver unparalleled customer services.