inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

-

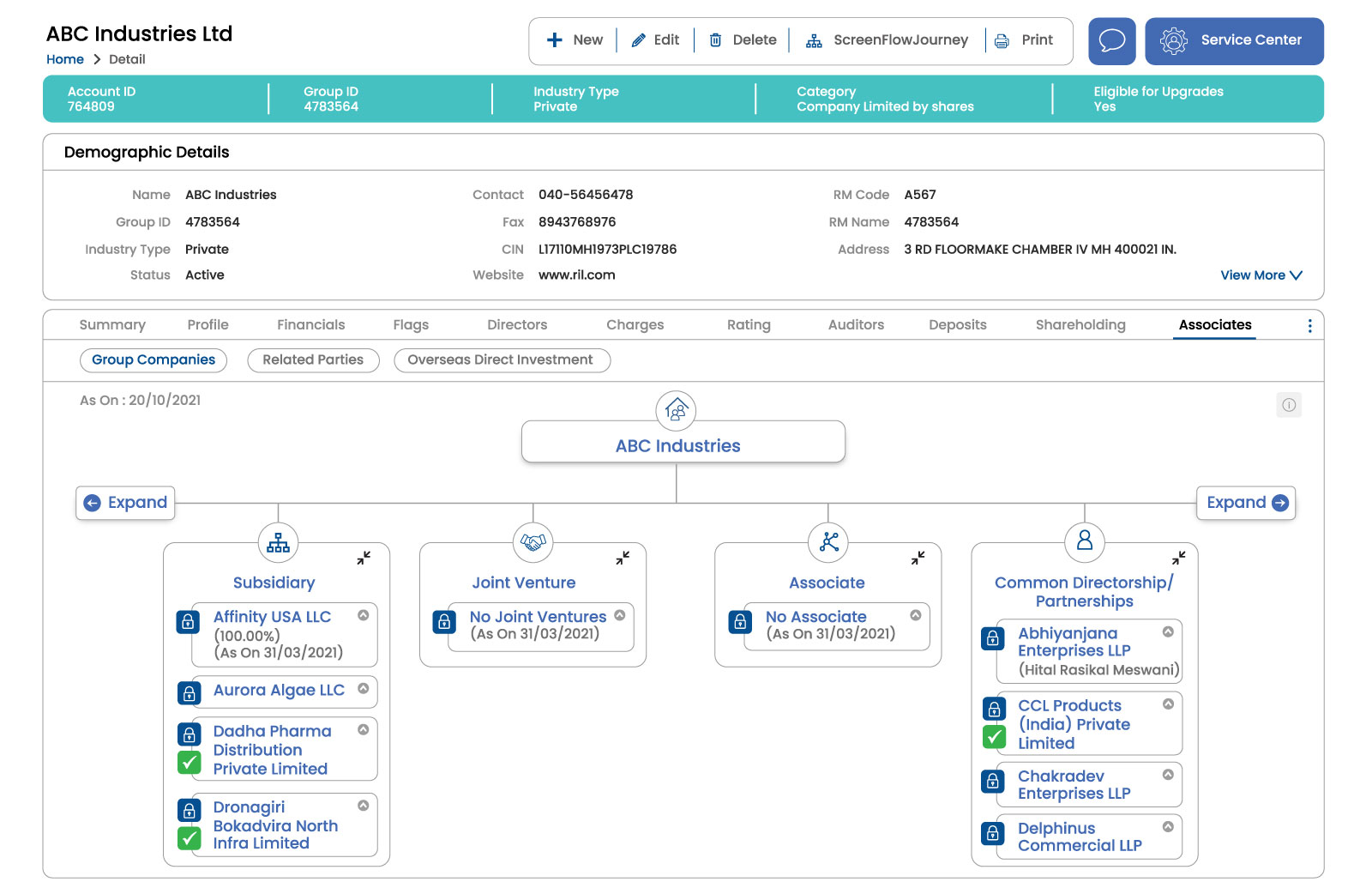

Smart Corporate & Group 360

-

Real-time account, contact and group intelligence from a unified customer data platform.

-

Group 360 gives you a hierarchical grouping of accounts, subsidiaries, partners, vendors, counter parties & more.

-

Increase revenue opportunities through network deal effect.

-

-

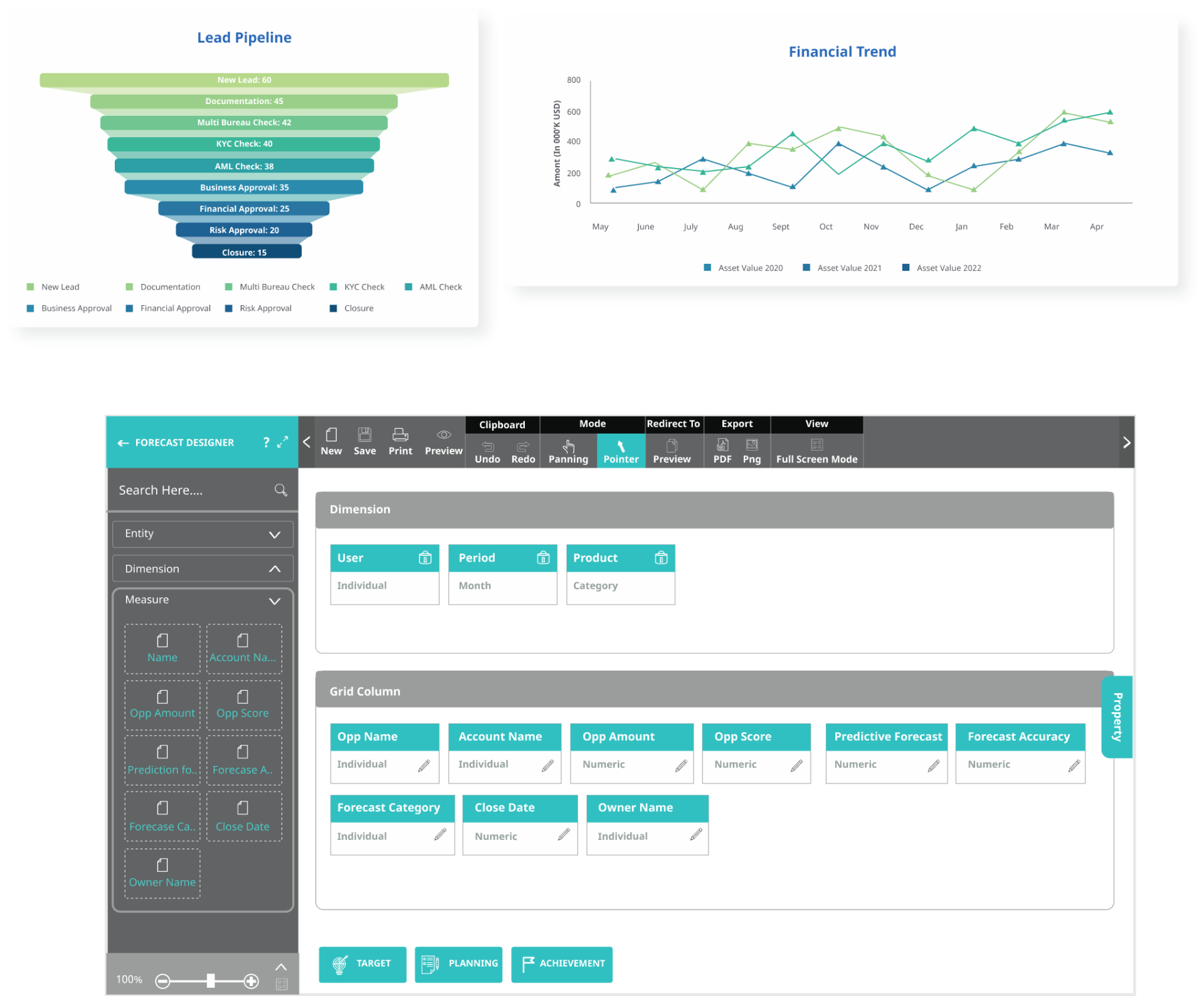

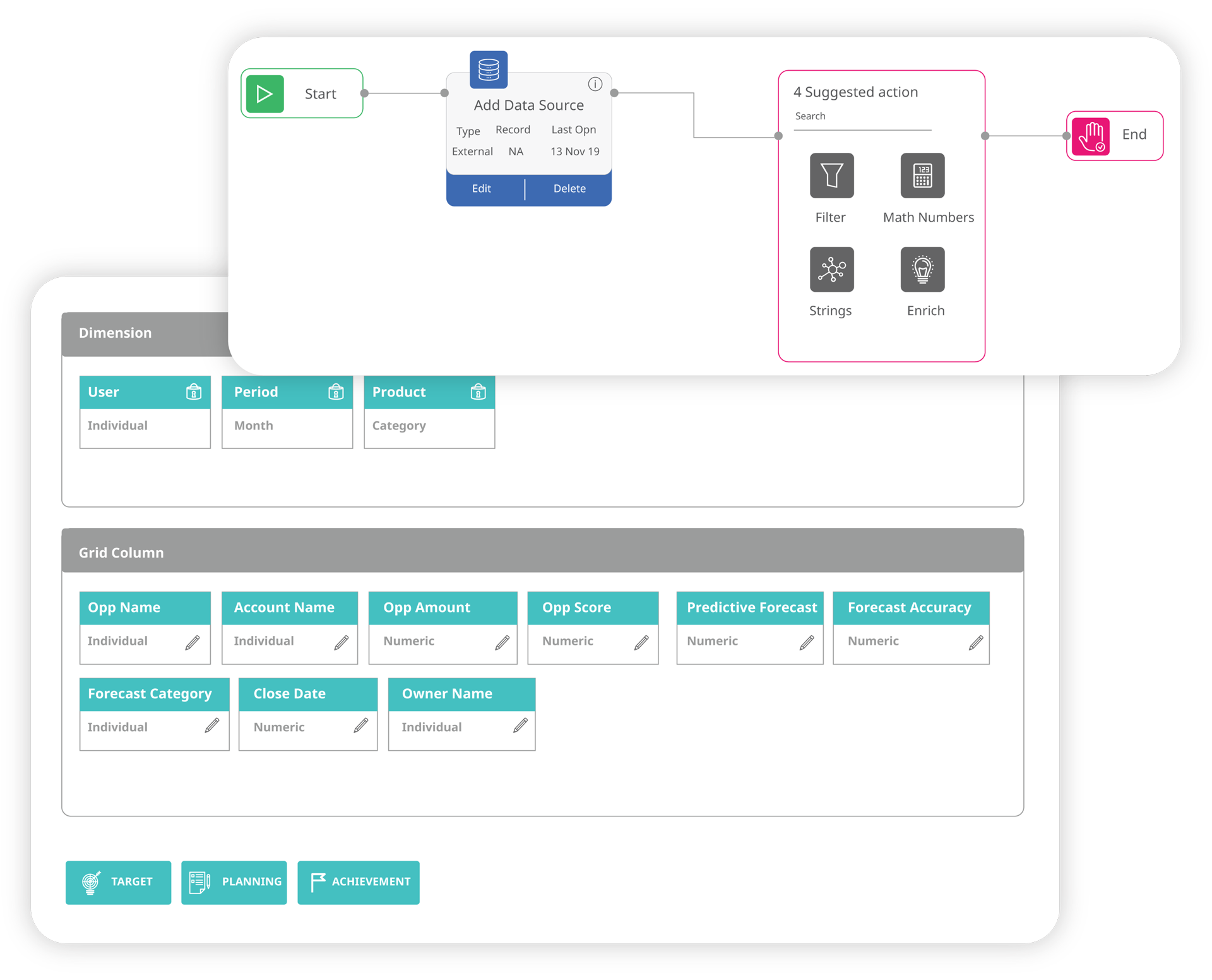

Systematically manage pipelines with accurate forecasting

-

Configure forecast models and define dimensions, quotas, target, product, review and planning.

-

Leverage corporate banking CRM-powered prescriptive analytics that delivers recommended actions to close pipeline/quota gaps.

-

-

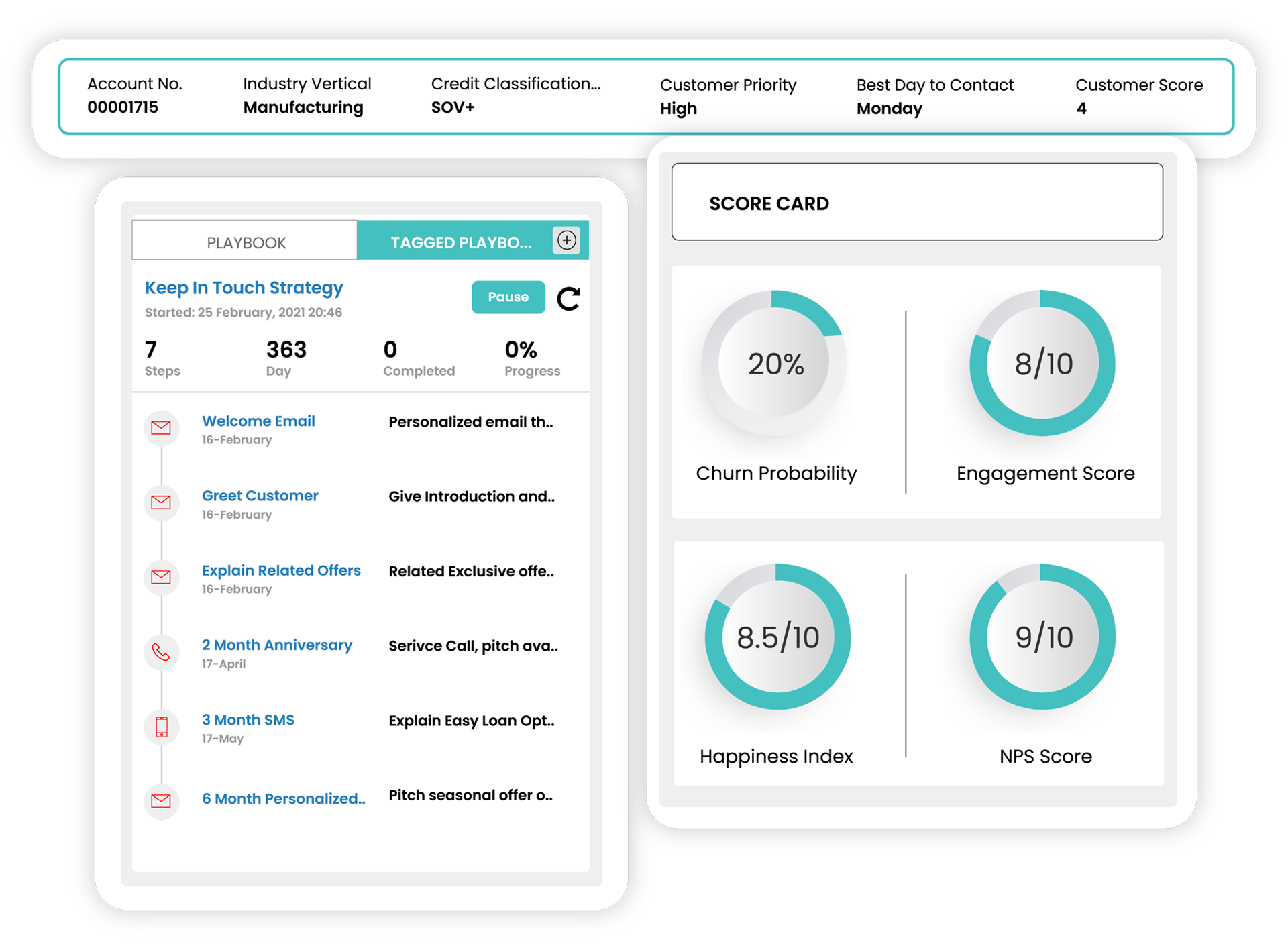

Accelerate opportunity sales cycles

-

Build basic or advanced opportunity playbooks with a visual playbook designer.

-

Advanced corporate banking CRM-enabled playbooks across leads and opportunities, with role-based assigning of owners.

-

Schedule daily activities like sending emails, creating templates, send meeting invites & assign playbooks for specific opportunities.

-

-

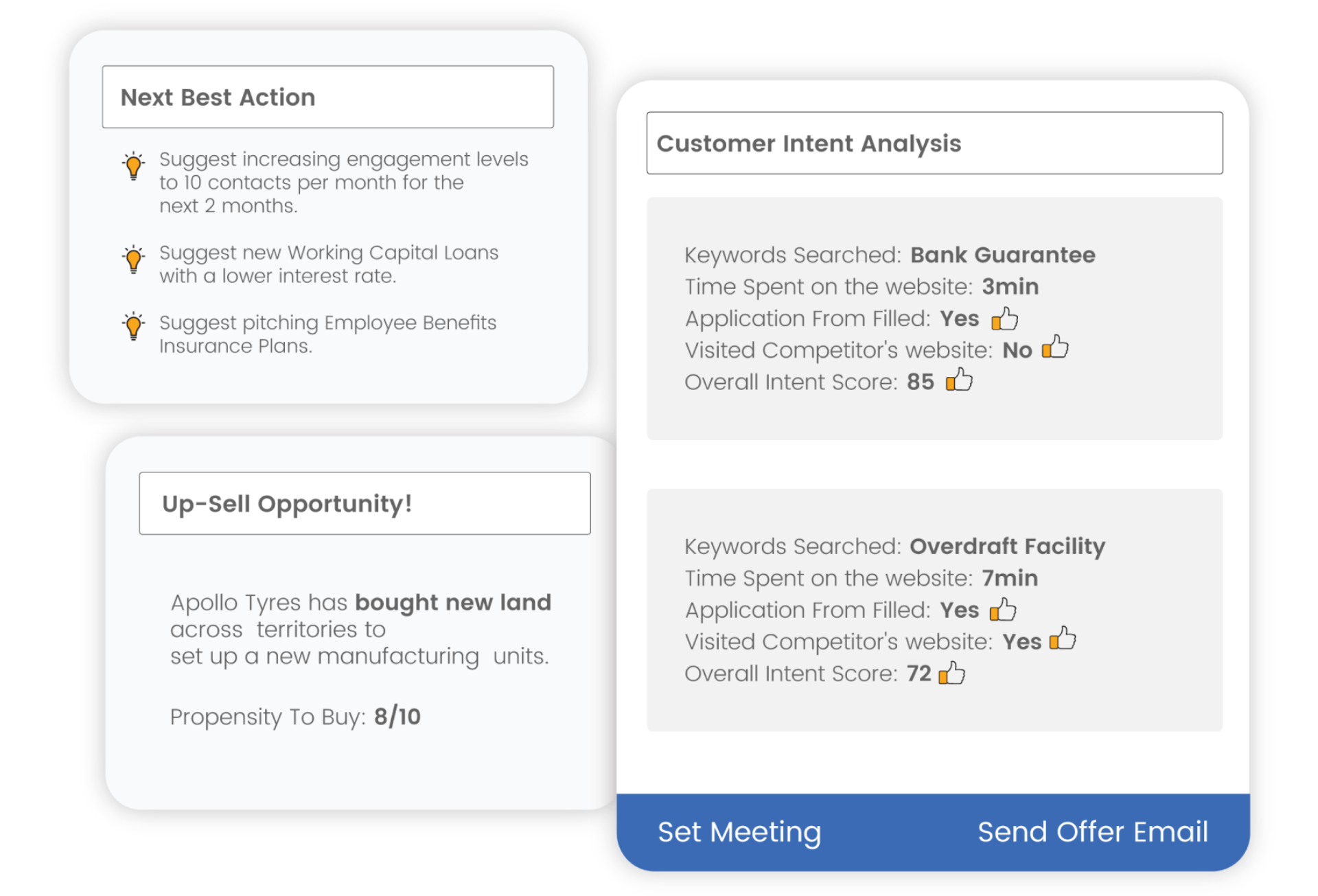

Account planning with AI/ML models

-

Intelligent account planning with real time engagement scores, risk scores, contact score and create activities directly from channels.

-

Build self-learning predictive models for closure probability, deal insights and more.

-

Create adaptive prescriptive models that harness signals taken by users and corporate customers to deliver next best actions such as best content to share, campaign recommendations and more.

-

-

Accelerate RM performance

-

A corporate banking CRM to track and evaluate meetings scheduled by RMs.

-

Real-time view of lead conversion rates and hit rates with the Catalyst Performance Modeler

-

Next best actions with real time insights like product offer suggestion, creating new appointments & more.

-

-

Keep track of activities with reports and dashboards

-

Design custom tabular and matrix reports through the UI Report designer in a few clicks.

-

Conduct advanced analysis with custom calculations, and trend analysis for user-defined time periods with advanced data visualization options, such as heat maps, tree maps, bubble charts, or scatter plots.

-

Auto-generate, schedule, and trigger personalized reports based on roles and permissions via emails from a single report.

-

-

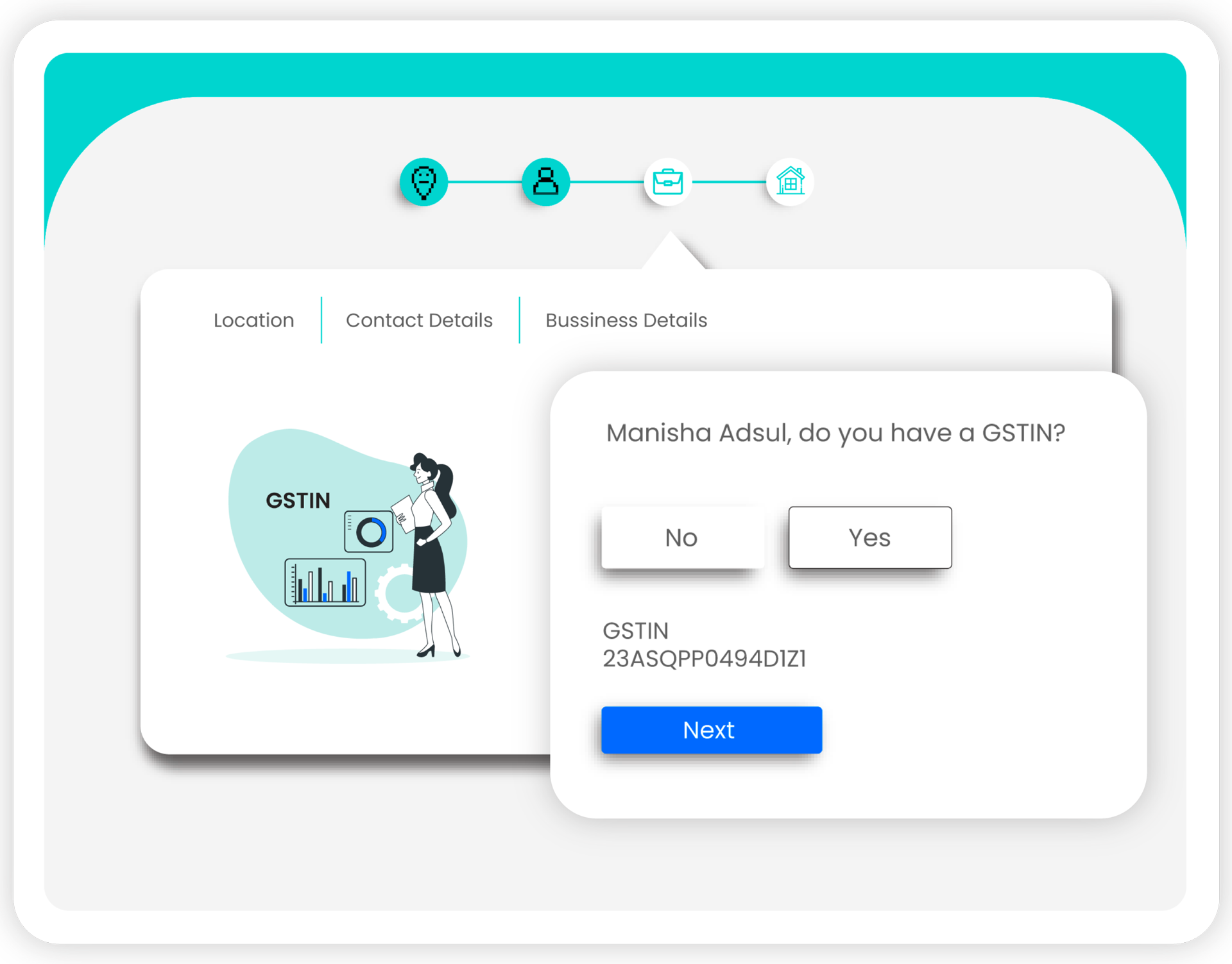

Instant business account opening with faster onboarding

-

Smart corporate CRM-powered digital current account opening journeys with instant activation.

-

Enable instant funding options through integrations with multiple payment gateways.

-

Pattern based integrations with regulatory agencies, DWH, back office, core banking, compliant with GDPR, AML, KYC and other Government regulations.

-

-

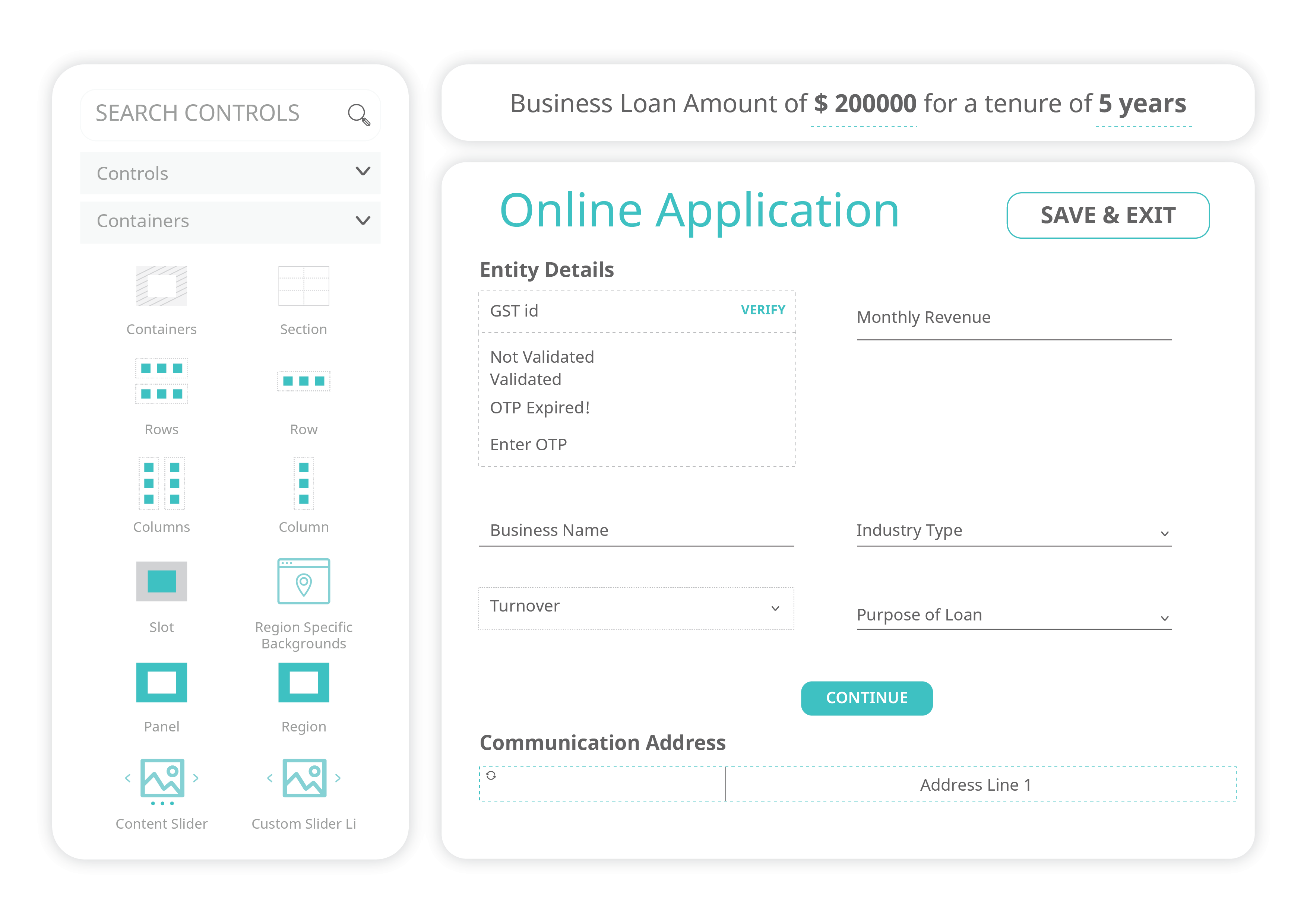

Create attractive, responsive screens with Vivid Screen DesignerTM

-

Modify backgrounds and add validations on fields with a drag-and-drop designer.

-

Design screens for change-ready journeys on the fly.

-

Intuitively define data sources and custom actions.

-

-

End-to-end borrower processing

-

Create and import borrowers with proper checker processes and validations, fully compliant with government regulations.

-

Configure processes to any industry, group entities, size and manage multiple countries.

-

Analyse different rating behaviour scenarios on different natures of borrowers incl. greenfield entities to operational entities.

-

-

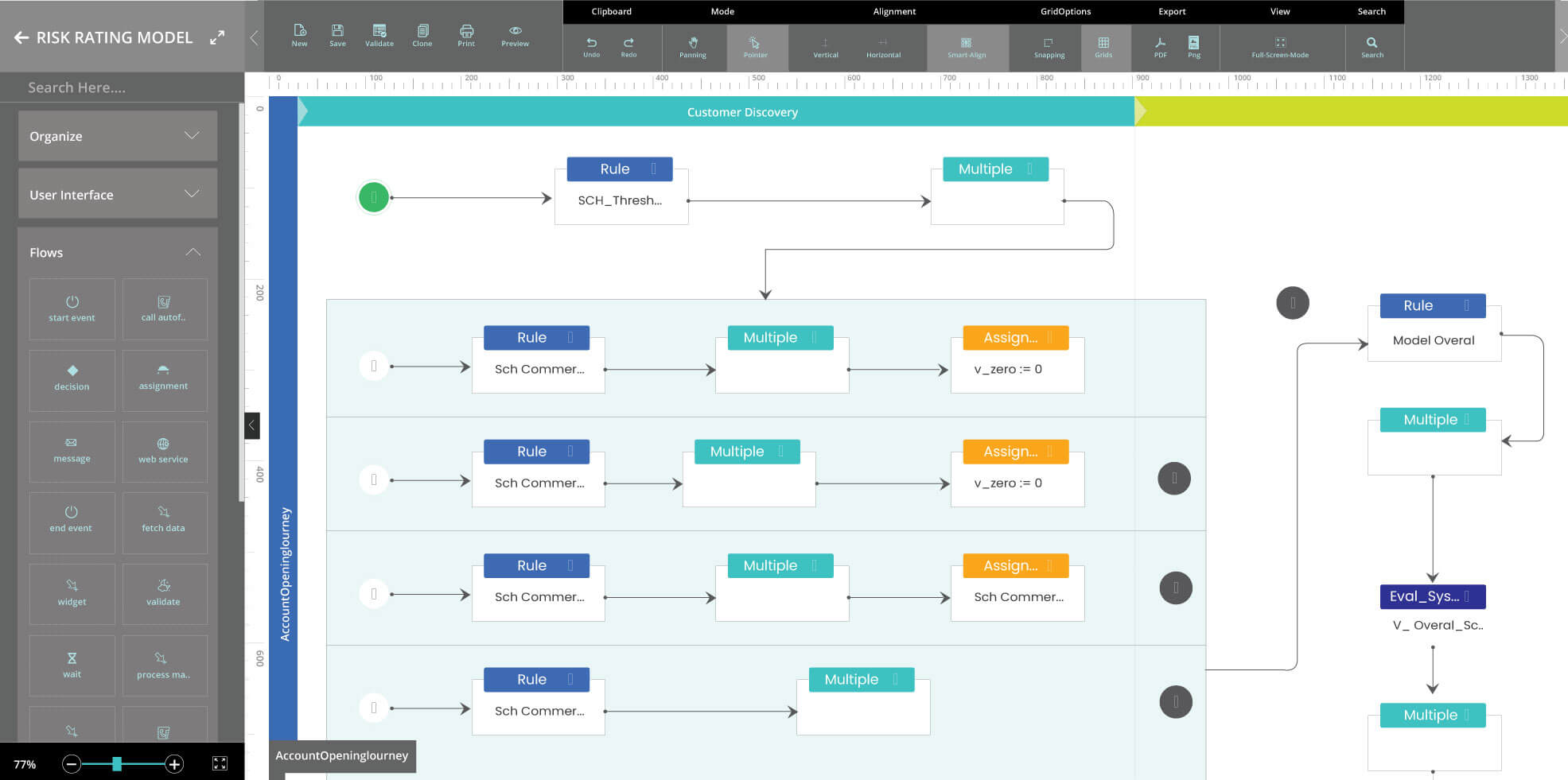

Create your own business differentiators with smart Rating models

-

Use a powerful business rule engine to design proprietary and unique rating models.

-

Enable automatic triggering of ratings based on custom criteria, for instance, external rating downgrade, financial spreads, etc.

-

Input risk rating parameters including financial ratios, industry risks, market risks, business risks and financial risks.

-

-

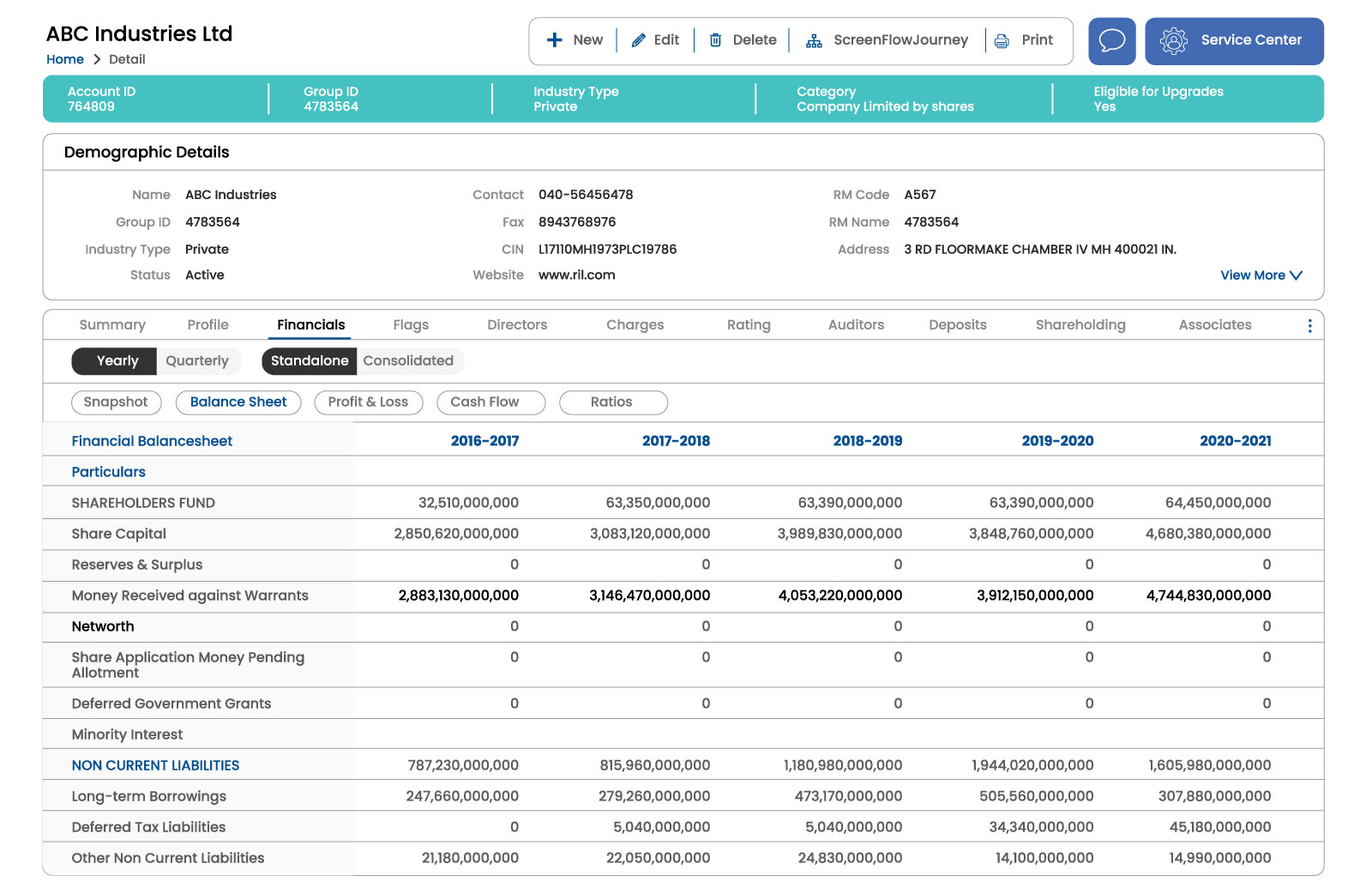

Leverage the maximum potential of financial data

-

Easily upload financial data with smart, guided template suggestions.

-

25+ pre-built models, with the flexibility of creating custom models through zero code, rating designer with minimal training.

-

Quickly validate borrower data and download financials in excel.

-

-

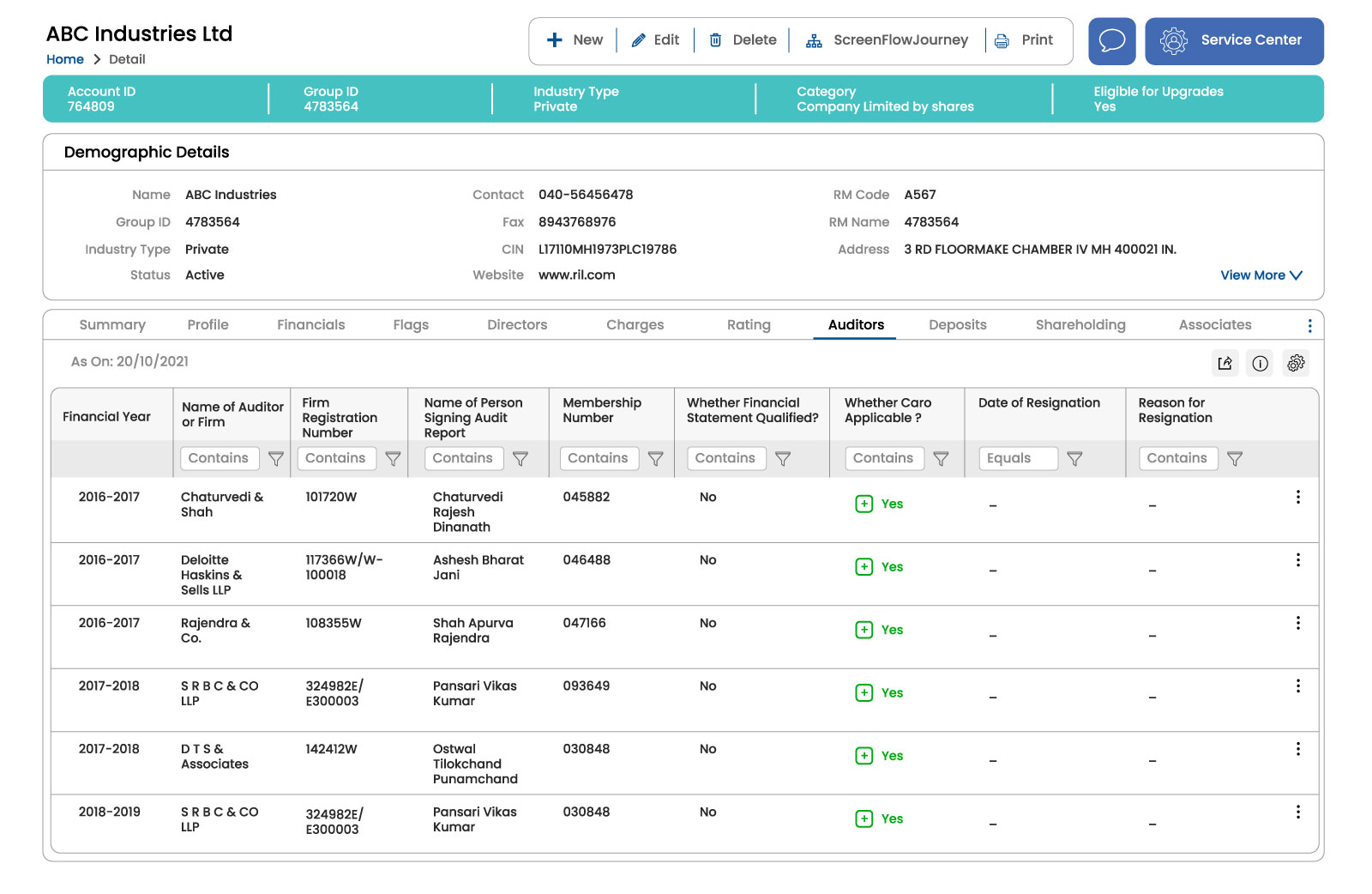

Be compliant in each step

-

Get better reporting structure with interim, and mid-journey reporting capabilities.

-

Complete rating process visibility with an end-to-end audit trail.

-

-

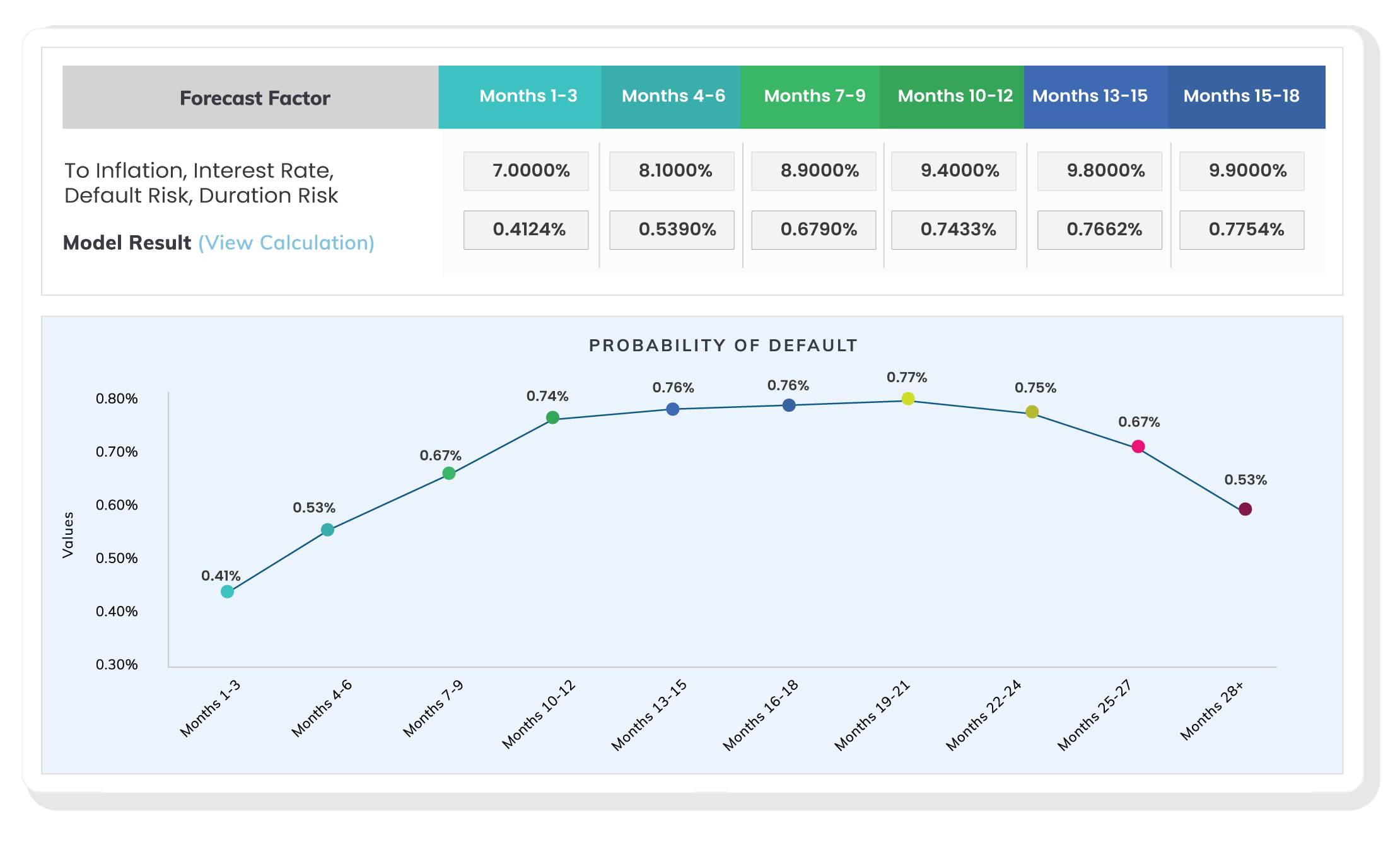

Quickly conduct stress tests and analyse the impacts

-

Easily configure complex mathematical computations for scenario simulations.

-

Execute stress tests against historical datasets and get warning signals early on.

-

Automatically execute model calculation logic for bulk rating execution against sub-portfolios based on specific criteria.

-