Impactful

Generative AI

Frontline Sales Pilot

-

Use daily predictions like lead scoring, deal predictions, sales predictions, email engagement predictions, customer behaviour insights, competitive analysis, product recommendations, content recommendations, follow up suggestions, sales coaching, pipeline health, customer churn predictions, deal timing and more to close deals faster.

-

Teams can also use AI day planner, Cold intro - follow up Email generation with customizable tone, discussion pointers/Conversation strikers by analysing personal interests of prospects/customers.

-

Get human like response to questions like “who are the top accounts” and more.

Contact Center Assistant

-

GPTNEXT helps to automatically generate personalized responses to quickly email or message to customer, human like responses to frequently asked questions.

-

Service teams can automate service workflows like create new case or update existing ones.

-

You can generate automated email response generation with personalized communication and targeted messaging.

Semantic Knowledge Base Search

-

Empowers users to conduct advanced searches within vast information repositories, enabling swift and precise retrieval of relevant data.

-

The platform employs contextual understanding to interpret user input, discerning the underlying meaning and intent, allowing for highly accurate and contextually relevant search results.

-

Users can explore diverse datasets, including documents, articles, and structured databases.

Customer interaction & sentiment analysis

-

GPTNEXT empowers teams can performs real-time sentiment analysis on customer interactions, such as emails, chats, or call transcripts.

-

Users can identify recurring topics, preferences, and the channels through which customers prefer to interact, enabling personalized communication.

-

By analysing past interactions and customer profiles, GPTNEXT generates conversation starters and discussion pointers. This helps customer service representatives and relationship managers engage in more meaningful and relevant conversations with customers.

Text classification & Entity Extraction

-

GPTNEXT can automatically categorize text data into predefined or custom categories. For example, classify customer feedback into positive, negative, or neutral sentiments. The platform can also recognize and flag urgent or high-priority messages, allowing for timely responses and issue resolution.

-

Extract and identify specific entities from text, such as names, organizations, locations, dates, and financial indicators from Named Entity Recognition (NER).

-

Automatically detect mentions of banking products, services, or specific offerings in customer interactions, enabling targeted marketing or issue resolution. The platform can also quickly identify numerical values, including amounts, percentages, or transaction details, to ensure accurate data capture.

Product Recommendation Assistant

-

GPTNEXT delivers tailored product recommendations, from savings accounts, credit cards, loans, investment opportunities, and insurance options, based on their financial history, transaction patterns, and individual preferences.

-

GPTNEXT analyses a customer's financial behaviour and provides insights on how to improve their financial health.

-

The platform can seamlessly integrate with banking chatbots to provide real-time product recommendations during customer interactions, such as chat sessions and mobile app inquiries.

Customer Churn Prevention

-

GPTNEXT utilizes advanced predictive analytics to identify at-risk customers by assessing indicators like transaction history, account activity, and behaviour.

-

The platform provides deep insights into customer behavior, aiding in understanding the root causes of churn and influencing factors.

-

GPTNEXT recommends personalized retention strategies, triggering real-time alerts and automated campaigns to re-engage and retain at-risk customers through tailored offers and communication channels.

Account Summary

-

GPTNEXT aggregates and analyses vast amounts of data from various sources to generate comprehensive account summaries.

-

The summaries provide a cumulative understanding of customer interactions, purchase history, communication patterns, and other relevant information.

-

Account summaries also lists down potential upsell opportunities, personalized engagement strategies, or predictive insights into customer behaviour.

Activity Call Summary

-

GPTNEXT employs natural language processing (NLP) and sentiment analysis to provide real-time insights during sales calls.

-

It can detect key phrases, emotions, and conversational cues, generating a summary of the call's content and tone.

-

The summaries include metrics such as call duration, frequency, successful outcomes, and areas for improvement.

Call Preps

-

GPTNEXT dynamically generates call talking points tailored to individual customer profiles and sales scenarios.

-

By analysing historical data, customer preferences, and buying behaviour, the user can craft personalized scripts that resonate with each prospect, increasing the likelihood of successful engagements.

-

It can suggest next best actions, highlight key talking points, and offer prompts to address common objections, helping representatives navigate conversations more effectively and close deals more efficiently.

Email Auto Responses

-

GPTNEXT generates personalized email auto-responses by analysing historical communication data, lead/prospect preferences, and behavioural patterns.

-

Users can craft responses that are tailored to each recipient's queries.

-

GPTNEXT adapts to evolving customer preferences and market trends, refining its language, tone, content to optimize engagement and increase the likelihood of desired outcomes, such as conversions or follow-up discussions.

Lead Summarization

-

GPTNEXT assimilates vast amounts of lead data from diverse sources, such as CRM systems, social media, and website interactions and through natural language processing (NLP) driven data analytics, summarizes key information about each lead, including demographics, interests, past interactions, and potential buying intent.

-

Leveraging machine learning algorithms like lead scoring, GPTNEXT prioritizes leads based on their likelihood to convert, allowing sales teams to focus their efforts on high-value prospects and tailor their approach to maximize conversion rates.

-

By condensing complex lead data into concise summaries, get actionable recommendations, such as recommended follow-up actions, personalized engagement strategies, or targeted messaging, empowering sales teams to efficiently nurture leads through the sales funnel and drive revenue growth.

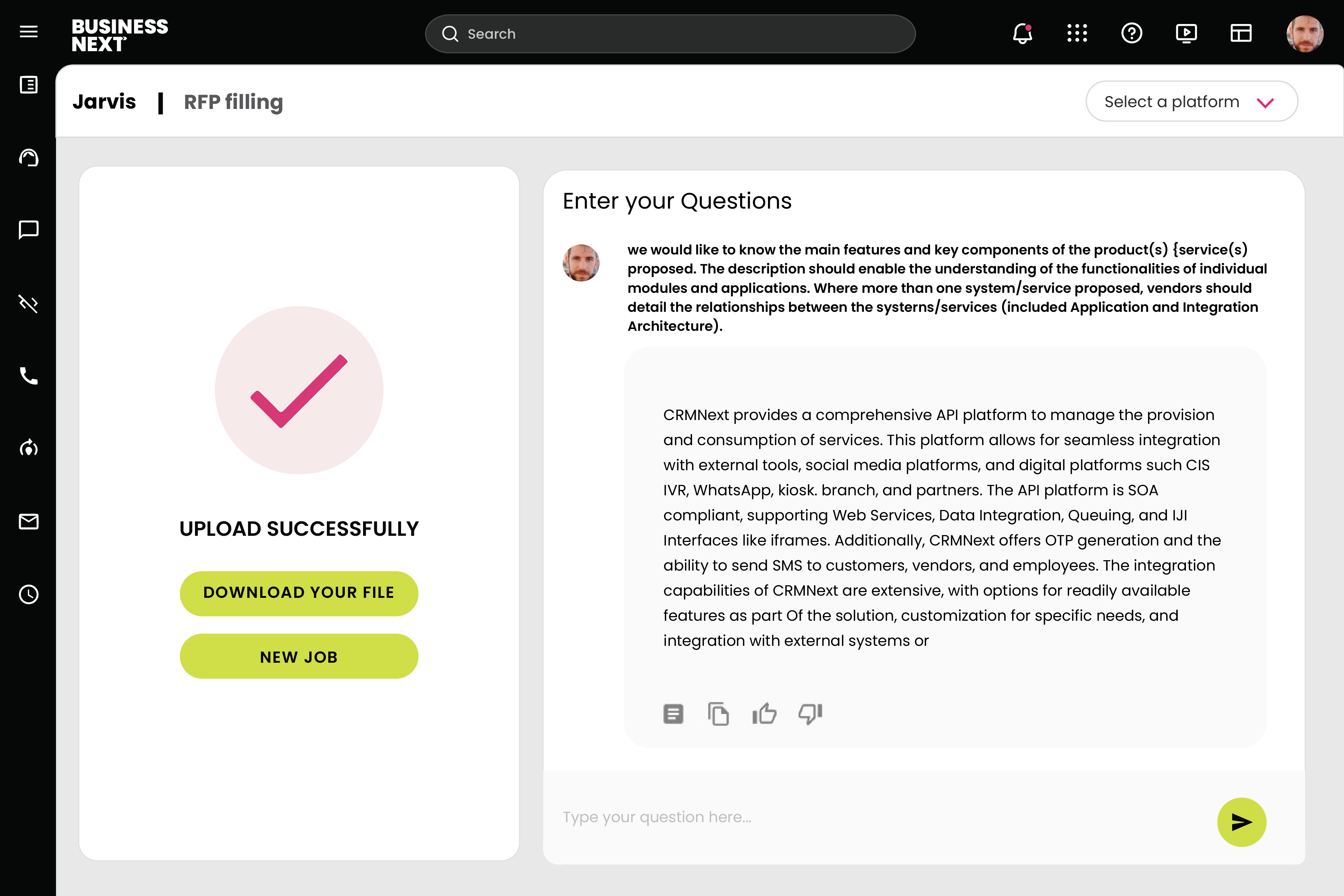

RFP Bot

-

RFP Bot automates initial draft creation, saving time and resources by generating comprehensive proposals tailored to client needs.

-

Users can handle and process multiple client RFPs simultaneously, increasing efficiency and productivity.

-

Key features include automated draft creation, customization options, Excel file upload for RFP details, interactive chat interface, parallel processing, seamless integration, and significant time and resource savings.

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all