Increase year on year

active risk ratings

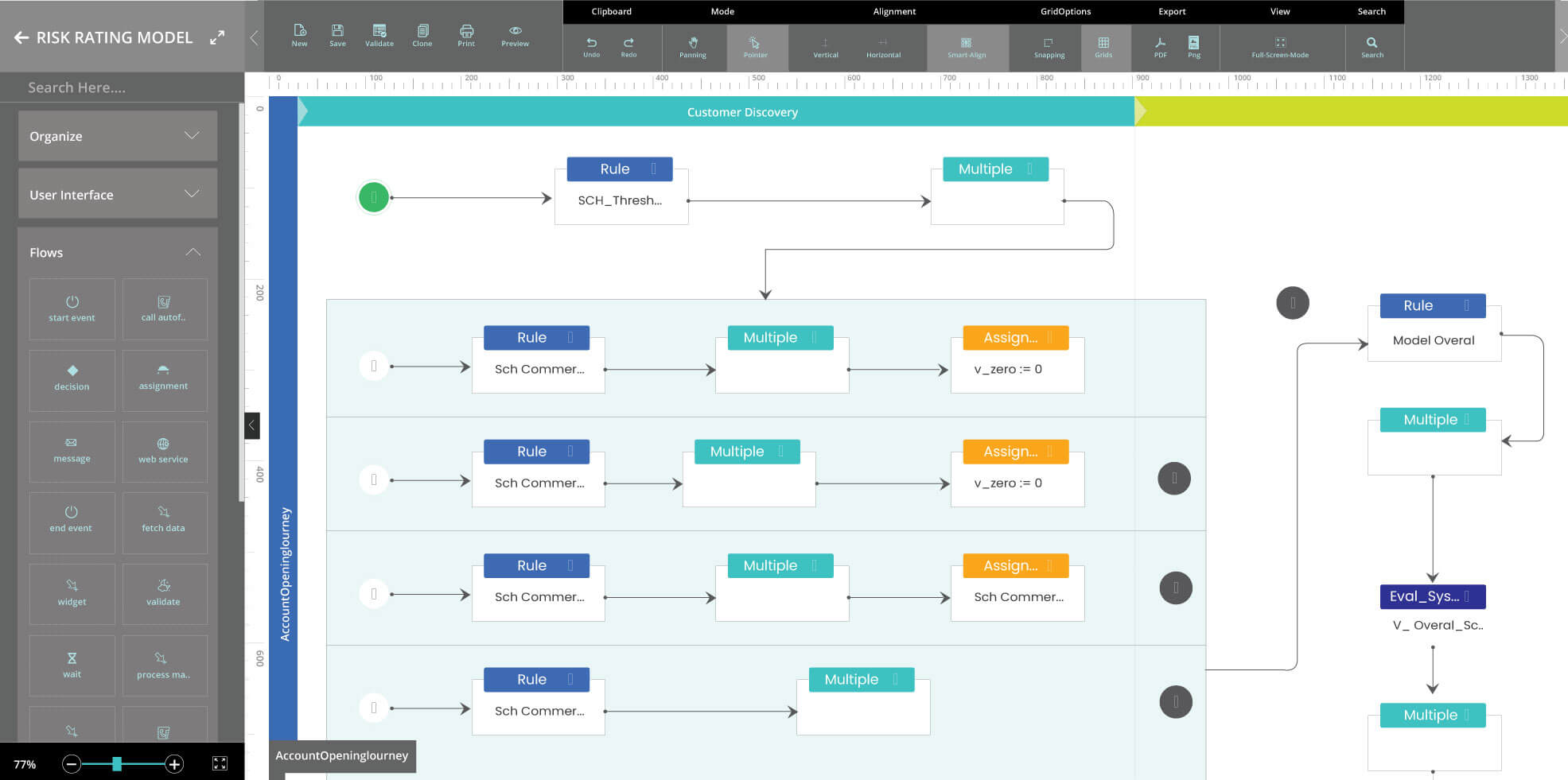

Design and automate complex risk rating models

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

AI Driven

Risk Assessment & Rating

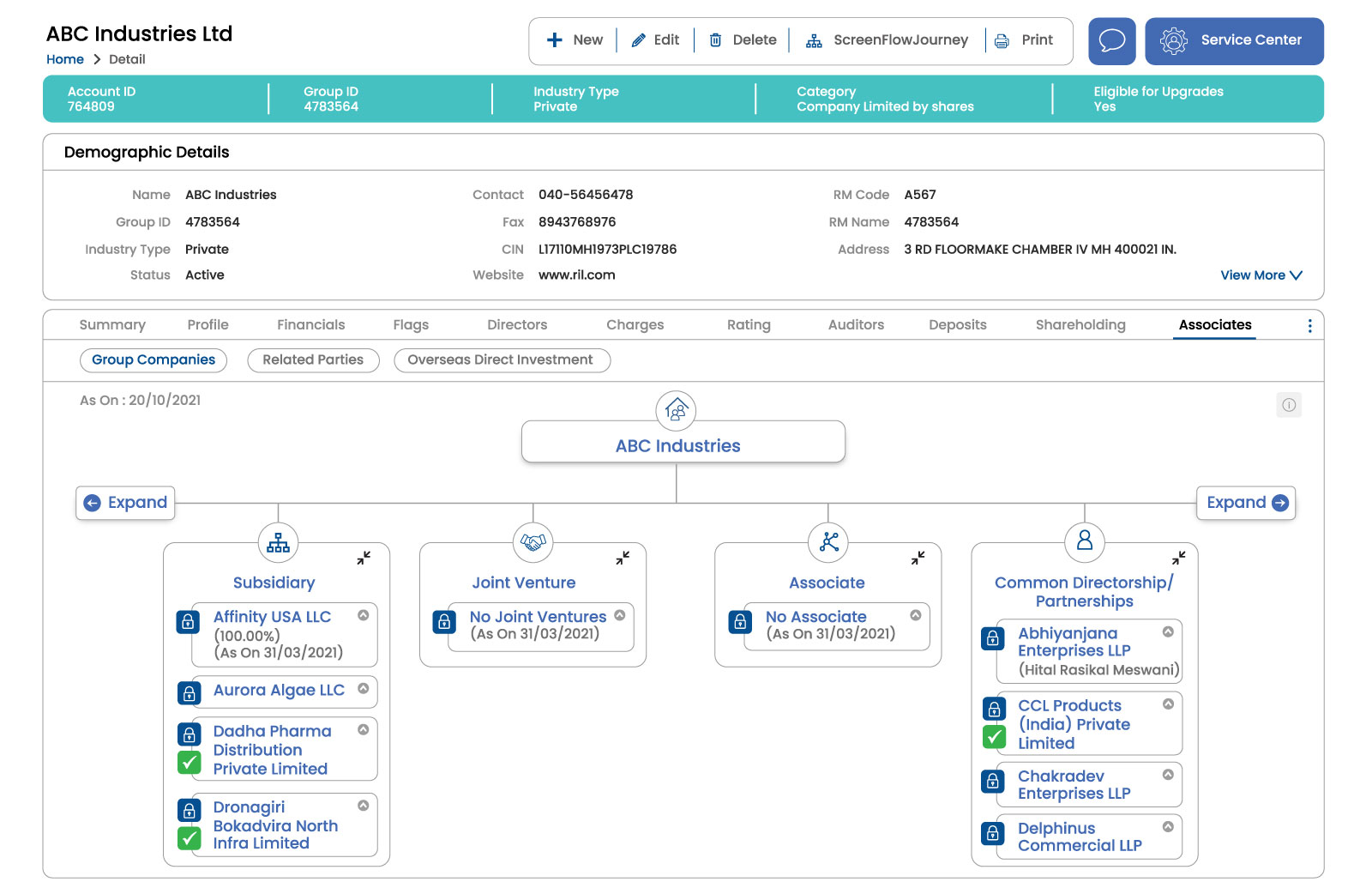

End to end borrower processing

-

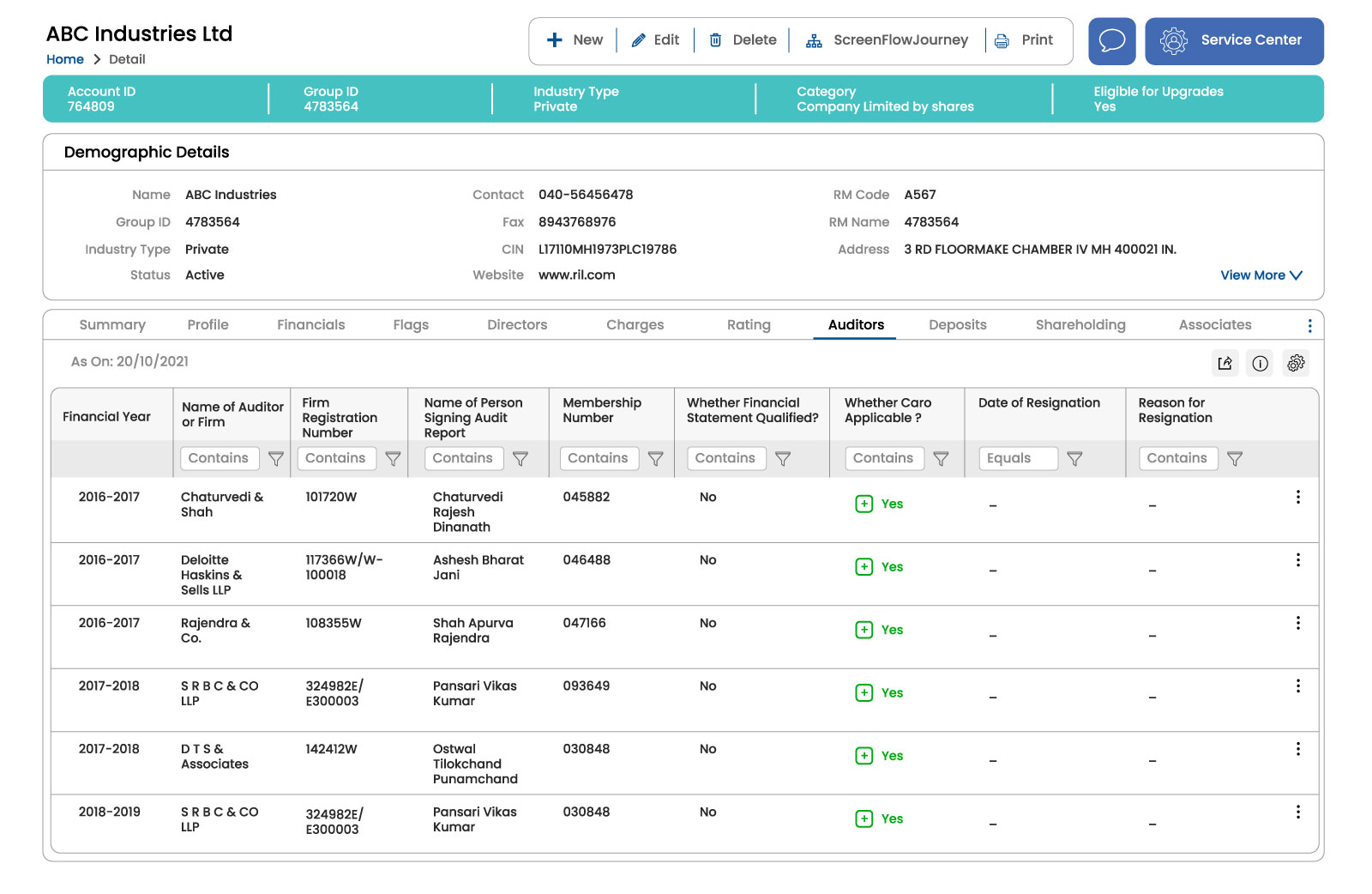

Create, import borrowers with proper checker processes and validations, fully compliant with government regulations.

-

Configure processes to any industry, group entities, size and manage multiple countries.

-

Analyse different rating behaviour scenarios on different nature of borrowers incl. greenfield entities to operational entities.

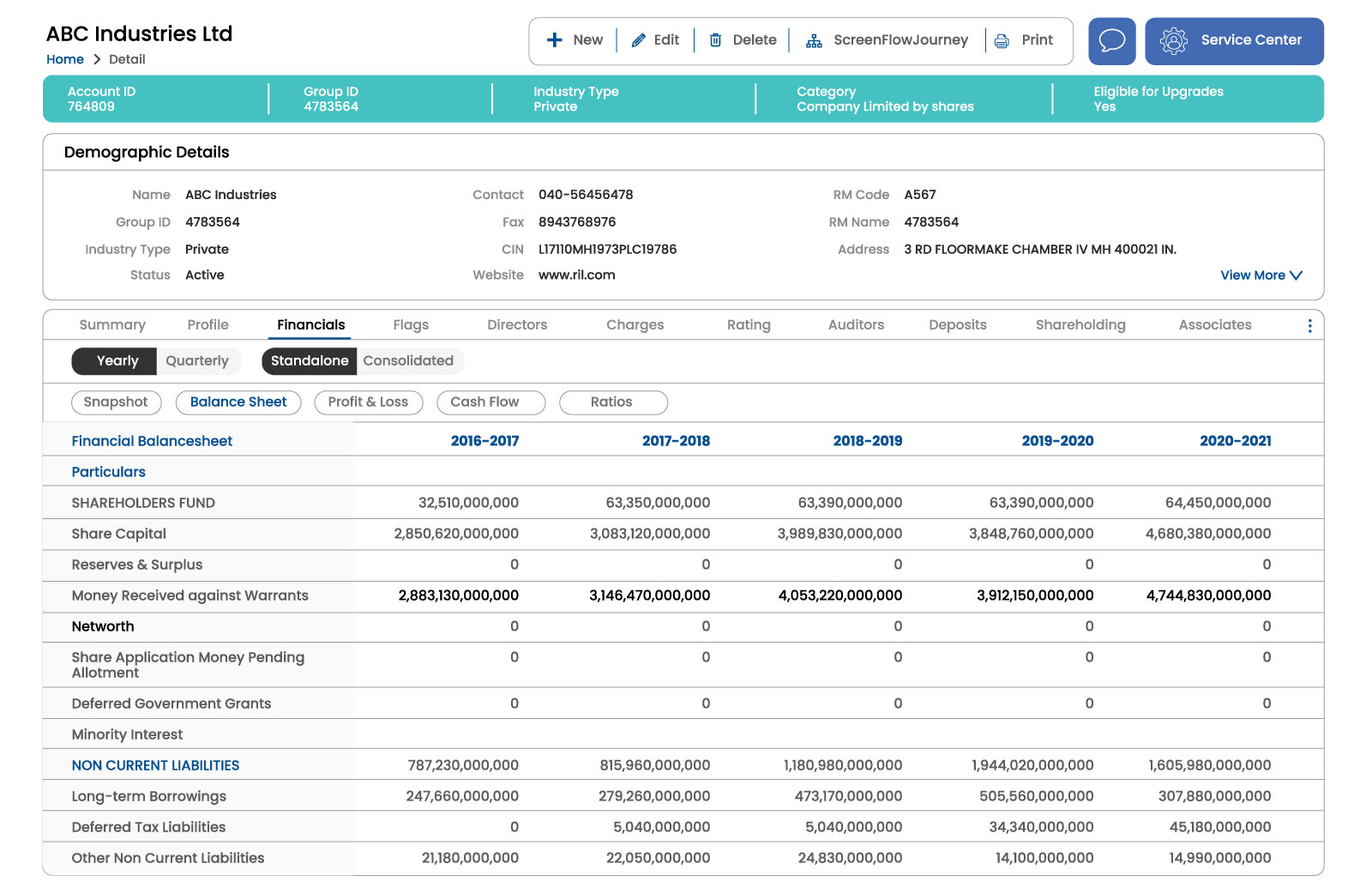

Leverage the maximum potential of financial data

-

Easily upload financial data with smart, guided template suggestions

-

25+ pre-built models, with the flexibility of creating custom models through zero code, rating designer with minimal training

-

Quickly validate borrower data and download financials in excel.

Create your own business differentiators

-

Use powerful business rule engine to design proprietary and unique rating models.

-

Enable automatic triggering of ratings based on custom criteria, for instance, external rating downgrade, financial spreads etc.

-

Input risk rating parameters including financial ratios, industry risks, market risks, business risks and financial risks

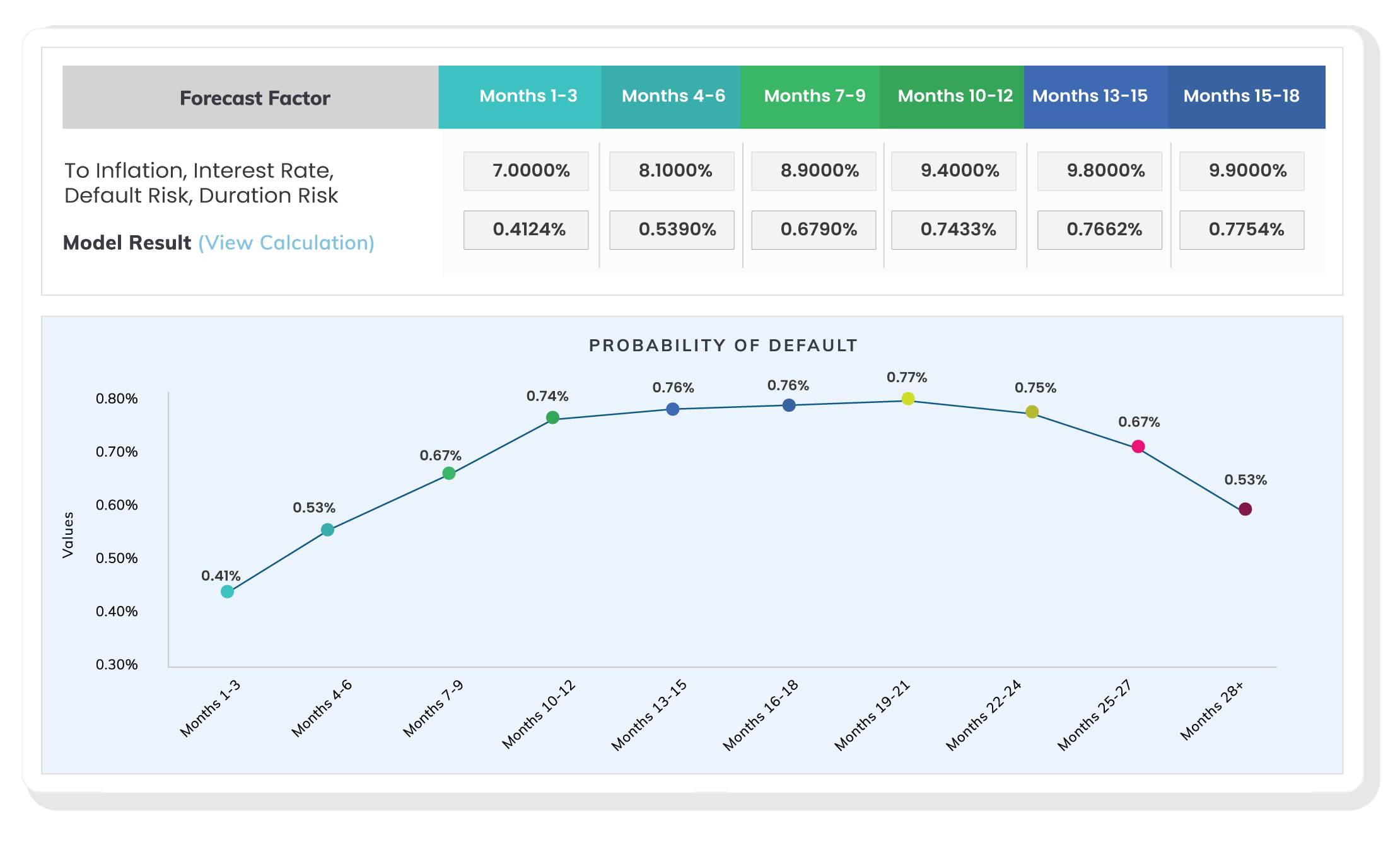

Quickly conduct stress tests and analyse impacts

-

Easily configure complex mathematical computations for scenario simulations

-

Execute stress tests against historical datasets and get warning signals early on

-

Automatically execute model calculation logic for bulk rating execution against sub-portfolios based on specific criteria

Be compliant in each step

-

Get better reporting structure with interim, mid-journey reporting capabilities

-

Complete rating process visibility with end-to-end audit trail

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all