Increase Lead conversions

by 300%

Make leads love talking to you.

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

AI powered

Modern Lead Management

Easily process high lead volumes

-

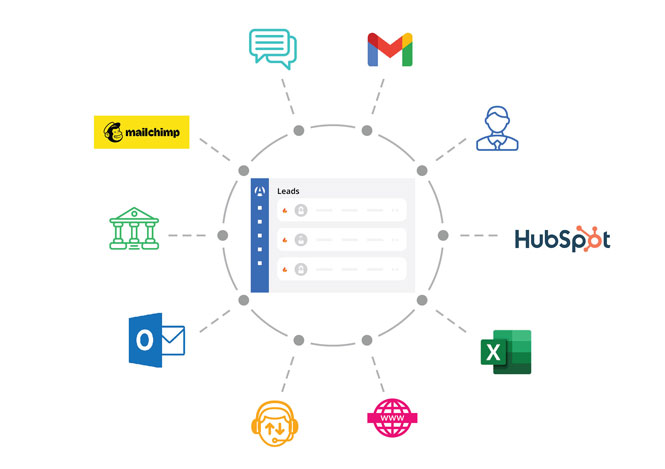

Capture leads across channels, campaigns in real time or upload in batches manually.

-

Identify, clean lead funnel by removing inactive leads and automatically match leads to accounts

-

Collect and build firmographics, demographic and behavioural history for both leads and accounts.

Enrich leads in real time

-

Clean lead information in real time, integrate external profile enrichment sources and store profile data

-

Associate the right information with the right lead and account

-

Eliminate incomplete, redundant, or duplicate lead information

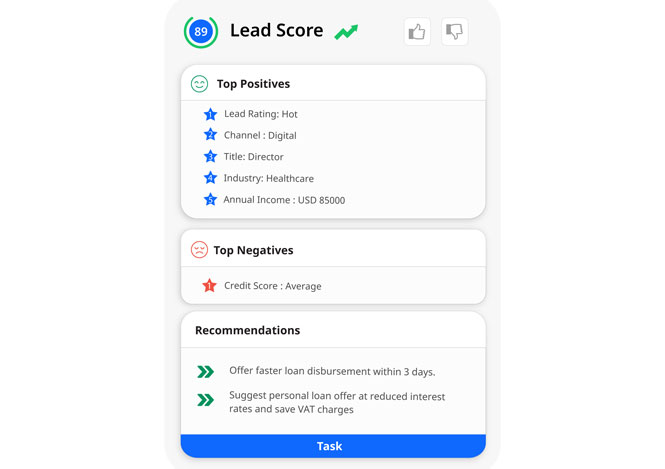

Identify and work on high quality leads faster

-

Create multiple lead qualification and scoring processes using AI/ML driven business rules

-

Boost Account Based Marketing (ABM) with account and engagement scoring.

-

Set scores based on criteria including campaign, product type, customer segment, lead data fields, estimated customer value, opportunity value and more.

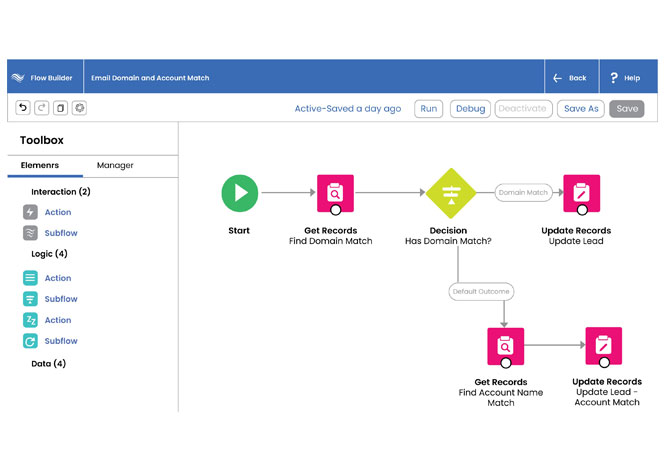

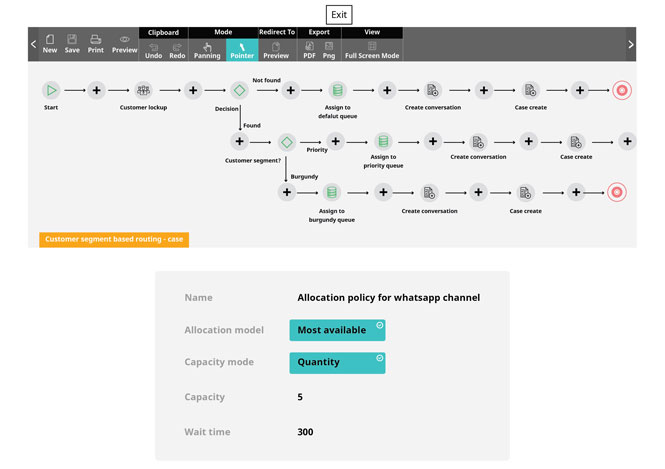

Deliver faster lead fulfilment

-

Create lead management workflows to manage and control the lead life cycle through drag and drop visual designers.

-

Auto routing leads through intelligent logic, including lead scoring, qualification, nurture, augmentation, and distribution processes based on criteria such as geography, estimated value and more.

-

Execute multiple lead management processes and workflows simultaneously in a single instance.

Zero lead slippage

-

Implement your lead strategy across multiple channels or platforms, thus maximizing opportunities to interact with prospective customers.

-

Capture and nurture from basic channels including emails, websites, landing pages, microsites, social, webinar, direct and more

-

Take advantage of advanced channels including E-commerce, VR/AR, trade shows, events and more.

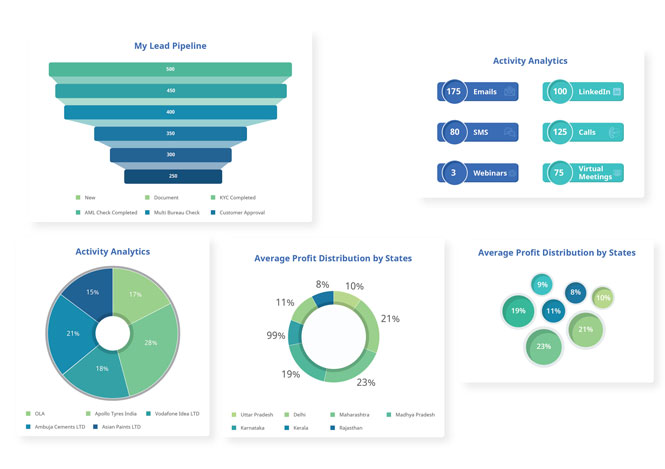

Measure operational performance

-

Predictively forecast revenue generation, revenue guidance and insights based on current lead volumes/quality.

-

Get preconfigured reports, insightful, role based, dashboards, metrics and KPIs.

-

Close the loop between sales and marketing with real time attribution and get prescriptive analytics like journey design, content recommendations, campaign optimization and more, driven by AI/ML models.

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all