inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view all

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

Faster Sales

40% Increase in Positive Customer Experience Index (PCEI) and more transformations at Kotak Life Insurance

-

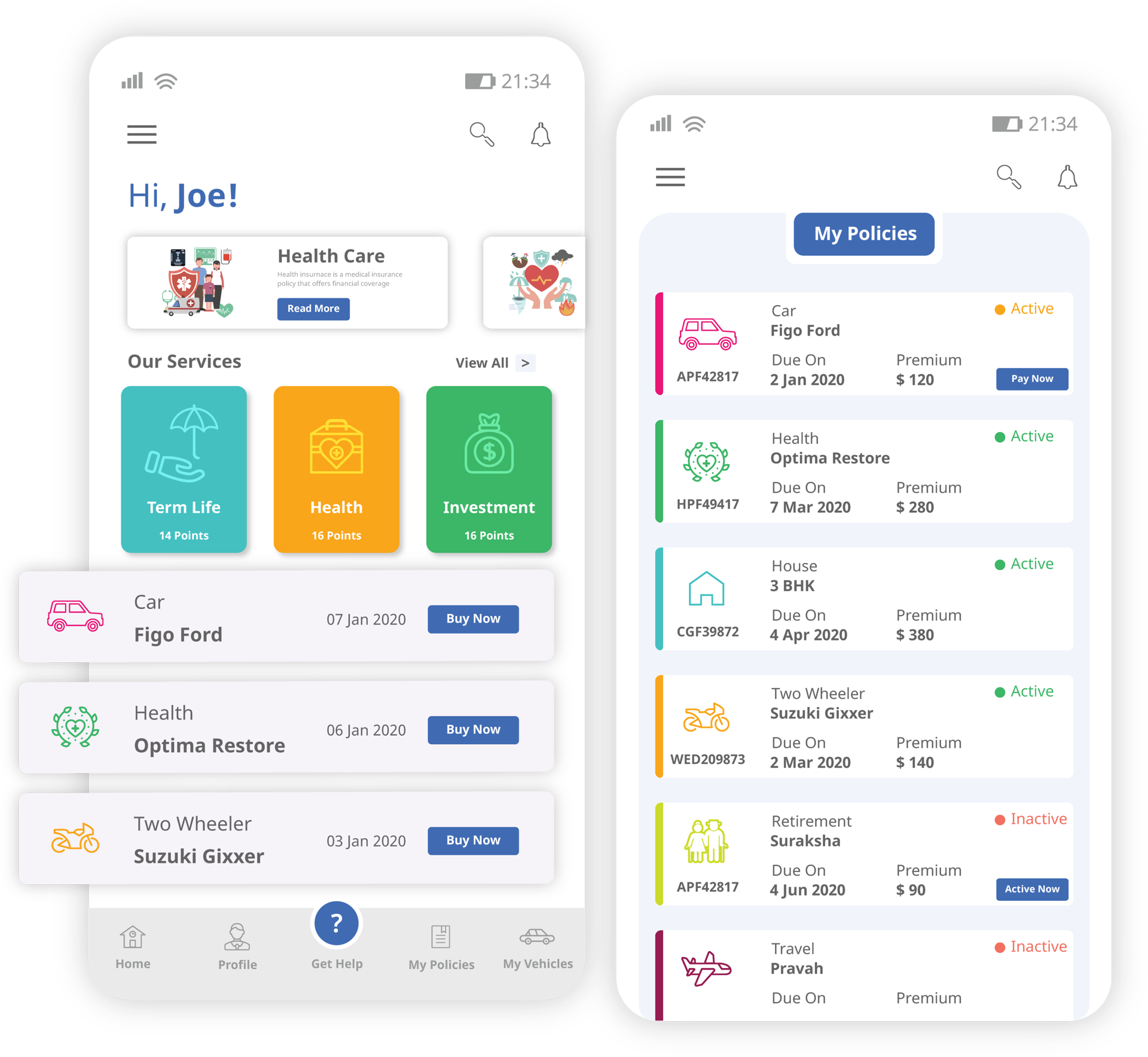

Boost acquisitions

-

Enable your customers to buy insurance policies with intelligent digital journeys.

-

Capture inquiries from all channels and auto route to the right agents with smart routing logic.

-

Minimize drop offs with intelligent win back processes.

-

-

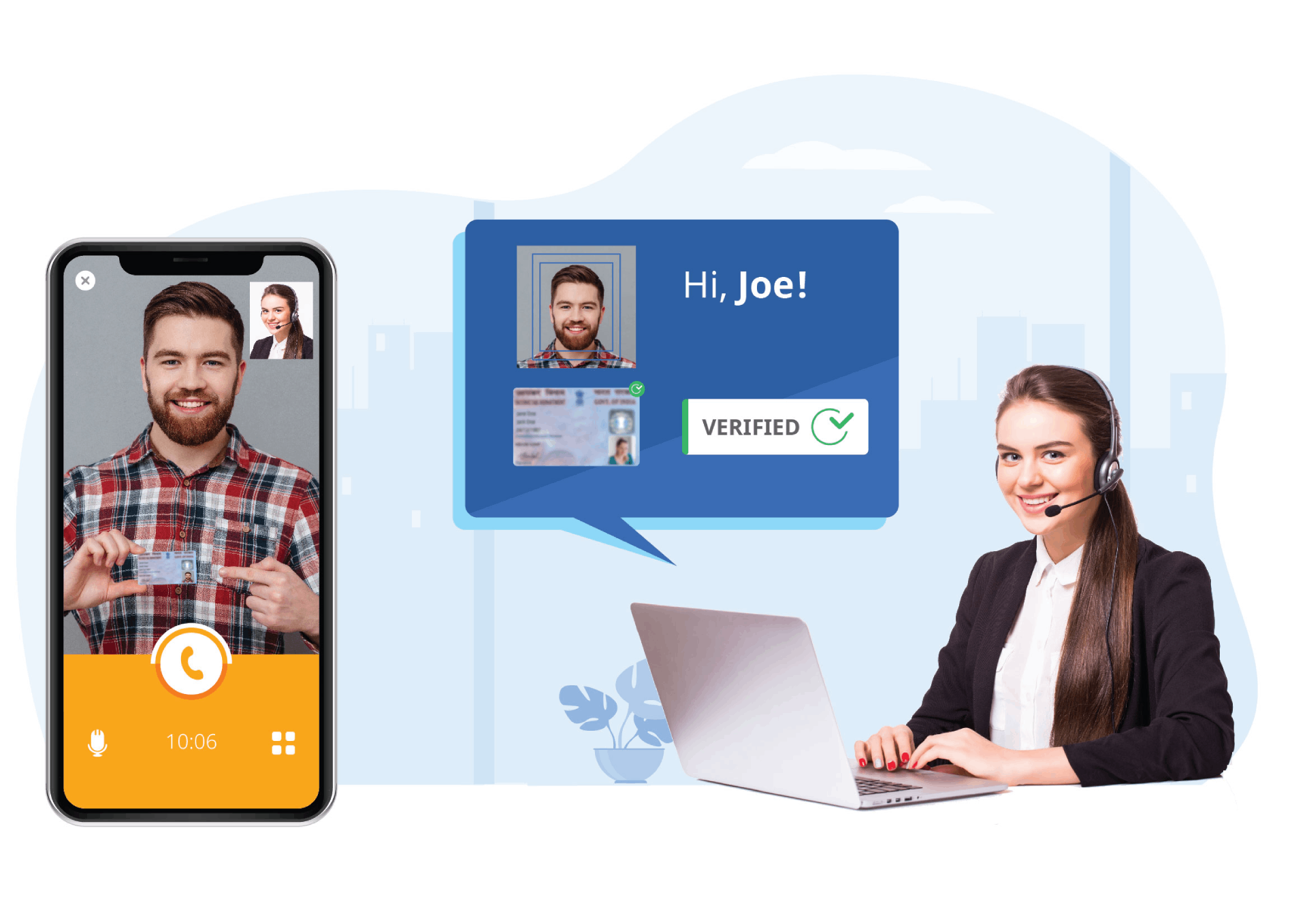

Onboard customers faster

-

On demand, video enabled eKYC to cut down issuance time and eliminate fraud.

-

Automated end to end workflows from welcome letter to policy documents.

-

Reduce post issuance grievances with unique pre-issuance and post-issuance calling processes.

-

-

Boost Retention

-

Personalized renewal offers with AI/ML-driven CRM for Insurance.

-

Targeted renewal campaigns with auto creation of calling workflows with assigned dates with real- time notification and alerts.

-

Predictive/progressive/preview dialling methods for reaching customers in various buckets and enable disposition-based data recycling.

-

-

Increase cross sell

-

Analyze existing customer intelligence in real time to provide contextual, personalized offers.

-

Automated decisioning processes for instant approvals with intelligent insurance CRM.

-

Enable teams with guided upsell/cross sell call scripts.

-

Smarter Service

250% Increase in First Contact Resolution Rates (FCR) and more transformations at TATA AIA Life

-

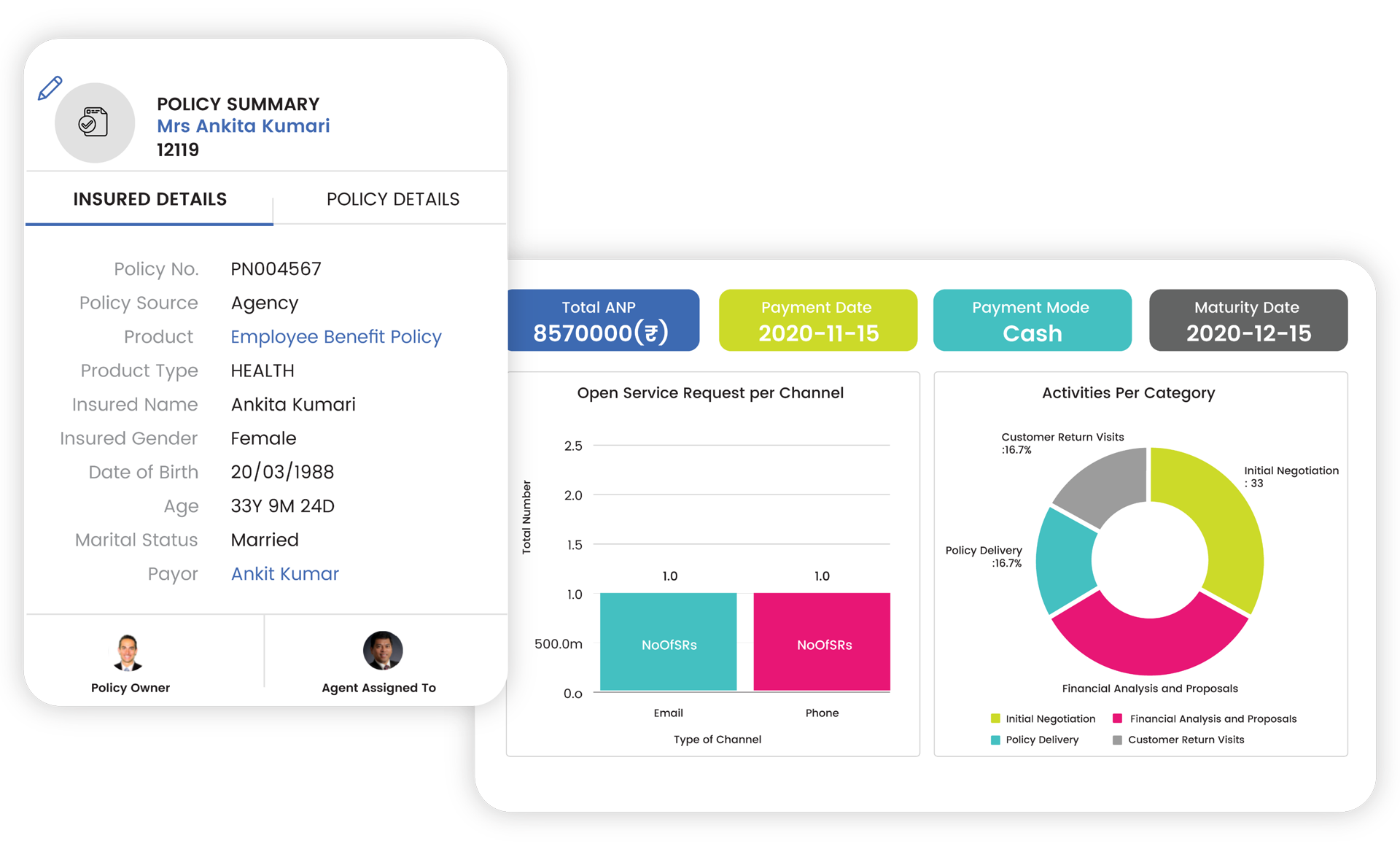

Easy policy servicing

-

Comprehensive policy summary with a 360 degree view.

-

Automated end-to-end processes for policy amendments with a policy action centre, funds changes, reinstatement, policy transactions, surrender, and retention.

-

Generate and send letters straight out of the platform.

-

-

Faster claim processing

-

Facilitate faster and simpler processes including initiation, workflow, policy riders, auto-approval matrix, intimation, and dispatch tracking using AI-powered insurance CRM.

-

Enable customers to initiate and track claims across channel of their choice.

-

Start claim investigation journeys and fast track claim processes.

-

-

Drive CSAT with Higher First Touch Resolutions

-

Increase first time resolution rates with STPs, smart chatbots, automated call scripts, realtime help, and exhaustive solution bank.

-

Faster resolution of routine and complex service issues on Open Communication Platform (OCP).

-

Predictive analytics like sentiment analysis, happiness score, customer satisfaction surveys across channels and touchpoints.

-

Empowered Partners

Enable your partners to deliver exceptional customer experiences

-

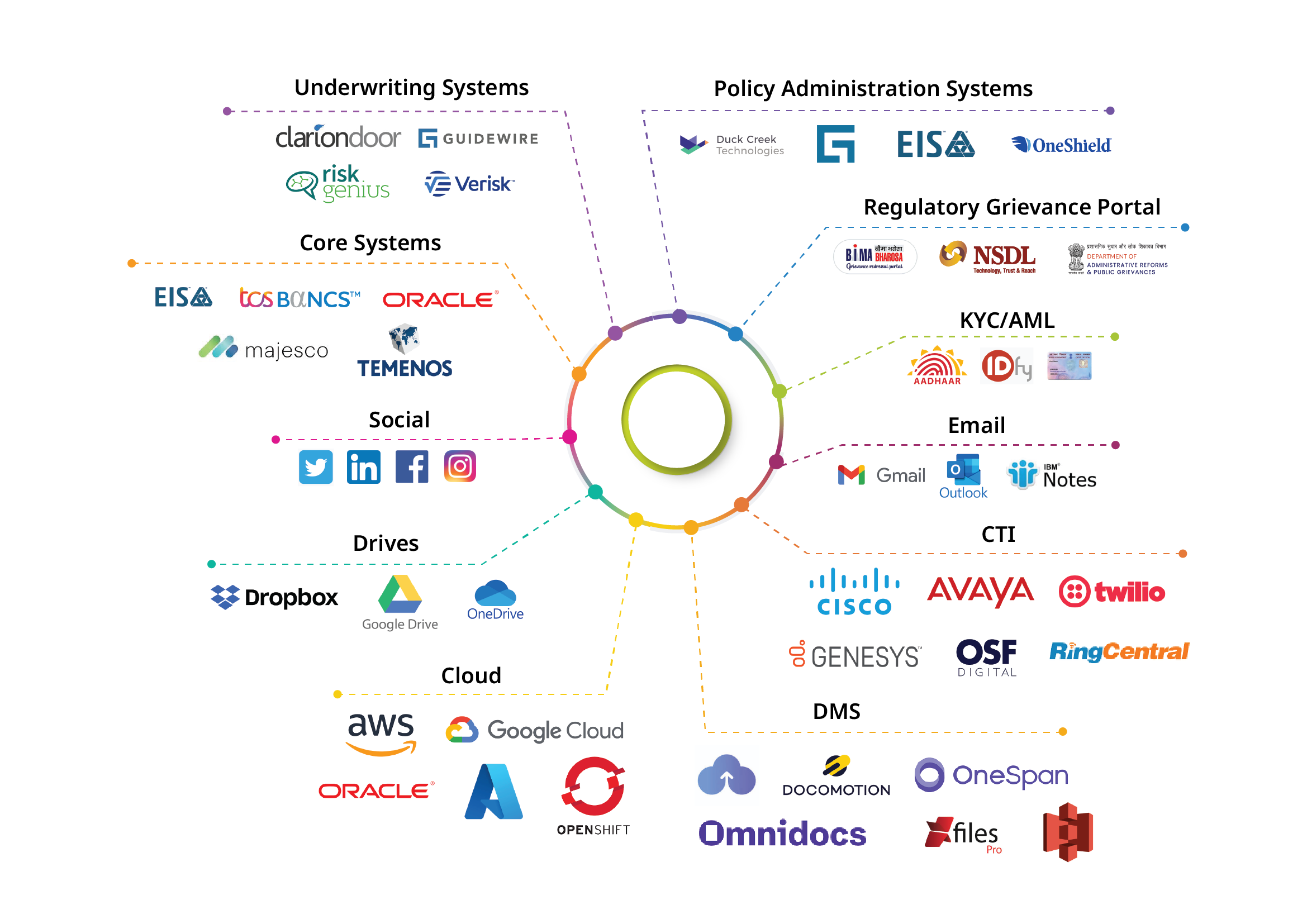

API driven partner ecosystem

-

Integrate insurance CRM with partner APIs to take advantage of partner networks.

-

Leverage big data to personalize offerings and enable customer segmentation.

-

Deliver mini insurance packages at partner touchpoints like mobile centers, amazon, car service centers and more.

-

-

Partner onboarding

-

Welcome partners & process huge volumes of interactions with a scalable partner portal.

-

Cut down onboarding time from months to just days.

-

Enable partners and distributors to connect better with their customers.

-

-

Partner 360

-

Get a complete, 360-degree view of intermediaries and agents.

-

Segment partners into various value bands based on revenue potential and profitability.

-

Integrate partner data from multiple sources with strict security and privacy controls.

-

-

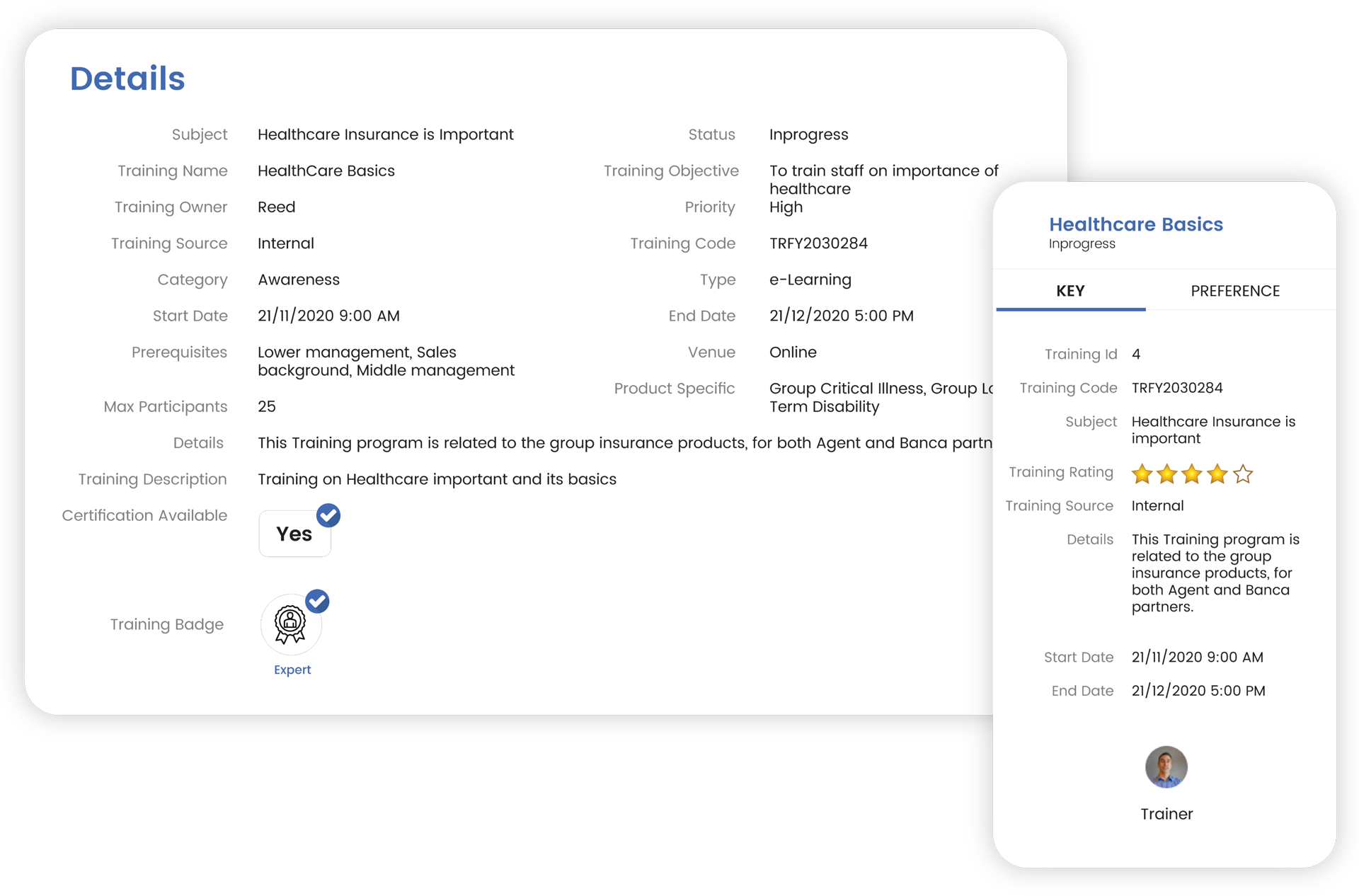

Partner Servicing

-

Comprehensive service request view, interaction history and other details.

-

Deliver high First Time Resolution (FTRs) with dynamic knowledge screen.

-

Manage licences and take partner surveys and feedback regularly with insurance CRM.

-

-

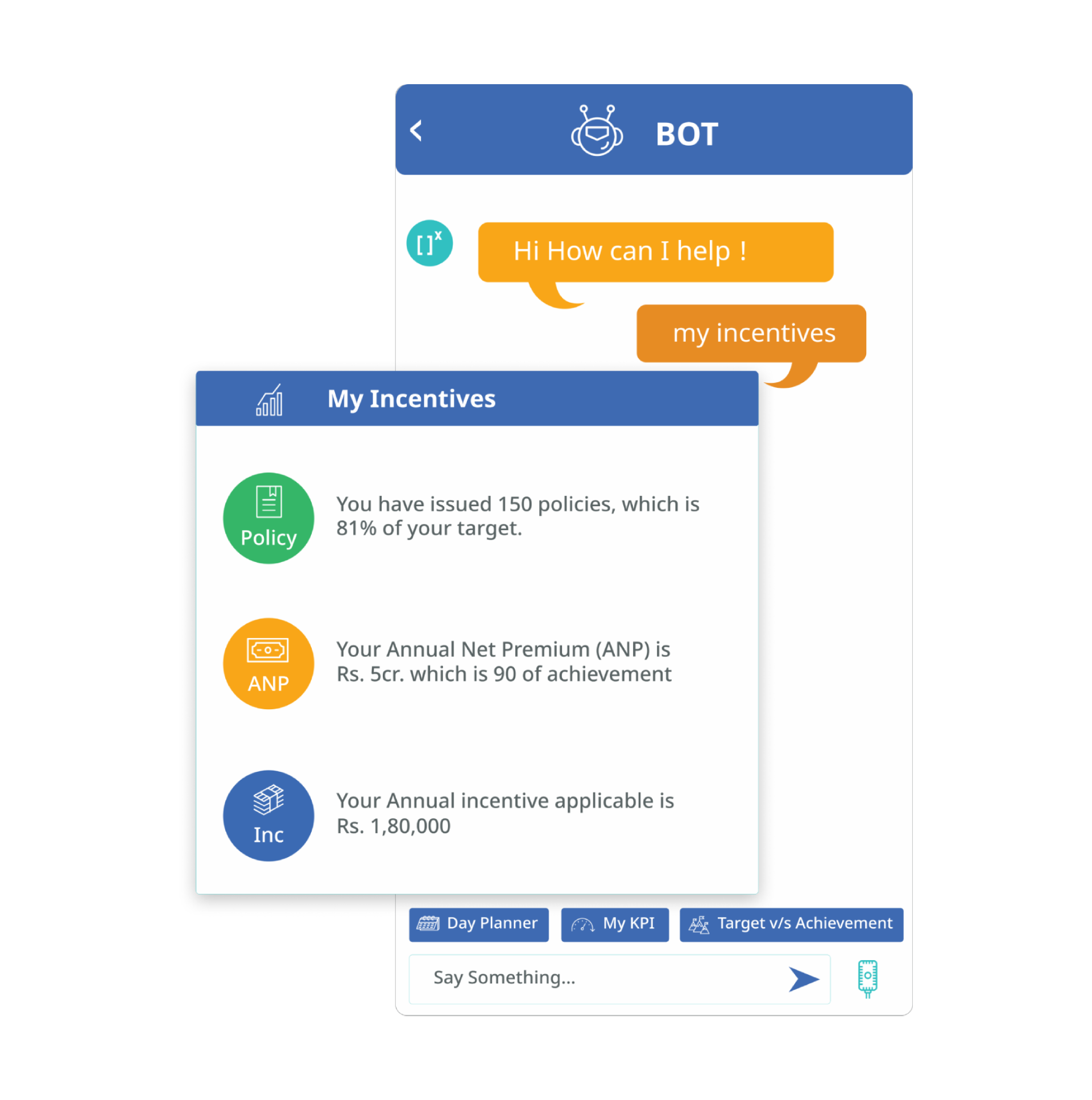

Optimize partner performance

-

Set up advanced analytics based incentives with role specific models, split and omnichannel incentives etc.

-

Get granular insights on a partner performance and recommendations for next best actions.

-

Gamify partner sales processes, boost conversions with higher performance and increase persistency ratio.

-