Reduce Loan Processing Time 80%

Lend more with less

One-stop solution for all your lending needs

-

Consumer Loan

-

MSME Loan

-

Commercial Loan

-

Agri Loan

BUSINESSNEXT recognized as a Leader

Forrester Wave™ Financial Services CRM, 2023

Forrester's comprehensive evaluation of financial services CRM providers against 39 criteria includes BUSINESSNEXT as a leader, securing highest scores for the top five evaluation criteria below

-

Prospecting and Outreach

-

Lead Generation and Prioritization

-

Customer Insight and 360 View

-

Account Opening

-

Customer Self-Service and Engagement Capabilities

AI-Driven

Digital Lending Platform / LOS

Upgrade Lending Experience

-

Capture applications from website, mobile apps, SMS, phone calls, missed calls, TAB, Branch, ATMs, KIOSK, Business Correspondents (BC), Business Facilitator(BF), Direct Selling Agent (DSA), online lead aggregators and more.

-

24X7, Omnichannel accessibility with hyper personalized offers and advanced targeting.

-

Effortlessly upload documents, check eligibility from automated predefined business rules and display pre-approved offers.

Create end to end lending experience

-

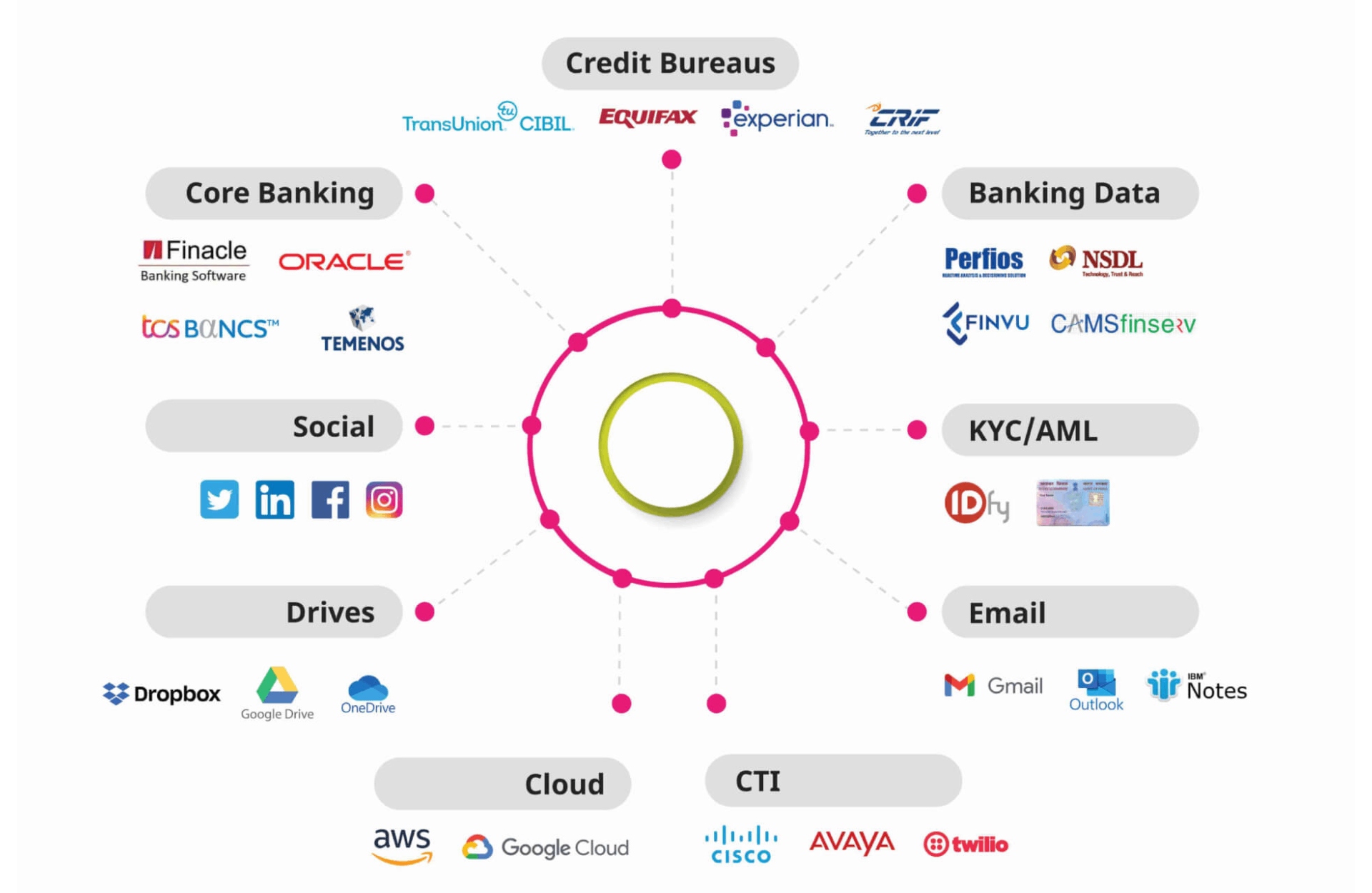

90+ Ready connectors to fetch, extract and utilize data from various systems including National ID system, Tax systems, LOS, credit card, core banking, credit rating bureaus, social and more.

-

Codeless configuration with more than 50 out-of-the-box patterns.

-

Make full use of multi-app capabilities with restful web services which can share data with any external application and support 2-way bidirectional integration.

Lower credit delivering time by 90%

-

Enable end to end, instant decisions with AI/ML driven models

-

Automate identity verification and validation

-

Configure smart business rule engine for lending in minutes.

Get high configurable lending workflows

-

Intelligent, customizable workflow journeys backed by AI/ML models

-

Enable robotic process automation (RPA) to speed up operations, reduce operating risks and tightly control cost to serve

-

Designer driven workflow designers capable of creating, deploying complex, parallel processes

Reduce NPAs

-

Capture behavioural data and algorithmically analyse risk level

-

Automatically approve conforming applications or prioritize deviations for final decisions.

-

Streamline and speed up processes for faster decisions and set customizable, dynamic risk limits.

Unlock more opportunities

-

Enable partners to orchestrate credit processes and offer personalized services.

-

Activate new revenue streams through partner ecosystem that magnify and extend credit value chains

Lending domain native Document Management

-

Integrate seamlessly with existing systems with best-in-class encryption and data privacy.

-

Enable easy document uploads, fetching, auto filling and data extraction with OCR capabilities

-

Enable extensive APIs for smooth DMS experience

Change Rule Parameters through a Front-end User Controlled MDM

-

Leverage first-in-industry, parameterized MDM to change Go-NoGo credit rules, deviation rules, and investigation rules on the go.

-

Customize alerts, criteria, and actions for flexibility and efficiency in rule management.

-

Highly configurable and intelligent rule parameters for all the retail and corporate lending products.

inspirational

Success Stories

In our customers' words, how we got them ready for anything the future could bring.

view allFAQ's

-

What is BUSINESSNEXT’s Digital Lending Platform?

BUSINESSNEXT Digital Lending Platform is an advanced solution designed to simplify the lending experience by leveraging digital journeys, Loan Origination System (LOS), and Customer Relationship Management (CRM), all powered by AI-driven and parameterized Master Data Management (MDM).

-

How does digital lending work?

Digital lending simplifies the borrowing process by digitizing traditional lending procedures. Prospective borrowers can easily apply for loans online, submit necessary documents electronically, and receive their loan approvals virtually. The entire process, from an application to approval to disbursal, can happen entirely online, often in less time than traditional lending methods.

-

What is a Go-NoGo decision and how can the Go-NoGo in Digital Lending Platform improve the loan process for borrowers?

Go-NoGo decision is a pivotal step in loan approval where lenders decide whether to proceed (Go) with an application or not (NoGo). Go-NoGo feature provides a fast, convenient, and transparent loan application process. Borrowers can apply online, upload necessary documents, track their application status in real-time, and receive notifications right at their fingertips. This digital and simplified interface reduces processing time and enhances the borrower's overall experience.

-

What is a Loan Origination System (LOS)?

A Loan Origination System (LOS) is a software platform designed to automate and streamline the entire loan application process, from submission to funding. It efficiently manages tasks such as application processing, credit decisions, document management, and borrower communication.

-

How does the Loan Origination System benefit lenders?

A Loan Origination System (LOS) offers numerous benefits to lenders, including increased efficiency, reduced processing times, improved compliance, enhanced borrower experience, and better risk management. By automating manual tasks and providing centralized access to loan data, LOS helps lenders streamline operations and make informed lending decisions, ultimately leading to greater profitability and customer satisfaction.

-

What are the advantages of BUSINESSNEXT’s Digital Lending Platform?

Experience simplified lending with BUSINESSNEXT's Digital Lending Platform- from end-to-end process management to rapid decisioning and instant disbursement. Benefit from no-code designers to accelerate time-to-market for new product launches, seamless integration with fintech connectors, and the industry's first parametrized MDM for agile rule adjustments on the go. Ensure adaptability and efficiency for your lending operations with our cloud-powered, ultra-scalable, and highly configurable platform.