Blog Details

Corporate Banking CRM: 10 Innovative Solutions to Elevate Operational Excellence

Introduction to Corporate Banking CRM

In today’s rapidly evolving financial landscape, banks are continuously seeking ways to enhance client engagement and operational efficiency. Leveraging advanced technologies and streamlined processes, banks are redefining client engagement and operational excellence to stay ahead of the competition. One such innovative platform leading the charge is BUSINESSNEXT’s Corporate banking platform, that offers unparalleled features designed to empower corporate banks.

Venturing into the transformative realm of CRM for corporate banking, we unravel the profound impact it wields on the corporate banking industry, reshaping paradigms and redefining industry standards.

Unified Corporate Banking Platform

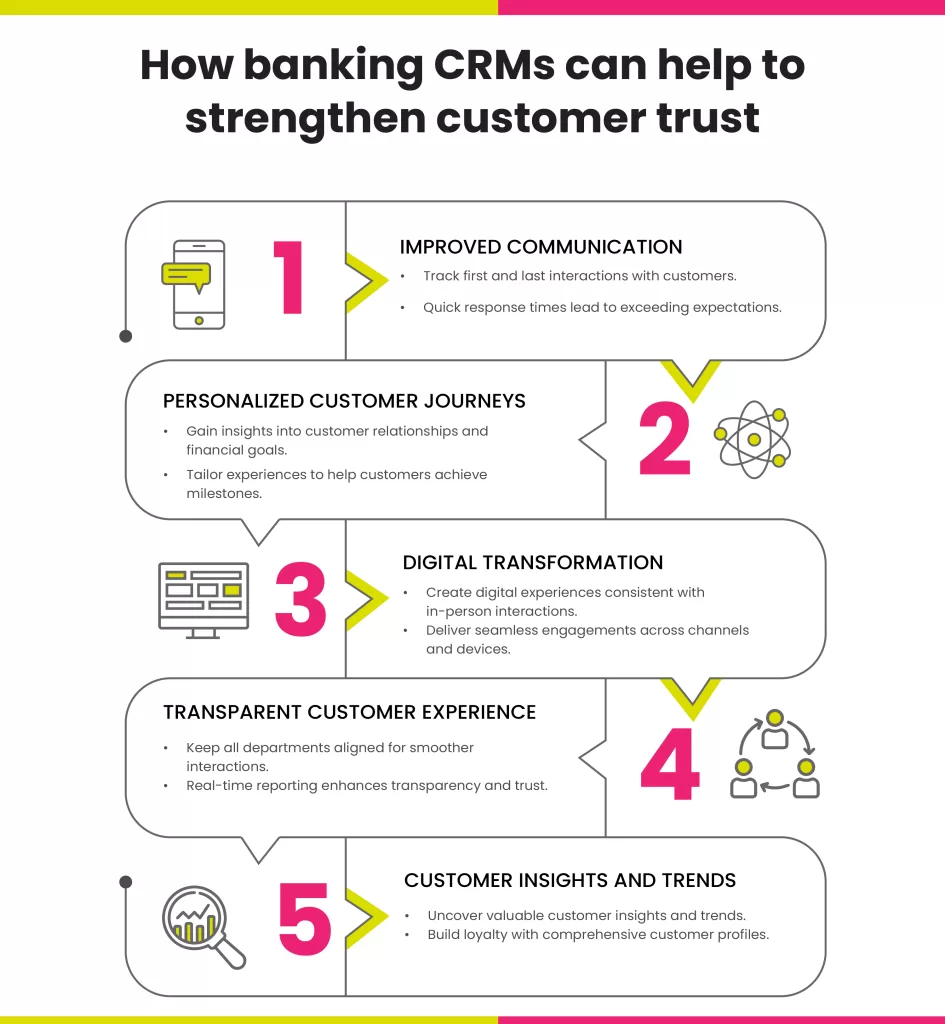

A seamless, omnichannel corporate banking experience is now a reality, empowering clients and resolving issues efficiently across all touchpoints. BUSINESSNEXT’s AI-powered Corporate banking CRM offers a unified platform that integrates with various banking systems, enabling real-time access to client’s data and interactions. Whether clients prefer in-person interactions, online banking, or mobile apps, banks can deliver consistent experiences that enhance satisfaction and loyalty.

Modernizing Corporate Relationships

Real-time insights and intelligent analytics enable banks to deepen corporate relationships, uncovering new revenue streams and opportunities. Corporate banking CRM provide relationship managers with a 360-degree view of each client, enabling personalized interactions and proactive relationship management. With predictive analytics and AI-driven recommendations, banks can anticipate client needs, mitigate risks, and drive revenue growth through strategic cross-selling and upselling initiatives.

Instant Accounts & Onboarding

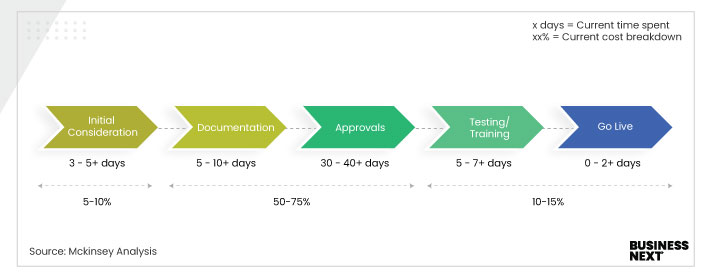

Digital onboarding solutions streamline account opening processes, reducing costs and enhancing the banking experience. Corporate banking CRM enable banks to digitize manual processes, such as document verification and compliance checks, allowing for seamless account setup and onboarding. By offering self-service options and mobile-friendly interfaces, banks can cater to the preferences of digital-native clients, improve satisfaction, and drive loyalty.

Customer Lifecycle Value Optimization

By embracing modern service platforms, banks unlock the full potential of client relationships, driving profitability and loyalty throughout the lifecycle. Corporate banking CRM enable banks to personalize client interactions, anticipate their needs, and deliver tailored services that resonate with their clients. Through advanced analytics and automation, banks can identify high-value clients, nurture relationships, and maximize customer lifetime value.

Digital Transformation with CRM

Modern CRM platforms are revolutionizing lead management and client retention in corporate banking, fueling growth and fostering lasting relationships. By centralizing client’s data and interactions, banks gain a comprehensive view of each client, enabling personalized engagement at every touchpoint. With features like automated workflows and predictive analytics, banks can streamline processes, identify cross-selling opportunities, and deliver targeted marketing campaigns to drive revenue growth.

Next-Generation Engagement

Through seamless onboarding and digital transformation initiatives, banks are witnessing unprecedented growth in leads and client acquisition. Corporate Banking CRM streamline account opening processes, enabling instant account setup and personalized onboarding experiences. By leveraging automation and self-service options, banks can reduce friction, improve efficiency, and accelerate time-to-revenue for new clients.

Accelerated Sales Cycles

AI-driven account planning and corporate banking CRM-enabled playbooks expedite sales cycles, empowering relationship managers to seize opportunities swiftly. Corporate banking CRM provide sales teams with actionable insights, enabling them to prioritize leads, identify cross-selling opportunities, and personalize sales strategies for maximum impact. By streamlining processes and automating routine tasks, banks can reduce administrative burden, increase productivity, and drive revenue growth.

Performance Tracking and Insights

Real-time analytics equip banks with actionable insights, driving performance and enabling proactive decision-making. Corporate banking CRM provide dashboards and reports that offer visibility into key performance metrics, such as client acquisition, retention, and revenue growth. By monitoring trends and identifying areas for improvement, banks can optimize processes, allocate resources effectively, and stay ahead of changing market dynamics.

Advanced Reporting and Analysis

Customizable reporting tools provide in-depth analysis, empowering banks to identify trends and personalize strategies for success. Corporate banking CRM offer flexible reporting capabilities that allow banks to drill down into client’s data, segment their client base, and uncover actionable insights. By tracking KPIs and measuring performance against benchmarks, banks can fine-tune their strategies, optimize resource allocation, and drive continuous improvement.

Risk Rating Platform

Robust risk rating platforms ensure compliance and mitigate risks, safeguarding the interests of both banks and clients. CRM for corporate banking integrate risk management tools that enable banks to assess creditworthiness, monitor exposure, and mitigate potential risks in real time. By automating risk assessment processes and leveraging data analytics, banks can make informed decisions, reduce default rates, and protect their bottom line.

The convergence of advanced CRM technologies, digital onboarding solutions, and risk management platforms is reshaping corporate banking, driving efficiency, and elevating client’s engagement to new heights. Embracing these innovations is not just a choice but a necessity for banks looking to thrive in today’s dynamic market landscape. By harnessing the power of AI-powered CRM for corporate banking, banks can unlock new opportunities, drive growth, and deliver exceptional experiences that differentiate them from the competition.

Additionally, businesses seeking to enhance their corporate banking CRM operations should consider leveraging the advanced features offered by BUSINESSNEXT’s AI-powered Corporate banking platform. With its comprehensive suite of tools for customer relationship management, digital transformation, and risk management, BUSINESSNEXT empowers corporate banks to streamline processes, drive growth, and deliver unparalleled banking experiences for clients.