Blog Details

Delivering Perfect Card Experience with Digital Journey

“Simpler the processes, happier are the customers.” But, it’s easier said than done. Transforming this simple idea into a seamless reality can often prove to be a challenging endeavor. When it comes to driving consistent business growth in the financial sector, there’s one key element that stands out: the card experience. In today’s digital age, customers demand nothing less than a continuous and seamless credit card experience. It’s no secret that simplifying processes leads to happier customers, but achieving this ideal state can be a complex challenge.

Financial executives are diligently working to craft the perfect customer journey, one that seamlessly integrates digital solutions and ensures a continuous customer experience. This journey aims to provide customers with precisely what they need, precisely when they need it, all while offering a variety of channels to choose from.

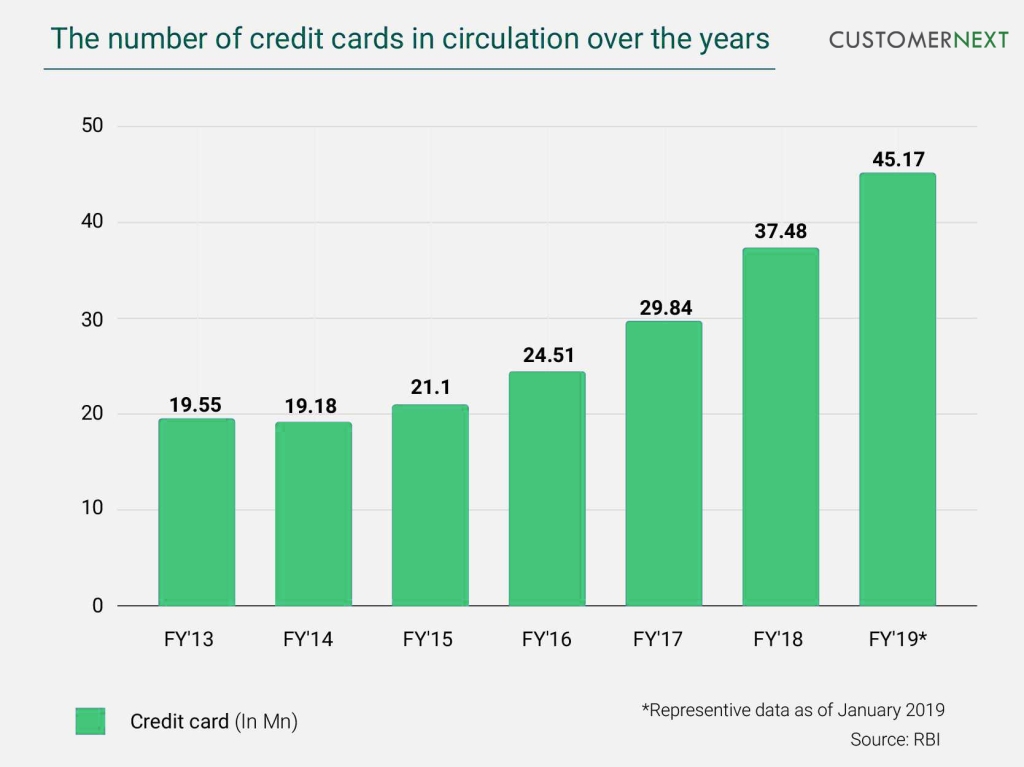

In the pursuit of delivering targeted, cross-channel, and just-in-time product purchasing or service journeys, one product stands out as a beacon of consistent growth for financial institutions: the credit card. The card experience, from application to transaction and beyond, plays a pivotal role in shaping customer perceptions and loyalty. It’s no wonder that financial institutions are increasingly focused on designing convenient and effective seamless credit card experience journeys that not only attract new customers but also retain and nurture existing ones.

Age of self-service

For customers, today is the age of instant fulfilment. Thanks to smartphones, they demand hassle-free, seamless and straight through experience. Designing personalized digital credit card experience with self-service capability will deliver a truly digital experience.

Here are a few journeys to make credit card experience seamless and fulfilling:

Modifying Credit Limits

While this activity might sound quite simple, ask anyone who wanted to modify their credit limit. They have no idea who to talk to. Net banking may offer a limited approach. While it is the bank who decides the maximum credit limit for a customer, wouldn’t it be simpler if the customer was in control, within reasonable credit limits? A robust digital journey can reduce this task to a few simple steps wherein a request can be raised at the press of a few clicks.

Address, phone number change

How simple is changing your registered address and phone number? Customers stuck with legacy systems often has to deal with cumbersome offline methods. With codeless digital journeys with straight-through processes, customers can themselves change the details themselves and submit proof right in the journey.

Card Upgrades

John is on a business trip. He lands at Heathrow Airport and walks through the terminal for his connecting flight to Mumbai. As he passes a billboard for his bank, he receives a text message offering him a credit card upgrade, one with better dining, travel and reward perks. When he opens the message, he is taken to a personalized web page that provides benefits and features based comparison of his existing card and the new one the bank is recommending. He simply taps an “apply” button to start the upgrade process. When he does, another message appears prompting him to take and upload a “selfie” so the bank can authenticate her with digital scanning.

Resolving cases

Raising a case for an issue often takes a lot of time. Most of the time the method is not clear, and it creates unnecessary problems for customers. Having a simple journey that can help your customers solve a problem and they can have an option to get an assured callback. In this journey, customers can also verify their identity, raise their issues and then get prompt responses that will ensure that a quality experience is always maintained.

All these self-service options are important for the customer and they want to be able to do these themselves without wasting time and waiting for processes of banks. If customer requirements are taken care of as and when they demand, financial institutions can enjoy automated, consistent retentions.