Blog Details

5 Proven Strategies for Mastering Customer Service Excellence in Financial Services

Banking and financial service leaders are embarking on a transformative journey that fuses the intricacies of finance with the limitless potential of technology. Their mission? To unravel the intricate puzzle of modern customer expectations and needs.

Gone are the days of one-size-fits-all solutions, generic product offerings, and lackluster loyalty programs. Today, the path to a customer’s heart and their wallet lies in the realm of next-generation customer service, meticulously orchestrated through the power of Financial Services CRM (Customer Relationship Management).

Here are the five effective ways to deliver scalable, delightful customer care through CRM in financial services and banking-

AI-driven chatbots

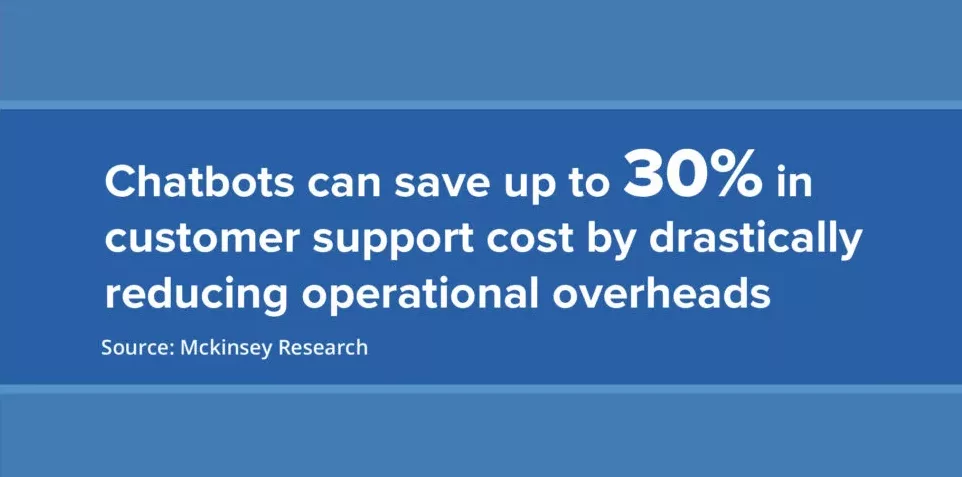

Customers today have their banks and financial providers in their pockets. So it is imperative for financial services to be where their customers are. Chatbots that are powered by AI and machine learning enables contextual, conversational banking. It is also increasingly used as a medium for deliver instant gratification through pre-defined rules.

Advanced chatbots helps in deeper understanding customer journeys that can be a base for personalized service in the form of text or voice based which can further be integrated in the system through CRM for financial services.

Convenient self service portals

Digital self service portals empowered by financial services CRM help customers to take control of their profile and engage with their business through a powerful and visual interface. A powerful self service portal helps them to view all their product holdings in a single view, automates simple repetitive queries and instantly fulfill their routine needs through straight through processing.

CRM in financial services can use self-service portal to display relevant and personalized cross sell offers, thus boosting conversions. Customers can also track real time status of their service requests through their self service portals.

Single service window

Playing football with customer service request, due to siloed intelligence, is morale and goodwill sapping. CRM for financial services can consolidate multiple request types across product holding into fewer, faster processes.

A single service window will also enable pro-active escalation management, reducing the turnaround time, resulting in notable improvement in SLA compliance.

Seamless service delivery through Customer 360 action center

Bankers and financial users can use a comprehensive customer 360 degree view that includes real time transactional, analytical and static data on product holdings, account details etc. Integrations with multiple sources gives a rich and actionable customer intelligence.

Seamless service delivery is made possible with quick action links powered by straight through processing and executed through digital journeys with financial services CRM. This delivers instant fulfillment in service request and eliminates reworks and errors.

Boost first time right (FTR) resolutions

A digital CRM in financial services ensures that customers can now have their issues accurately and quickly addressed at the first connect itself thus increasing delight. Service teams can deliver to deliver single touch resolutions with the help of drag and drop visual designers.

This translates into increased customer delight and advocacy. Auto allocation of service requests to the right reps based on business rules and seamless integration with document management system (DMS) guides agents with the right service collateral for higher FTR numbers.

In conclusion, the paramount significance of prioritizing next-generation customer service in the financial services industry cannot be overstated. Customers are not just consumers; they are the true proprietors of any business. To thrive in today’s dynamic landscape, financial institutions must embrace digital customer service solutions that offer swift, efficient, and unified support.

One of the key benefits lies in the cost-effectiveness it brings. By reducing operational expenses through streamlined processes and automation, financial institutions can allocate resources more effectively, allowing them to focus on core functions and innovation.

Moreover, fostering a positive customer experience is essential. It’s not just about resolving issues promptly; it’s about creating an environment of trust and loyalty. This, in turn, contributes to the overall value proposition of the institution. When customers feel valued and heard, they become long-term advocates, driving sustainable growth and success in the competitive financial services sector. In essence, the road to next-generation customer service is the road to lasting success in the financial services industry.