Blog Details

Powerful Strategies for Revolutionizing Insurance Claims Experiences in 2024

In an era defined by rapid technological advancement and shifting consumer expectations, the insurance landscape stands at the precipice of transformation. The convergence of digital innovation, evolving customer needs, and competitive pressures necessitates a paradigm shift in insurance claims processing methodologies. As insurers navigate this dynamic terrain, harnessing the transformative potential of insurance CRM emerges as a cornerstone in delivering unparalleled insurance claims experiences.

Rethinking Claims Experiences

Amidst the evolving insurance landscape, the insurance claims process emerges as a pivotal juncture where insurers have the unparalleled opportunity to solidify customer trust and loyalty. Addressing the intricate needs of policyholders with empathy, efficiency, and transparency not only fosters satisfaction but also cultivates enduring brand advocacy.

The Imperative of Seamless Interactions

Insurance CRM enable insurers to transcend traditional barriers and deliver seamless insurance claims experiences characterized by personalized engagement and operational agility. By leveraging advanced AI enablers and digital channels, insurers can streamline workflows, expedite resolutions, and enhance customer satisfaction.

Overcoming Challenges: Key Hurdles in Claims Processing

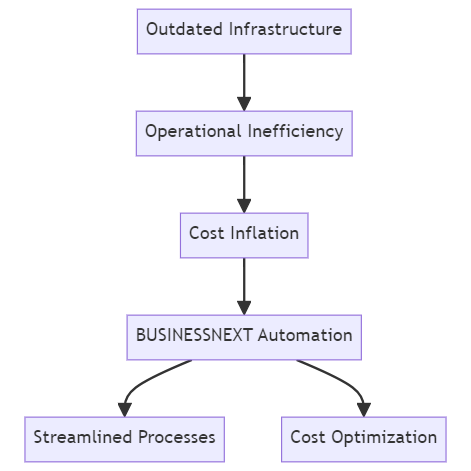

- Outdated Infrastructure: The prevalence of siloed systems impedes claims processing efficiency, inflating costs and compromising service quality.

- Friction-Filled Experiences: Consumer dissatisfaction stemming from bureaucratic hurdles and communication gaps underscores the imperative of digital transformation. By adopting a digital-first ethos, insurers can obliterate paperwork bottlenecks and expedite claims adjudication.

- Impersonal Service: While self-service channels proliferate, human interaction remains paramount in assuaging customer concerns. Balancing automation with personalized support enables insurers to forge genuine connections and instill confidence in policyholders.

A Roadmap to Excellence: Four Pillars of Transformation

- Customer Lifecycle Management: Empowered by advanced solutions, insurers can orchestrate personalized customer journeys across physical and digital touchpoints, driving engagement and loyalty.

- Policy 360: With comprehensive policy management capabilities, insurers gain unprecedented visibility into policyholder needs, enabling tailored services and proactive engagement.

- Claims Servicing: Automation revolutionizes claims servicing with automated workflows, real-time insights, and personalized communications, thereby expediting resolutions and enhancing customer satisfaction.

- Performance Management: Leveraging advanced analytics and gamification tools, insurers can optimize agent performance, drive sales productivity, and foster a culture of excellence.

Elevating Insurance Claims Experiences with BUSINESSNEXT

As insurers navigate the complexities of the modern insurance landscape, BUSINESSNEXT’s AI-powered Insurance platform emerges as the partner of choice for driving innovation, efficiency, and customer-centricity in insurance claims processing.

The Power of BUSINESSNEXT’s AI-powered Insurance Platform

- Smart Claim Initiation and Tracking: Enable customers to initiate and track claims seamlessly across channels, ensuring transparency and convenience.

- AI-Driven Claim Investigation: Leverage AI-powered algorithms to expedite claim investigations, minimize fraud, and enhance accuracy.

- Real-Time Service Insights: Harness the power of sentiment analysis, NPS, and predictive feedback to gain actionable insights and drive continuous improvement.

- End-to-End Policy Servicing: Automate policy amendments, transaction processing, and dispatch management, enabling faster and simpler servicing experiences.

- Dynamic Partner Ecosystem: Collaborate with partners seamlessly through API-driven integrations, enabling personalized offerings and enhanced customer segmentation.

Embrace the Future of Insurance Claims Processing

In a rapidly evolving insurance landscape, BUSINESSNEXT‘s Insurance platform equips insurers with the tools, insights, and capabilities needed to thrive in an increasingly digital world. By embracing innovation, leveraging data-driven insights, and prioritizing customer-centricity, insurers can redefine insurance claims experiences and drive sustainable growth.