Blog Details

5 Powerful Advantages of Loan Automation Systems

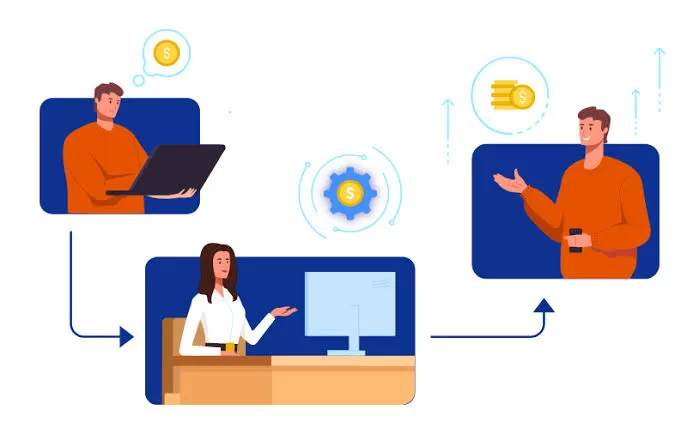

The borrower lifecycle journey has drastically changed in the last few decades. Gone are the days of waiting weeks for loan approvals; today’s borrowers demand speed, convenience, and efficiency. This paradigm shift has ushered in the era of loan automation systems, empowering lenders to meet the evolving needs of their customers with unprecedented agility and precision.

At the heart of this revolution lies the convergence of technology and finance, where innovative solutions are reshaping the lending landscape as we know it. In this article, we delve deep into the realm of loan automation systems, exploring their critical components, advantages, challenges, and the exciting trends that are shaping the future of lending in 2024 and beyond.

The Evolution of Borrowing

The borrowing journey has evolved significantly over the past few decades, driven by changing consumer expectations and technological advancements. Where once borrowers sought loans for specific occasions such as weddings or home purchases, today’s borrowers have diverse needs ranging from daily expenses to travel and leisure activities. This shift has necessitated a reimagining of the lending process, prompting lenders to embrace automation as a means of enhancing efficiency and meeting the growing demand for credit.

The other side of this coin for fast-paced execution is the creditors. Lenders had to improve their operational efficiency exponentially to meet the growing demand and increase their bottom-line growth. To achieve this, they needed to rethink traditional operations and eliminate redundancies with the help of cutting-edge tools. And so, financial and tech experts came up with strategies and tools to achieve this.

A loan automation system is one such tool adopted by lenders everywhere. It improves the lending and recovery process, from application to approvals and EMI payments. The loan automation system makes the loan process faster, more efficient, and it can decrease human error by 90%.

What is a Loan Automation System?

Critical Components of A Loan Automation System

A loan automation system is a technology or a collection of tools working together to automate the loan process. This means that aspects like origination, servicing, debt collection, and reporting are all automated to some degree to achieve higher efficiency.

Usually, a loan automation system is an amalgamation of many vital components. Here are five critical elements that top lenders use to automate their loan lifecycle journeys:

1. Loan Application Management System (Pre-LOS)

For many lenders, application management can be a standalone problem statement. As the demand for credit grows, more borrowers will apply for new loans at your firm. But there’s a catch. These borrowers will also apply at 4-5 more firms for the same inquiry. Winning this competition depends on convenience and TAT, it’s straightforward in the borrowers’ minds today. Simultaneously, due to the diverse nature of loan borrowing, lenders must also segregate their inquiries on various parameters and deal with them accordingly.

These factors could be:

- Loan type: Secured/ Unsecured

- Borrower income

- Borrower language

- Location

- Branch

- Channel: Social media, app, website, pay-per-click ads, referral, and more

A loan application management system is an excellent tool that solves these use cases. You can automate elements like inquiry capture, application, verification, processing, and sanctioning to achieve more efficiency.

2. Underwriting/ Decisioning System

Until a few years ago, the underwriting process was very subjective to the underwriter, and loan borrowing terms deviated often. The process was extremely time-consuming as it involved a lot of manual decisions and personalization.

For instance, the average underwriting time for a loan could vary anywhere between a few weeks to more than a month, and the time could be longer for secured products like home loans/ mortgage loans.

But today, new-age underwriting platforms can automatically verify KYC documents & other financial collaterals to identify incorrect information. Additionally, these platforms leverage pre-existing customer data to automatically suggest underwriting terms and can identify fraudulent applicants by comparing their information across multiple databases.

3. Loan Origination System

A loan origination system can combine all pre-LOS, underwriting/decision-making, and disbursal capabilities into a single solution.

Such platforms have many benefits, including:

- Centralized operations

- End-to-end reporting

- Enhanced productivity

- Better customer experience

- Faster time-to-market

- Improved risk management

However, there are downsides to having all these features loaded into a single platform, as it can make the solution monolithic and inflexible. Hence, managing application processing on a pre-LoS platform is always better to increase efficiency and bring creditworthy applicants into LOS for the disbursal process.

4. Loan Management System

A loan management system is another critical component used by lenders to manage the post-disbursal lifecycle of the customer. Once a lender onboards a customer, the lender can seamlessly manage all processes—loan servicing, cross/up-sell, debt collection, loan modification, and risk management.

5. Debt Collection System

The collections process is the backbone of the lending industry. While debt collection is usually an integral part of the loan management process, most lenders often treat it separately and have dedicated teams working on recovering loans.

But traditional collection processes have many challenges, such as:

- Manual case management

- Low intelligence about probable delinquencies

- Low rep productivity

- Communication problems with customers

- Cohesive team management

To solve this problem, top leaders deploy debt-collection CRM platforms.

Future of Loan Automation System

As we navigate the ever-changing landscape of finance, one thing is clear: the future of lending belongs to those who embrace automation and innovation. By harnessing the power of loan automation systems, lenders can unlock new opportunities for growth, efficiency, and customer satisfaction in 2024 and beyond.

With more advancements in artificial intelligence and machine learning, such as the introduction of Chat-GPT, lenders must expect tighter competition and a rise in demand for highly personalized experiences from borrowers. Soon, these tools will take on more complicated but repetitive tasks, leaving people-centric customer experiences to your loan officers.